Customer understanding bridges the gap between financial institutions and the lived experience of people all over the UK. Do you know why your customers make the decisions they do when they do? Why they’ve dropped off your radar or started to look elsewhere for products and services?

Understanding what drives customer decisions and how to engage with them is what we do here at Eligible. So, we’ve put together ten practical steps you can take to keep Consumer Understanding at the heart of your work. And if you want to delve a little deeper, you can also download our Consumer Understanding Checklist to ensure you’re on the right track.

1. Create a consumer-based strategy

We’ll get to customer journeys in just a moment, but we kick off with consumer-based strategy. These may sound similar, but the distinction is essential. This is because while customer-specific insights are invaluable, consumer insights are more holistic. They give you a broader market perspective.

With a consumer-based strategy, you understand how and why consumers across the market interact with products and services, choosing to engage with some while discarding others. It recognises that context is changeable and that people use myriad resources (both market and non-market) to pursue goals and live their lives (Epp and Price 2011).

With a birds-eye view of the consumer goal, you avoid becoming hyper-focused on one touchpoint or message. Consumer-based strategy is about seeing the complexity of the decision-making process and planning your approach accordingly.

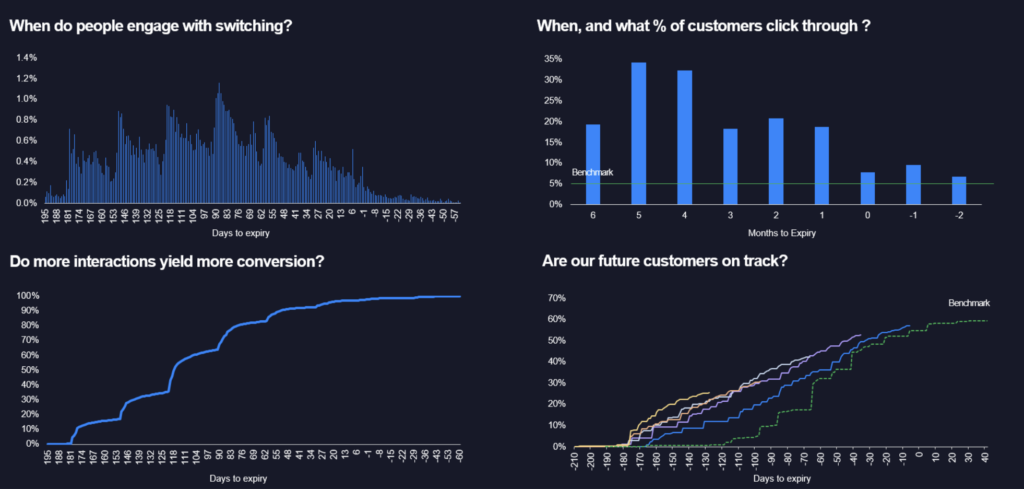

Below is an example of how to use consumer strategy to improve your processes, taken from Eligible’s aggregated data of 1 million customers.

2. Get Personal

We’ve said it before, and we’ll say it again. Get rid of generic paper-based communications and flat customer journeys.

The personalised and dynamic customer journey makes use of every touchpoint, interaction, and event to improve outcomes and demonstrate that you’re paying attention. You’re taking note of individual goals, aspirations, fears, obstacles, and learning styles. Personalisation also gives customers a sense of control over how they interact with financial institutions (Chheda et al., 2019). Where these journeys are customisable and adaptive, financial autonomy increases.

One person can receive up to 5000 communications from different businesses over the course of just one day. If you don’t make your communications specific to the individual, yours is just another notification to dismiss. At the end of every one of your interactions is a person trying to live their life. Put the work in to make sure you’re adding value, tailoring content to their needs and expectations. Generic and irrelevant information may confuse customers, directly impacting their engagement with you and their outcomes.

3. Embrace Technology

If you haven’t already started using technology to map and execute your customer journeys, you might want to start. Accuracy, efficiency, financial inclusion, transparency, fairness, and reporting are just a few of the reasons manual journey mapping is becoming obsolete.

