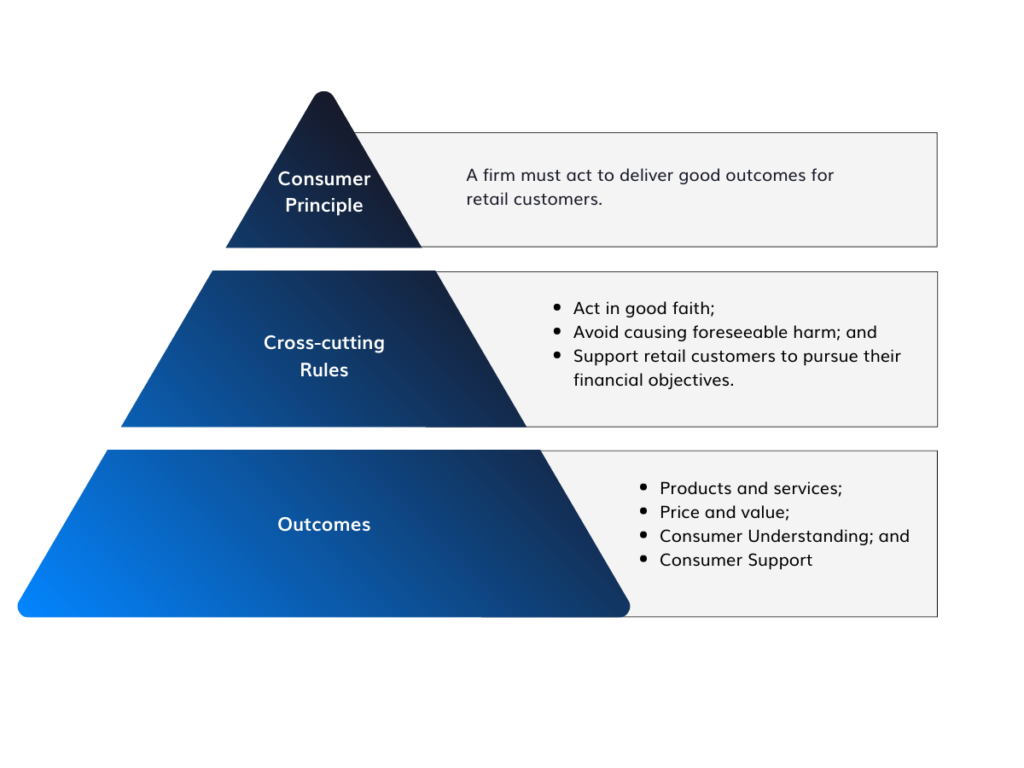

It has been the seemingly never-ending headache of compliance teams across financial services since the final rules were announced in July 2022: Consumer Duty. And on Monday, those rules came into force.

While many will be breathing a sigh of relief that the preparation period is finally over, many others are still dealing with the complex challenges of yet more regulations in an industry already governed by a vast network of complex requirements. The intricate nature of mapping out compliance strategy means firms often have more projects than they can manage and lack the resources to execute them effectively. Where some processes have been digitalised, teams need to find a way of marrying this efficiently (and accurately) with those still handled manually. All this while monitoring customer outcomes and firefighting problems wherever possible.

Compliance costs are high, and the introduction of Consumer Duty means institutions can no longer prioritise budgets over effectiveness. For many, this means expanding teams to bridge the gap, increasing already stretched workloads, and implementing new processes with little up-front guarantee of success. With the overwhelming tasks at hand, we have to ask:

Is there a better way of fulfilling regulatory obligations?

As usual, the short answer is yes. Keep reading for the long answer.

Technology as the Compliance Game-Changer

“Our rules require firms to consider the needs, characteristics and objectives of their customers – including those with characteristics of vulnerability – and how they behave at every stage of the customer journey. As well as acting to deliver good customer outcomes, firms will need to understand and evidence whether those outcomes are being met.” – FCA

Long-held practices will now be directly breaching the FCA’s regulations. Large exit fees, hard-to-find customer service contact numbers, insisting on branch visits to resolve a query – all of these now fall foul of Consumer Duty. But the real change for firms here is that while customers can still flag up unfair treatment, it is no longer solely their responsibility to do so. This now also falls to the institution – and this is where automation, complex algorithms, and artificial intelligence really come into their own for compliance.

