Share this post:

Eligible's exclusive data tells the story behind The Mortgage Charter.

The Mortgage Charter, announced by Jeremy Hunt on the 27th of June, describes a set of standards 85% of the UK’s lenders have agreed in order to help people navigate a turbulent set of rate increases and payment shocks.

It’s a welcome, all-around source of support and reassurance for mortgage customers and their families.

For us here at Eligible, one particular point amongst the list of pledges tells a compelling story about the customer journey in the lead-up to a product switch.

In fact, it’s the very idea Eligible was built on.

“With effect from the 10th July, customers approaching the end of a fixed-rate deal will have the chance to lock in a deal up to six months ahead. They will also be able to manage their new deal and request a better like-for-like deal with their lender right up until their new term starts, if one is available.”

- The Mortgage Charter

Usually, lenders are prompted to contact customers about their product transfer options around three months out. It’s often automatic and generalised It’s also hard to ensure the information is being read and, most importantly – understood.

But what if we told you that with 3 months to go, a huge portion of your customer base has already begun the switching process?

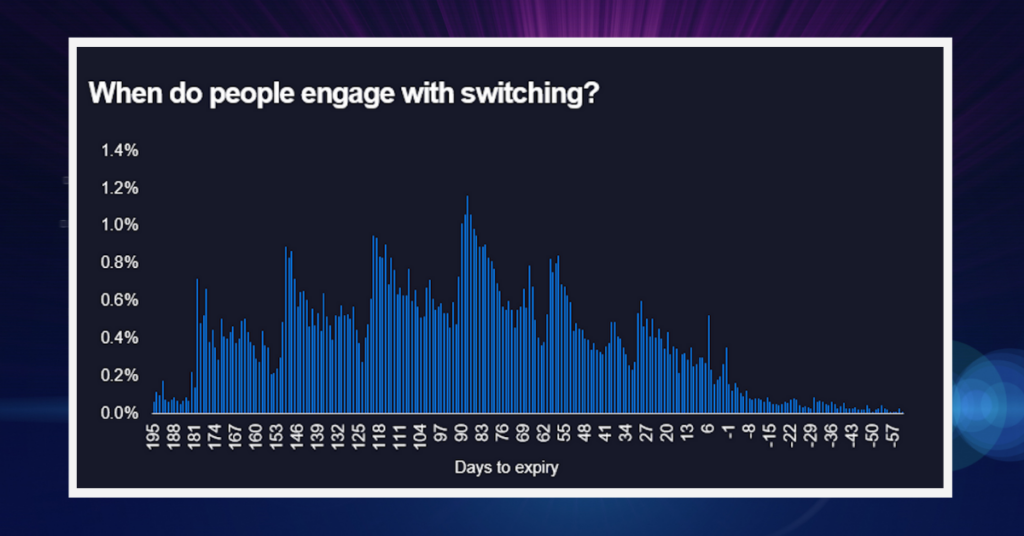

With aggregated data from one million borrowers, we have exclusive access to customer engagement trends, and we’re happy to let you have these for free:

Ponder that chart for a moment and consider how many customers have already made their decision before your system catches up. Opportunities lost because we assume people don’t think that far ahead, or lost because rich and tailored customer journeys don’t exist for product transfers (except they do – keep reading).

A generic date-triggered communication will often leave you – and your customers – cold. By three months, they may have completed their research, engaged with other lenders, and enjoyed the red-carpet experience that comes with being a new customer somewhere else. At that point, an automated letter on the doormat from your institution might be too little, too late.

The Mortgage Charter gives consumers a little more time and control over their options, but the truth is, six months has always been the ideal time to start engaging customers about the next step.

Diving a bit deeper into customer engagement...

