As the interest rates on two and five-year fixed-rate mortgages rises above 6%, the onus is on financial institutions to catch the people now slipping into serious vulnerability. It’s the highest rate we’ve seen since Liz Truss’s ill-advised Mini-Budget and will see the cost of borrowing rise sharply.

How are customers responding?

Prime Minister Rishi Sunak has urged homeowners to ‘hold their nerve’ with rising interest rates, but that’s easier said than done for people now living on the threshold of poverty.

If you search ‘UK mortgages’ on the popular news discussion platform Reddit, it makes for sober reading. Littered amongst the more amusing discussion headings of “Why are estate agents so useless?” and “Advice needed: Neighbour’s son urinating on the roof,” there’s a growing tone of desperation among threads as people look for advice amidst an ongoing cost-of-living crisis and relentless interest rate rises.

“What kind of interest rate is everyone getting right now?”

“I work full-time, and I am homeless.”

“I don’t know how I’m going to survive.”

It’s a stark reminder that while the finance industry watches trends in graphs and numbers, people all over the UK are seeing it in their ability to buy food, run a car, or even keep a roof over their heads. Small business owners are also struggling. With everyday items doubling in cost, people are cutting back on non-essentials – saving where and wherever they can. Add to that an energy crisis, rising costs of materials, and rising inflation; the immediate future is not looking bright.

The Rise of Mortgage Anxiety

What was once one of life’s most exciting milestones has become a source of extreme stress. It’s a significant financial decision that naturally comes with a certain level of anxiety, but fluctuating interest rates and an unpredictable financial climate are likely to overwhelm even the most relaxed homeowners. Those crippled by worry may find they miss important opportunities while trapped in a cycle of uncertainty and indecision.

Resolution Foundation’s recent YouGov survey indicated that people are more stressed about their housing situation now than they were during the pandemic. Financial resilience is in decline, and people are struggling to see how they can make it through such a brutal increase in monthly outgoings.

The time for rhetoric is over. Customers need tangible solutions and real support from their providers.

What's Being Done to Help?

None of this is news to the finance industry or the government. There is huge motivation to support people and improve financial prospects for people across the country – even as that gets harder to achieve when monthly household outgoings continue to soar.

Last week we summarised the government’s Mortgage Charter, a set of standards 85% of the UK’s lenders have agreed to in order to ease worry for those needing to secure new deals in the coming year. But even some of these measures look set to succumb to the law of unintended consequences. As the Financial Times points out, taking measures to cut mortgage costs right now might mean customers risk damaging their finances long-term, potentially extending a mortgage term into retirement age.

Appropriately, the Mortgage Charter and the FCA’s Consumer Duty are putting the focus back on customer communication. Initiatives designed to support people through the crisis are welcome additions to the market, but do customers understand the initiatives and how making these decisions now may affect them long-term? Are they making the right decision for their circumstances or are they reacting in panic when there are better options available for their particular situation?

The Gold Standard in Customer Communication

In the absence of scheduling face-to-face meetings with every customer, financial institutions should be looking for ways to personalise the customer experience. Instead of generic mailings, communication should be customer-specific and designed to add value, increasing the likelihood of good outcomes.

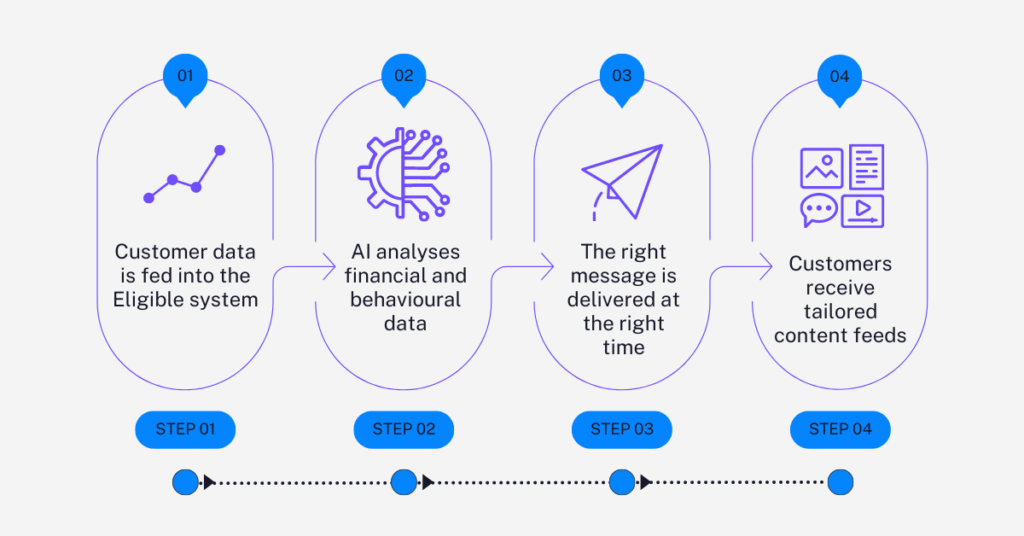

At Eligible, our AI-driven platform analyses both financial data and consumer behaviour to determine what information customers need and when. This ensures that customers get the right message at the right time, personalised and mapped to their preferred learning style. We put the emphasis on education, with end-users encouraged to engage fully with their options, showing them the likely outcomes of each decision and giving them the opportunity to learn more or confirm understanding.