What’s the best growth advice for mortgage brokers? The best advice isn’t just a single piece of helpful insight, it’s about many key aspects that contribute to growing a successful business. So, you need to figure out what’s important to your mortgage firm right now so you know where to focus your efforts for growth.

Mortgage brokers spend so much time advising their own customers, it’s only fair that they are given access to their own advice, to help them grow and succeed in financial services. So here goes…

Best Growth Advice: #1 Build Initiatives

Whether you’re starting out from scratch or looking to grow your existing business, you still need a robust growth plan or strategy. You don’t want to be making big mistakes before you’ve even started. You need to set out what you want to achieve and how you’re going to get there.

If you’re new to the scene you might want to think about initiatives that will help you grow quickly. In marketing, the term is coined as growth- hacking. Sounds fancy, we know. Think traditional growth on steroids.

This means trialling things that wouldn’t necessarily fall under traditional marketing. You’d test these experiments as quickly as possible to know what works and what doesn’t and optimise accordingly for your firm.

Best Growth Advice #2: Know Your Barriers

Understanding your blockers will help you align your strategy for successful growth. It’ll help you be more realistic with the goals you set yourself, your team and identify potential threats and how to overcome them. Think about your own barriers to growth, like budget and resource, as they can be unique to each firm.

#1 barrier to growth for mortgage brokers – generating new mortgage leads.

Unsurprisingly, mortgage brokers say that the number one barrier to growing their mortgage business is the ability to generate leads. You’re probably thinking that if you’re not generating enough leads you’re not growing your business, right?

We disagree, as retention experts, we know the best customer is the one you already have.

So, how do you define business growth? You can’t rely purely on new leads to help you grow your business. Don’t learn this the hard way.

Sure, when you’re starting out generating leads is super important. And, if you’re here looking for some lead gen tips, we’ve got those too. But determining the value of your customers and their impact on your growth is also very important.

We’re in an industry that heavily revolves around “How many leads did you generate this quarter”.

Whereas, on the flipside firms that want to grow should be asking the questions…

Best Growth Advice #3: Build Your Sales Funnel

Again, as we mentioned, there isn’t a single secret to business growth. It takes time and hard graft and you’re not going to succeed without thinking about these essential growth tips:

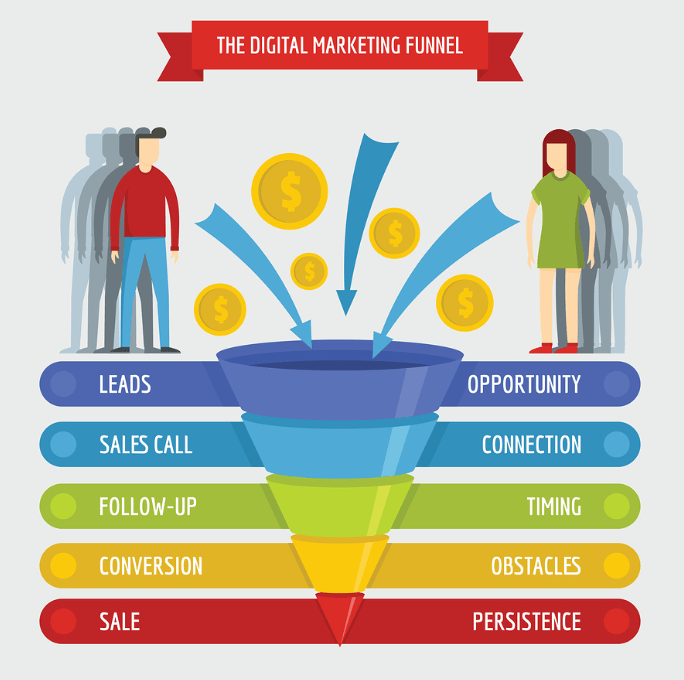

First things first, do you really know your customers? Part of building your sales funnel means understanding how your customers are even going to come into it in the first place. That means knowing how to promote your services to them and where. From there it’s all about pushing them through the “funnel” and converting them into a paid customer. The further down you get the thinner the funnel is and the fewer leads you have to convert. It’s important to optimise and nurture leads at every stage to minimise % of those lost.

Best Growth Advice #4: Analyse Your Competition

You want to be the best, the first thing in your customer’s mind – then you need to know what your competition is doing. You should be studying and learning from your competitors. You don’t know everything. Your competition could be doing things that you could do or evolve and reap rewards. You should always be looking for ways to improve your business. Be open to trying new things and recognising when your competitors are doing something better so you can do even better than that,

Best Growth Advice #5: Value Your Assets

Give great service and you’ll get great feedback and testimonials from your current customers. Your customers are your most valuable asset, so don’t forget about them. The team behind you are also a valuable asset to your business. So gather a great team to help you provide excellent customer service. This is so important, it helps improve retention, referrals, revenue and overall growth for your firm.

If you’re providing great service, customers will come back again and again. You can use automated tools that work in the background nurturing these customers for you. You can spend more time generating new leads for your business without forgetting these borrowers.

Best Growth Advice #6: Don’t Drop the Ball

Stay focused and follow a plan. You won’t be making money from day dot. You won’t see leads pouring in on their own. You won’t succeed without a plan. Understanding that it takes time to plan and deliver what you’ve set out. So make sure you’re setting yourself realistic goals and expectations.

Be consistent in every way possible. Being consistent is a reflection on your service and your brand. So, once leads come in make sure you’re responding to them as quickly as you can. Customers expect everything in an instant, so if you’re not quick to react then they’ll go to another broker. Working on your response and engagement rates can help you nurture and retain borrowers, strengthening your relationships for the long-term.

Best Growth Advice #7: Fail fast, Learn Faster

Be adaptable. If you’re not willing to learn from your mistakes, you’ll never grow- whether that be personally or with your mortgage business. Because, the key is taking risks if you can weigh out best and worst-case scenarios and predict the return you can assess whether something is a worthwhile experiment.

Richard Branson

Don’t get caught up, nothing is perfect. Embrace what you’ve learnt and turn it into teachings, learn from your mistakes.

Best Growth Advice #8: Make Sacrifices

Be prepared to make sacrifices to grow your business. If you’re looking to start your own broker firm then you need to invest a lot of time into it. Like any start-up you need to live and breathe your business, so you’ll have to make sacrifices. Even, if you’re not operating in a start-up making sacrifices, can mean putting in the extra hours to achieve what you’re working towards. This could mean sacrificing your personal life, family and friends- so be prepared.

Best Growth Advice #9: Measure, it Matters

MAKE METRICS MATTER. Numbers. Which ones are the most important to measure?

Track your firms’ progress and direction, understand what’s working well and what needs fixing or dumping (remember to fail fast, learn faster).

Our top growth metrics

#1 Customer acquisition cost

#2 Conversion rate and sales revenue

#3 Customer loyalty and retention

#5 Customer acquisition cost

Data is your treasure trove. It’s the reason why you do X,Y,Z – or at least it should be. It gives you guidance, rationale and evidence to aid decision-making, budget allocation and so on. So, data should be driving your direction, else you’re just aiming in the dark and hoping something will work.

Final thought

Implementing this advice will help you grow your business and bring more borrowers through the door.

Nothing should come between you and the success of what you are building. Get growth right.