AI is vital for customer journeys. It might not have been a few years ago, but to thrive in the current digital landscape, the advent of machine learning has revolutionised the way organisations interact with consumers.

‘Don’t let faceless AI remove personalised customer experiences!’ the cynics cry.

The irony is that AI allows for a much deeper connection with the people you serve. By analysing customer-specific information, it immediately presents only relevant resources and, most importantly, anticipates needs. With models that learn and adapt from each interaction, AI can transform customer engagement.

You’re not forsaking personal relationships by using AI – you’re strengthening them.

There's a better way of doing what you're doing

Customers should no longer be receiving generic communications designed for a loosely-fitting demographic. We have the capabilities now to tap into consumer goals, analyse behaviour patterns and tailor recommendations accordingly.

If you’re not already using AI for your customer journeys, you can be sure your competitors are. And they’re seeing much better results.

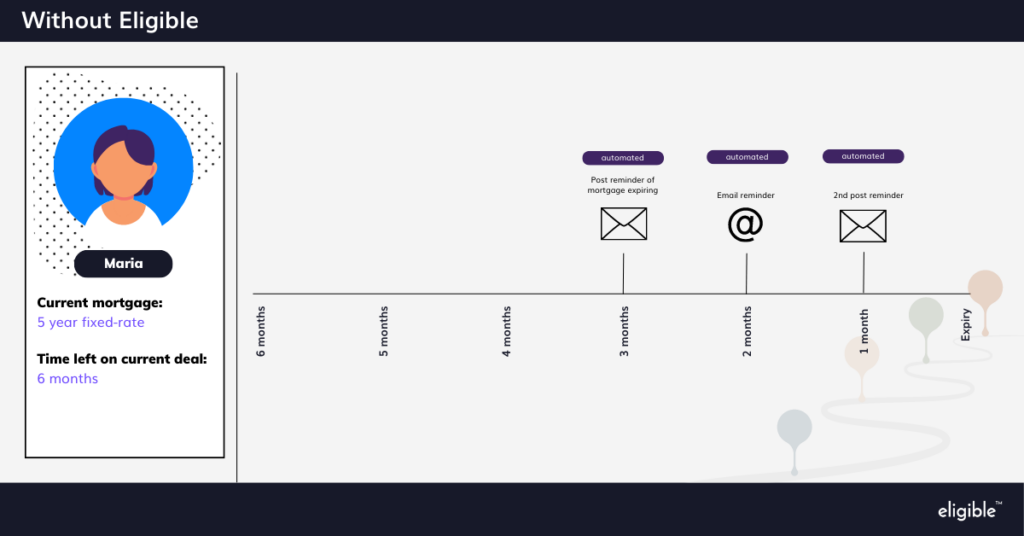

For example, here’s a quick visual on the difference between our AI-driven customer interactions vs more static, traditional customer experiences at the end of a mortgage term:

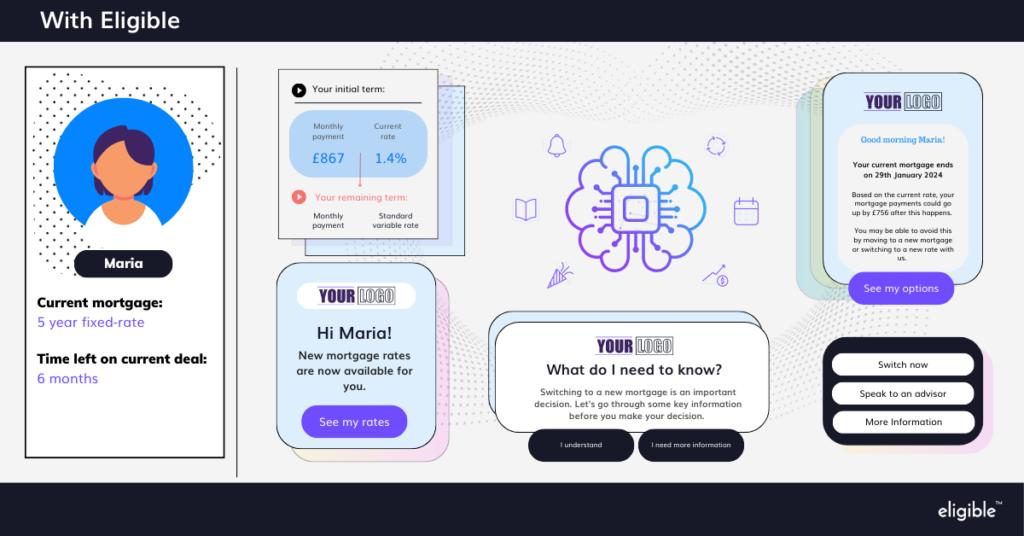

Becomes this:

The data firms collect can be harnessed to change lives for the better. For example, learning algorithms adapt to circumstances and behaviour patterns, delivering the right message at the right time for each and every customer.

Deep dive into the benefits of AI

Here are a few of the most important ways AI integrations can benefit your customers.

Personalisation

AI empowers businesses to gain a deeper understanding of customers by learning from their behaviour and preferences. The delivery of a hyper-personalised experience tailored to each customer journey and mapped to specific learning style. With this technology, customers need never see irrelevant information again.

Prediction

AI learning leverages predictive analytics to anticipate customer behaviour and needs accurately. By looking at historical data, algorithms can identify patterns and trends, allowing firms to better serve customers in the future. This facilitates proactive engagement and improves customer satisfaction.

Experience

With proper integration, financial institutions can create a seamless omnichannel experience for their customers. Consistent, personalised interaction across all touchpoints will help customers feel supported – particularly when the mortgage market is uncertain and people are worried.

Support

Full integration of AI technology makes customer support options much more efficient. Highlighted buttons with options to learn more, speak to an advisor, or be redirected to broker or lender portals improve customer satisfaction rates and foster brand loyalty. Support can and should be proactive, with consumer well-being at the heart of each interaction.

Regulatory Requirements and Government Initiatives

There is a lot at stake for people when making important financial decisions, and firms must now be able to demonstrate that they’re implementing solutions for customers that will help them reach their goals – especially now that the economic environment is so turbulent.

The Mortgage Charter, coming into effect yesterday, directs participating firms to ensure customers are fully supported and offered a range of options as they navigate the mortgage market amid rising interest rates. Financial institutions are best placed to help people plan ahead, reducing stress and providing reassurance.

Likewise, the FCAs Consumer Duty asserts that all firms redirect their efforts to ensuring customers are supported and, more importantly, that they understand the wealth of information they are given to make important financial decisions.

The truth is, the firms implementing AI into their customer journey strategy are already hitting these marks, while they and their customers see the benefit immediately. Integrating this technology also means that when called upon, financial institutions are able to demonstrate the steps taken to safeguard against harm and show they are committed to the best outcomes for each and every customer.