With instantaneous customer analysis and complex algorithms, your customer journeys can be fluid and adaptive, delivering important information at exactly the right time to improve outcomes. Digitalisation has revolutionised how people consume information. People now expect that the information they receive from firms is wholly relevant to them as an individual. Over 18 million UK adults say they trust the financial advice shared with them on social media, which makes your presence in your customers’ digital lives even more urgent.

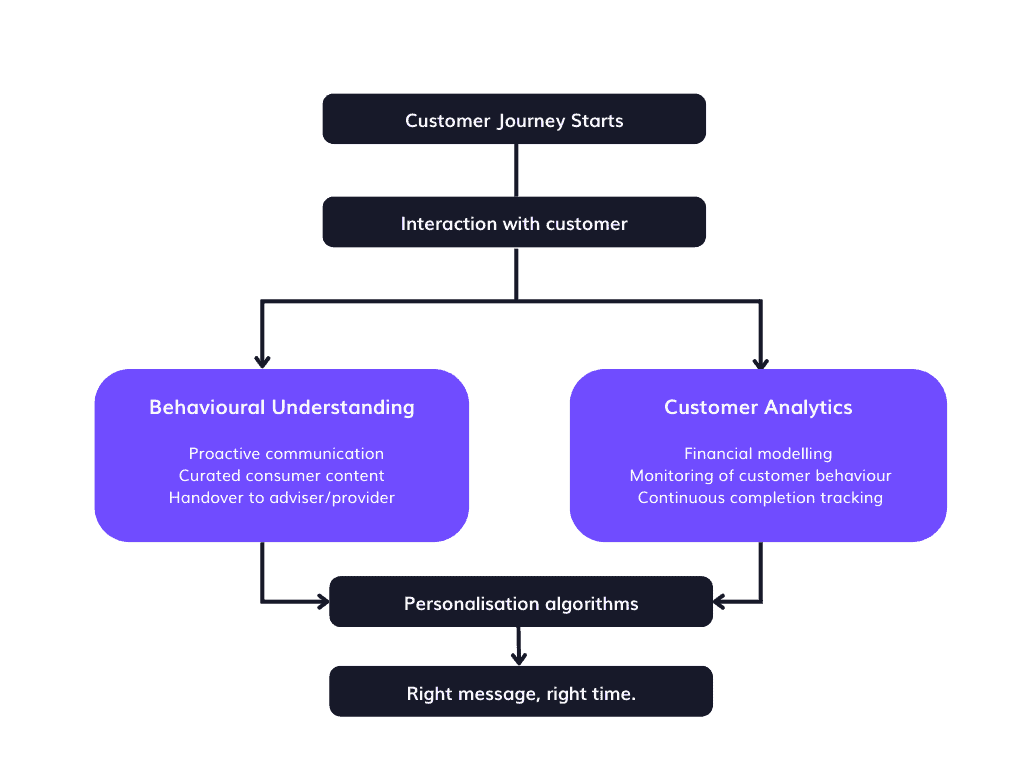

But it also means that you must take your journeys to the next level with purpose-built technology to stay ahead of misinformation and give your customers dedicated channels they can trust. See the below flow-chart for an example of how Eligible works to create a fully responsive and personalised platform.

4. Deliver clear financial education

Financial institutions have a reputation for impossibly complicated jargon – one of the things Consumer Duty aims to change. Financial literacy is imperative to lowering financial risk, and people prefer to make choices they feel competent or expert in. When someone has a vested interest in a financial topic, they will engage with information surrounding it and feel motivated to find out more. This is where you can add huge value to their journey with you.

Delivering clear information inclusive of all educational levels is critical. Firms have an opportunity here to safeguard customer futures by improving lifelong financial literacy. Research conducted by Shepherds Friendly tested 2,000 consumers in the UK on their financial knowledge. The results show that only 27% passed the test. The financial services industry has an opportunity here to educate, guide, and improve outcomes for people all over the UK – not just those with an existing level of competency.

