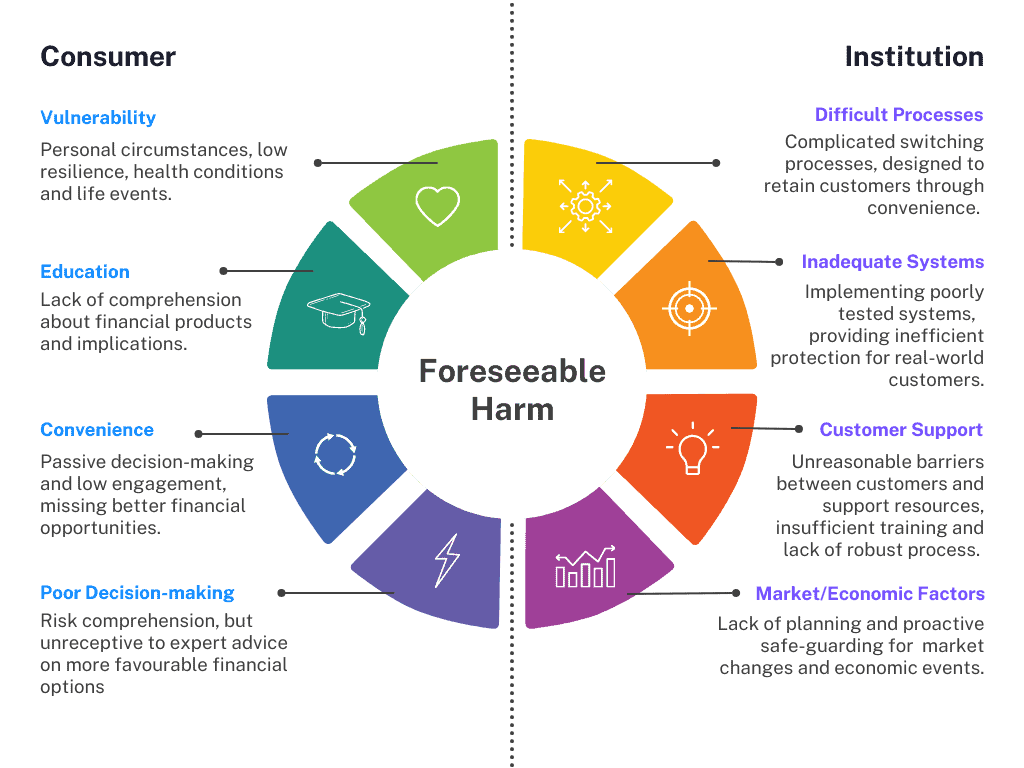

Avoiding foreseeable harm is one of Consumer Duty’s more murky requirements in terms of definition and criteria. Firms haven’t been told to start hiring fortune-tellers (not yet, anyway), but they are expected to refocus their attention on consumer circumstances and changing markets to ensure products and advice remain suitable.

To make this element of Consumer Duty more manageable, we’ve split the concept into two sections: consumers and institutions. From here, we can see immediately where we might implement changes to avoid foreseeable harm.

Let’s break this down even further for clarity…

Consumers

Vulnerability

Avoid foreseeable harm by:

- Segmenting your customer-base and adjusting communications appropriately.

- Implementing enhanced training for staff dealing with customers in difficult situations.

- Schedule regular reviews for more vulnerable customers.

- Monitor your digital channels to ensure information is accessible and customers are able to engage.

Education

Avoid foreseeable harm by:

- Providing information on financial products and services in a variety of different formats.

- Utilising digital channels and interactive content to keep customers engaged.

- Keep clear and accurate records of how and when you provided information to improve customer comprehension.

Convenience

Avoid foreseeable harm by:

- Proactively communicating with customers where better alternatives exist for them.

- Adjust processes to minimise the inconvenience to customers.

- Train staff to communicate with empathy and compassion where customers are reluctant to engage due to financial anxiety.

Poor Decision-making

Avoid foreseeable harm by:

- Ensuring you have made your advice as clear as possible.

- Explaining the benefits and consequences of each financial decision.

- Giving customers space and resources following conversations to think through decisions properly.

- Documenting that risk has been communicated and accepted.

Financial Institutions

Difficult Processes

Avoid foreseeable harm by:

- Redesigning customer journeys with Consumer Duty in mind, with an emphasis on customer experience.

- Making switching to new financial products easy, with clear signposting and information.

- Monitor and review processes regularly, figuring out where you can streamline or make improvements.

Inadequate Systems

Avoid foreseeable harm by:

- Ensuring all systems are subject to rigorous research and testing criteria before they are implemented.

- Considering all potential customer benefits and consequences, documenting the possible outcomes.

- Introducing close monitoring of new systems, making adjustments where needed.

Customer Support

Avoid foreseeable harm by:

- Ensuring customer support contact options are displayed prominently in all communication.

- Training staff to an exceptional standard in customer care, providing specialist support for vulnerable customers.

- Catering for customers with accessibility issues.

- Providing options for support, including face-to-face, telephone, email, and online chat boxes.

Market and Economy

Avoid foreseeable harm by:

- Planning for economic events and market changes.

- Having a strategy in place to deal with customers who are directly affected and struggling.

- Being transparent with how your firm or institution intends to deal with the changes and how customers can expect to be supported.

- Proactively communicate with vulnerable customers.

The FCA has made it clear that Consumer Duty is based on a principle of reasonableness. What a firm knows or can be reasonably expected to know should steer the customer pathway. Customers cannot be protected from all harm, but where firms are providing dynamic customer journeys and regular checkpoints to ensure effectiveness, they will be compliant.

Here at Eligible, we have transformed mortgage servicing by combining financial analysis with behavioural data. We provide tailored resources for each customer based on their circumstances and learning style. With full visibility on the customer journey and sophisticated reporting tools, there has never been a better time to join us.