Own the Relationship,

Control the Outcome

Eligible transforms customer engagement at key mortgage moments — using your data to deliver real-time journeys that boost retention, cut costs, and reduce risk.

See how our journeys support retention, SVR, maturity, and other key customer moments.

Trusted by leading lenders

Proven at Scale

£100bn+

Mortgages

managed

1M+

Customers

supported

850M+

Behavioural

data-points

We Deliver What Great Customer Journeys Need

Reach Everyone

Email, SMS, QR and app — orchestrated in one seamless flow

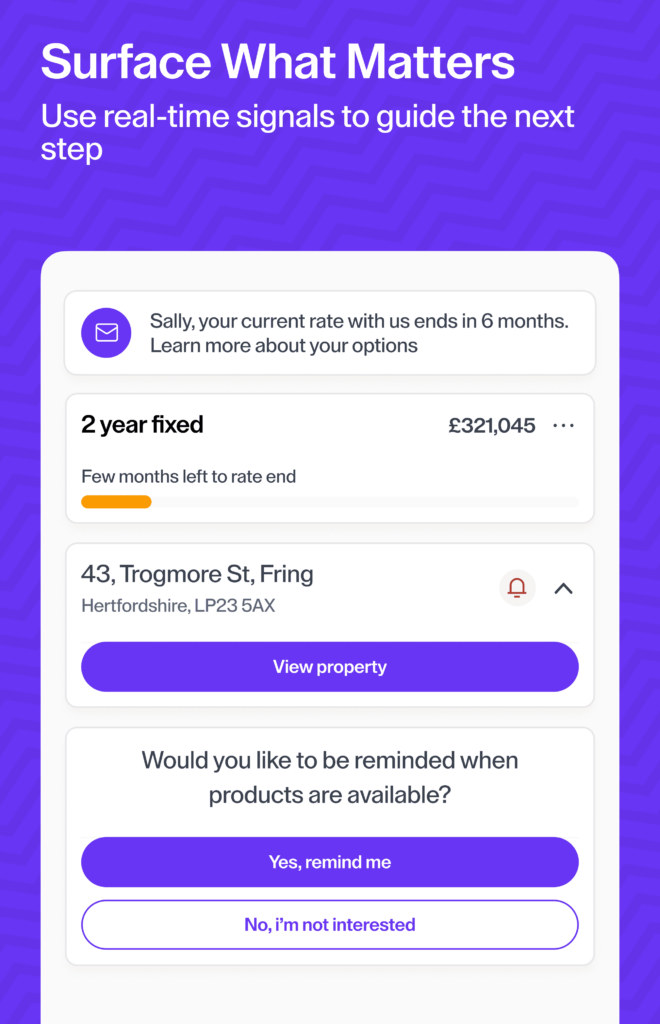

Adapt Intelligently

Behavioural and financial data guides timing and message

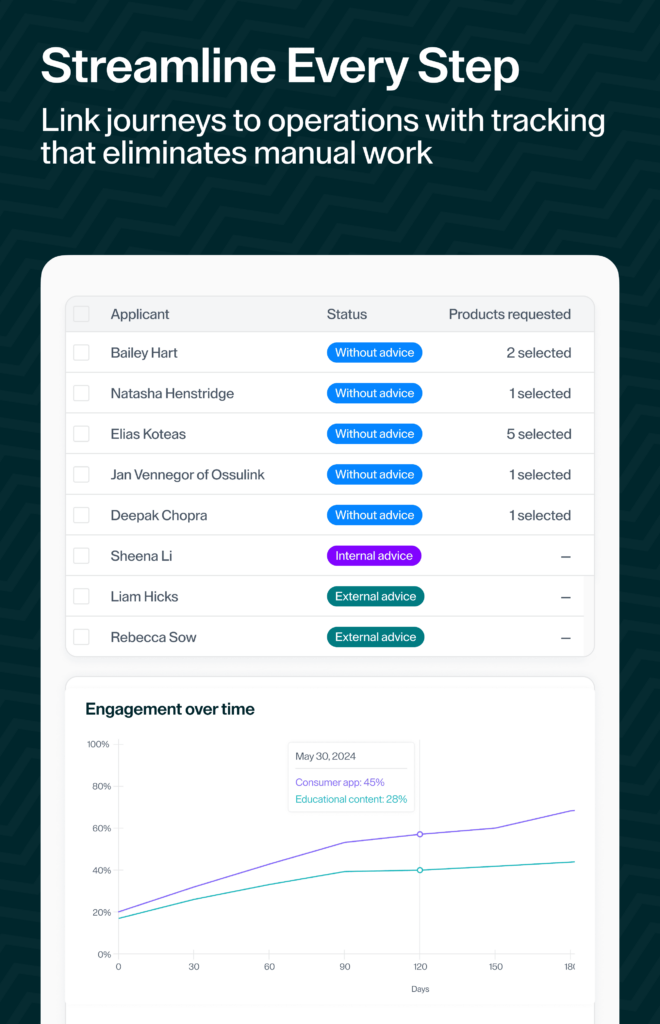

Sync Internally

Journeys sync live with operations, risk and compliance workflows

We Turn Engagement into Action

Our journeys guide customers with clarity, confidence, and control — across SVR, retention, switching, final maturity and more — reducing risk, driving outcomes, and streamlining every step behind the scenes