Simple language and easily digestible knowledge should be adopted to provide a standard where firms cannot lead the consumer astray (while ensuring obligations to the FCA are adhered to regarding information and disclaimers). Too much information can overwhelm someone, and too little can leave them improperly equipped to make crucial decisions.

5. Adopt an omnichannel approach

Implementing an omnichannel approach to customer communication is the only way to stay competitive in acquiring and retaining customers. But it also requires firms to replace an outdated transactional approach with one emphasising customer experience.

Using various digital channels to communicate information effectively increases customers’ likelihood of seeing and digesting information. Email, SMS, social media, and push notifications are all effective ways to deliver your message. It’s complicated, and you must assess and mitigate the risk of each platform before using them to avoid any potential harm.

The omnichannel approach allows you to use a variety of formats to deliver your message. Cater for different learning styles, levels of literacy, and attention spans. In doing this, your customer becomes the central point from which all communication is designed to protect and enhance. This is exactly what Consumer Duty is trying to achieve.

6. Give everything context

The FCA reports that just over 1 in 2 adults in the UK feel stressed and anxious about the cost-of-living crisis. And that’s just one of the issues affecting a very turbulent financial landscape.

Every interaction you have with a customer has the potential to cause harm, so it is vital that you implement ways of analysing financial circumstances and customer behaviour. Analysis of this kind provides a context from which communication can be guided. Safeguard customers and empower them to feel confident in their financial decisions by demonstrating you understand their circumstances and goals.

Technology like Eligible is ground-breaking for customer context, analysing customer circumstances, monitoring behaviour, and using complex algorithms to deliver exactly what customers need when they need it.

7. Measure success

Implementing measures of success is crucial for consumer understanding. If you have no way of assessing the impact of your communication, then there is no way of knowing if the intended purpose of that content translates effectively.

Testing for good outcomes is imperative – was the customer treated fairly? Could anything in their journey have been improved? Was the customer given every opportunity to achieve a beneficial outcome?

To do this effectively, you need to implement robust testing frameworks, the results of which can provide you with clear insights and direct the adjustments you need to make. This is a constant and fluid process – your work here is never done. There are always improvements to be made!

8. Encourage financial discussion

Half of the UK population avoids discussions around finances. This is reportedly due to psychological and cultural barriers, feelings of shame, fear of rejection, lack of financial resources, and trust in the financial sector. These barriers subsequently affect how individuals manage their finances. Encouraging and initiating conversations creates a supportive network and an environment that fosters financial curiosity.

This has a positive knock-on effect: talking about finances can remove feelings of shame, empowering customers to learn more and engage more. The industry is more eager than ever to change the narrative around financial services, and by gently guiding conversation, we can build trust and improve outcomes.

9. Foster brand loyalty

Brand loyalty directly impacts customer understanding. Customers loyal to a brand will trust the information sent to them. They are more receptive to your message and more likely to engage with your content. Clients want to feel that your services are of superior quality and value compared to your competitors, reinforcing their own decisions in a positive feedback loop.

Customer understanding relies on a firm knowing what resonates with the people they serve and how to communicate with them. There is no trick to achieving brand loyalty – it depends entirely on the value you bring to your customers’ lives and the quality of the information you present.

10. Document everything

History is the best teacher. Document everything, and you will always be able to go back to identify a problem, enhance a process, or build on past success. Keeping accurate records of data and trends should add to the dynamic quality of your services. Don’t just archive and forget them; reflect, review, and learn from everything you have collected.

What were your most successful communications? What did customers engage with the most? What did they disregard entirely? Documenting everything will mean you don’t waste time on things that don’t work. Always follow your data – it provides invaluable insight and shows you the way forward. As a bonus, you’ll always be prepared if the FCA call on you to demonstrate how you have approached Consumer Duty!