Eligible co-founder Zahra Hassan was featured in the FT Adviser last week, discussing the impact of artificial intelligence on customer support. Underlining the proven benefits of a system like Eligible – particularly its capability to spot customer vulnerability ahead of time – Zahra has highlighted the key areas in which AI is needed within the financial services industry.

"What AI can do today is interact with customers and measure the level of understanding of their existing product before providing bespoke financial expertise."

Zahra Hassan

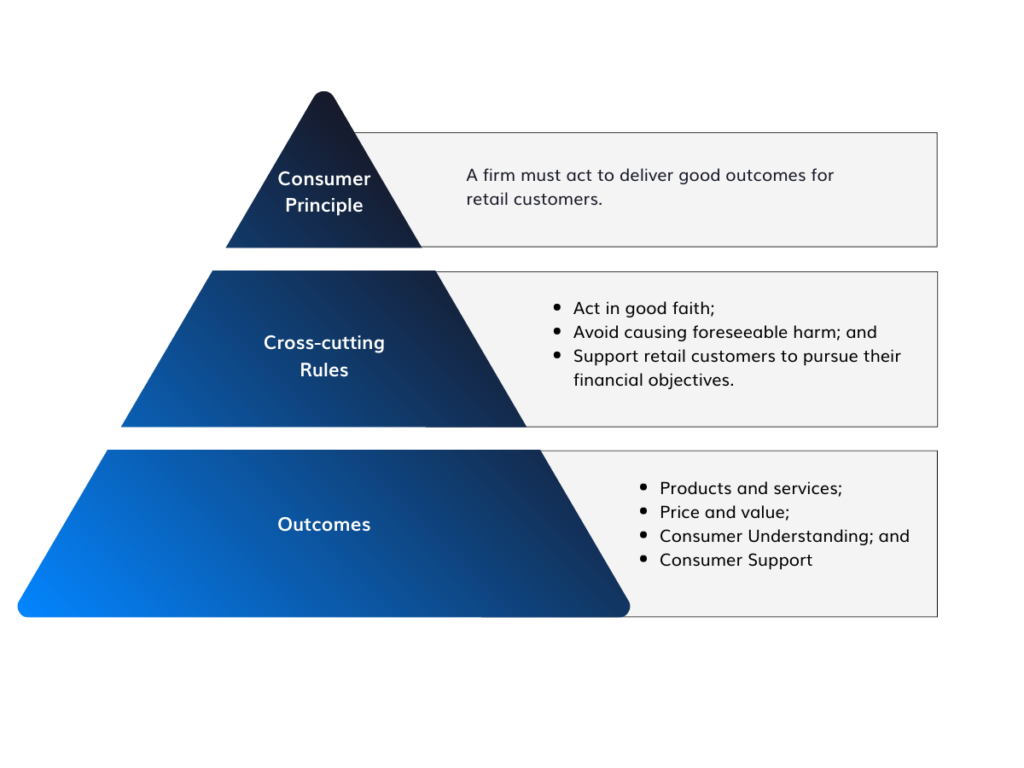

The customer benefit to AI-driven mortgage servicing is clear, but it can also play a huge part in compliance, providing structure and evidence for some of Consumer Duty’s more confusing rules. In this blog, we’re looking at how systems like Eligible can help companies stay ahead of the FCA, and create customer-focused journeys with zero internal integration. Let’s take a look at Consumer Duty in particular.

Outcomes: Consumer Understanding

In lieu of hiring armies of new account managers to check in with every single customer, AI is a game-changer for customer understanding. We no longer have to imagine a future where customers receive content tailored to their level of comprehension, where their engagement with that content is monitored, and where follow-up information or sign-posting is delivered exactly when they need it. We’re already there.

This means that across your customer base, every single person can be assessed not only for their understanding but also for their level of anxiety. This all happens instantly before they receive bespoke financial expertise based on their answers. This journey is recorded, giving you a full view of the customer journey and evidence where the FCA might call for it.

For more on Consumer Understanding, have a look at the following resources from Eligible:

Outcomes: Consumer Support

When we talk about journeys for the mortgage customer, we are often referring to the tail-end of the mortgage term. This is where we begin to re-engage with the customer to secure another deal for them. The idea behind AI systems like Eligible is to remove this transactional relationship and replace it with one that spans the lifetime of the mortgage.

With a dedicated platform designed to educate and monitor behaviour, customers are supported throughout their mortgage term. Complex algorithms are able to understand behaviour patterns and – vitally – put them within the context of financial circumstances to spot vulnerability. Where this applies, customers are sent back through to their providers for face-to-face advice from an adviser. This is done using 1-click contact buttons, saving customers the time and frustration of endlessly searching for the correct call centre number.

"AI can detect those who are likely to need assistance and proactively engage with them, fostering education and active dialogue."

Zahra Hassan Tweet

For more on Consumer Support, have a look at the following resources from Eligible:

Cross-cutting Rules: Avoid Foreseeable Harm

Analysing financial and behavioural data in tandem to identify emerging vulnerabilities puts you in a singular position to stay ahead of this cross-cutting rule. Account managers and advisers are fantastic at providing one-on-one tailored support, and this should never be replaced, but AI has the capacity to stop people falling through the net when they’re part of a huge customer base. The sheer volume of data AI can process and analyse in a short space of time adds an extra layer of protection for clients and an extra layer of reassurance for firms.

Platforms like Eligible provide a simple and convenient way for customers to digest information. It’s even mapped to individual learning style, delivered to each customer in a way they can understand.

In addition to this, customers can be safeguarded with knowledge. Improving financial literacy and allowing customers a level of educated autonomy takes the fear out of finances. Not only does this allow customers to identify their own knowledge gaps, they are also more likely to be comfortable seeking help when they need it.

For more on Avoiding Foreseeable Harm, have a look at the following resources from Eligible:

Cross-cutting Rules: Support Customers to Achieve their Financial Objectives

Eligible’s AI is specifically designed to serve people, not data. The holistic approach encompasses circumstance, attitude, sentiment, and comprehension. All of these elements must be present to legitimately claim customers are being supported to achieve their financial objectives. This cross-cutting rule isn’t simply about setting a goal – it’s about making sure the goal is achievable and that there is a clear, safe pathway to get there. It’s a role firms aren’t currently fulfilling, closing the book on a customer journey until the three to five-year term of their mortgage has nearly elapsed.

In this way, AI is setting the standard for customer support. It interacts with customers in the way personnel don’t have time to – presenting options and alternatives as they become available and establishing a consistent two-way dialogue.