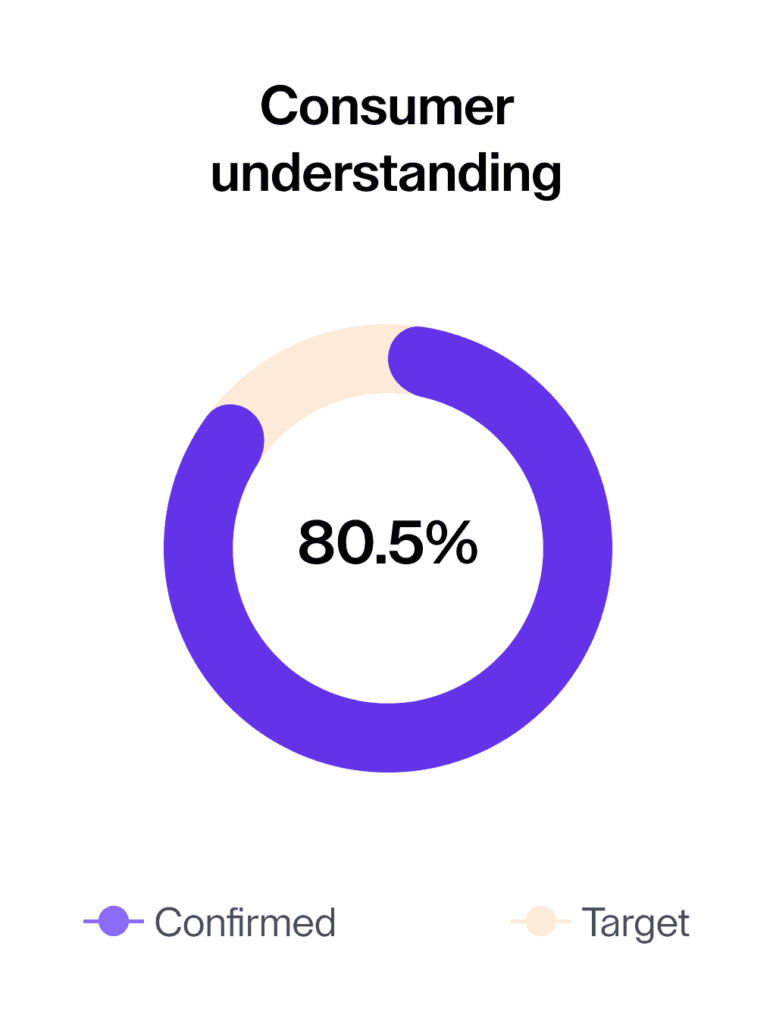

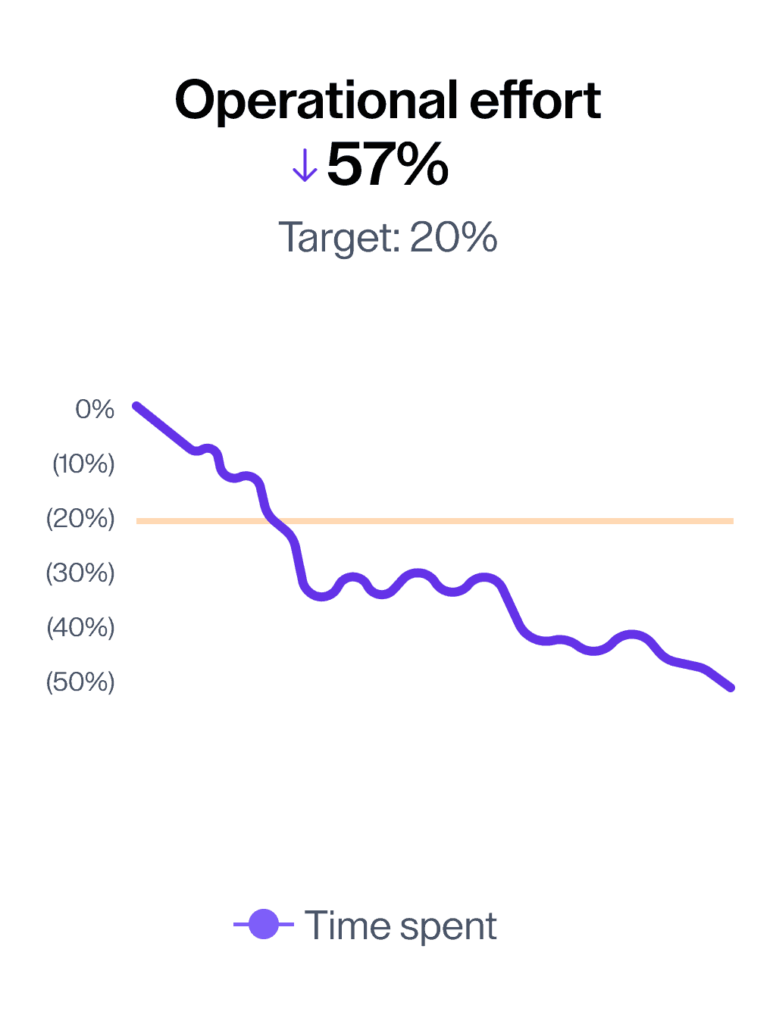

We Deliver Metrics That Matter

Our journeys don’t just improve experience — they move the numbers that matter. That’s why our clients see results like these

10%

5%

30%

100%

Built to meet compliance outcomes

100% flexibility, Zero Code

Eligible fits your business—not the other way around. From branding to journey logic, every element is configurable. Switch features on or off, set your tone, and decide how far to take each customer—no dev queue, no friction.

One File In. Full Journey Out.

No complex integrations. Just send us a single data file—we handle the transformation, journey logic, and decisions. All updates feed into your business-side app, giving your team real-time visibility without changing how they work.

Track, Optimize and Scale Outcomes

Eligible drives retention, capital efficiency, and ops savings—at scale. Expand easily across journeys, modules, or brands with full visibility, compliance-ready interactions, and real-time insight—no extra work for your team.

We Launch Fast.

You Scale with Ease.

Eligible slots into your existing world — fast, flexible, and fully modular. From branding to journey structure, every element is configurable. We handle transformation and deployment — no dev queue, no integrations, no friction