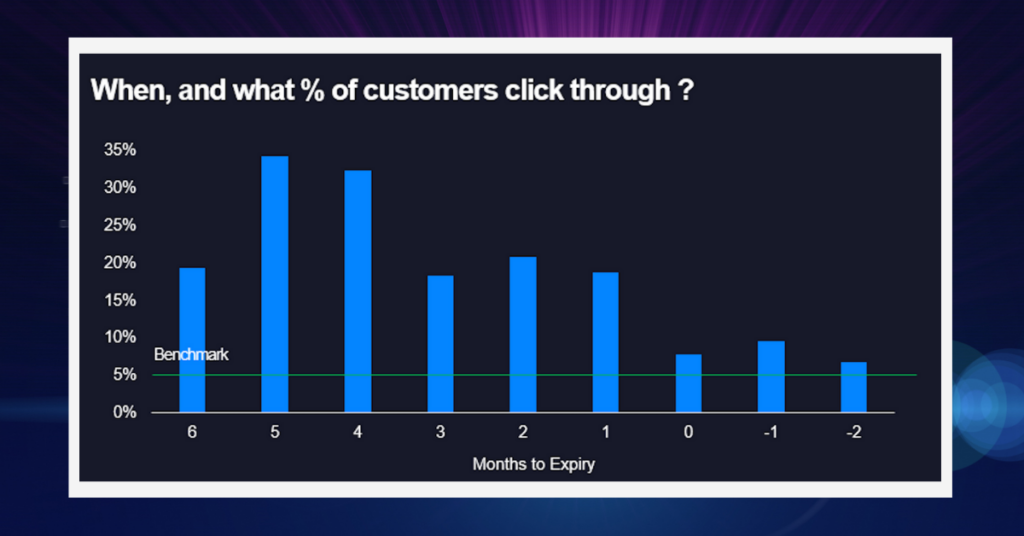

Engaging customers whose deals are expiring with six months to go achieves two things:

- It tells you if the customer is acting early, already looking for their next deal; and

- It gives you the opportunity to build on the relationship before they’ve seriously considered going elsewhere.

Once you have established interest, you can begin to create a personalised and valuable customer journey for them. For Eligible end-users, this means detailed and clear information about the next options and steps. It means communications mapped to their preference and learning style, with opportunities to learn more or confirm understanding before moving on.

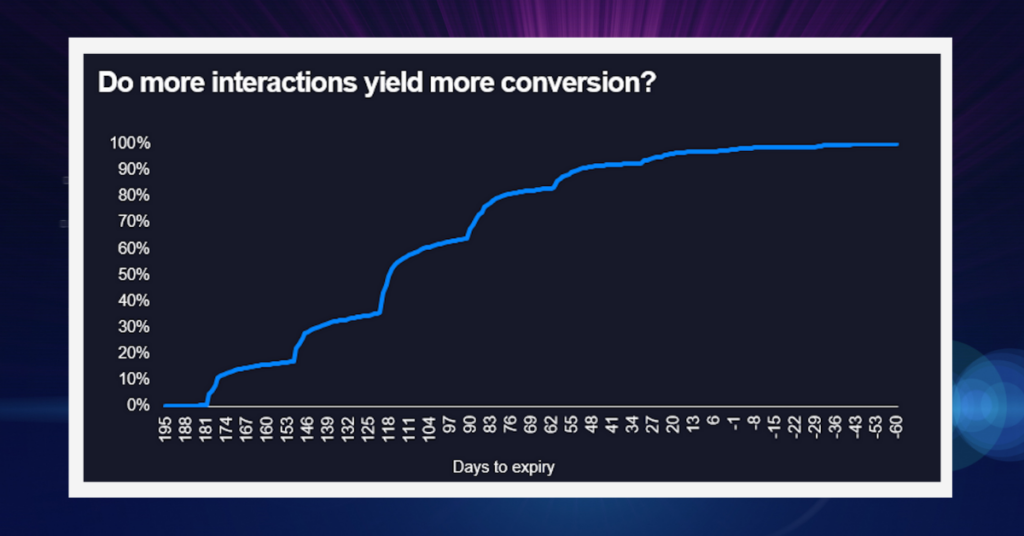

And do more interactions yield more conversions? Again, don’t just take our word for it – the data speaks for itself:

The answer is a definitive yes. The more opportunities you give a customer to see the work you’re doing on their behalf, the more likely they are to stay with you for the next deal.

It also taps into another pledge in The Mortgage Charter:

“Helping customers plan ahead with well-timed communications for those coming to the end of their current mortgage deals.”

- The Mortgage Charter

Well-timed, effective communication builds familiarity and customer loyalty. People are understandably concerned about switching products in the midst of a gruelling cost-of-living crisis, but financial institutions have an opportunity here to deliver real value with compassion and dispel some of the fear.

With less than two weeks to go until the 10th of July, we’re here to help get lenders compliant. Our servicing solution provides:

- Specialised and tailored customer journeys based on financial and behavioural data

- Full customer visibility

- Aggregated reporting