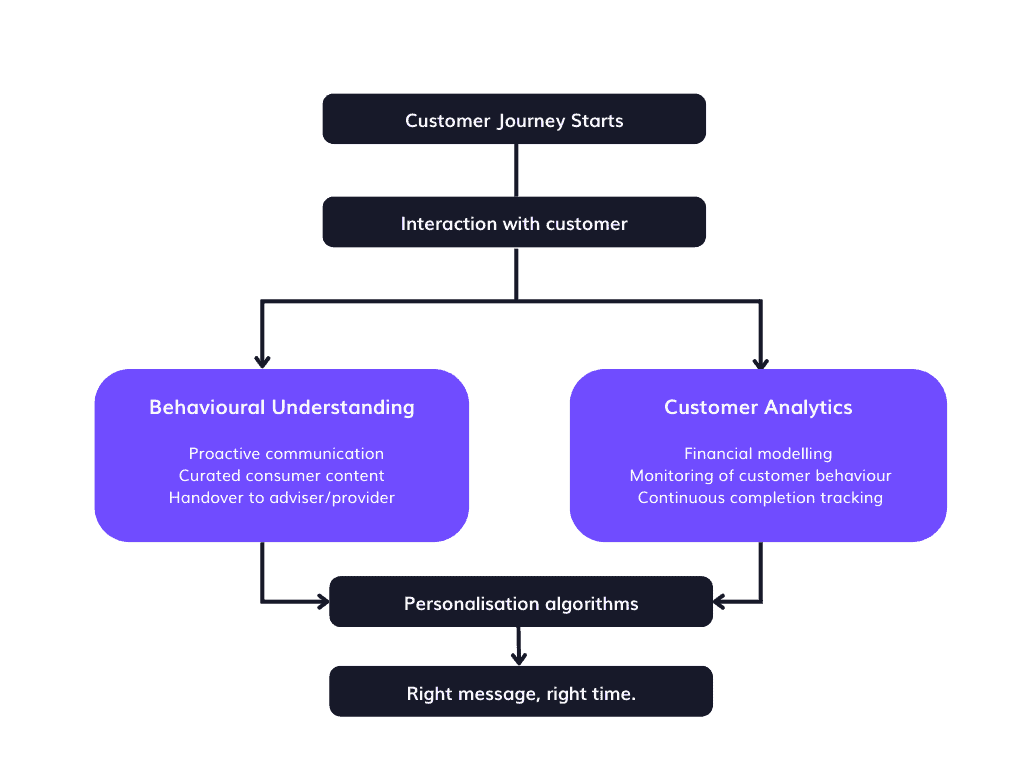

Personalised Information and Education

It seems counterintuitive to believe technology can do a better job of personalisation than a human, but the difference in accuracy and efficiency could not be clearer. Safeguarding customers, particularly the vulnerable or those with low financial resilience, is the cornerstone of consumer duty and technology can spot trends and learn from customers in real time – in a way that people can’t. Eligible, for example, analyses each customer’s financial situation and combines it with the behavioural data of that customer. Complex algorithms then decide instantaneously what information the customer needs next. It might be educational content, the presentation of new financial options, or a direct connection back to you for more in-depth guidance.

Armed with insights, Eligible can deliver targeted educational campaigns that empower customers with knowledge, provide immediate support to those who need it, and give complete visibility on the customer journey for monitoring and demonstrating compliance with the FCA.

Financial Inclusion

Financial technology (FinTech) now plays a pivotal role in ensuring financial inclusion. With applications built for convenience across myriad platforms and formats, customers are no longer indirectly penalised for being unable to physically attend a bank or having a low level of literacy. Messages can be delivered in multiple formats, mapped to learning style, giving consumers greater control over their finances. Technology gives firms many more opportunities to engage with customers from all backgrounds and, therefore, more opportunities to step in before they come to any financial harm.

Utilizing Big Data Analytics for Customer Benefit

Technology empowers firms to keep a vigilant eye on market trends and detect potential risks early on. By leveraging aggregated data, we can spot trends and respond quickly. It can tell us where the pain points are, what content is working, and what needs more work. These insights not only have the power to add real value to consumers’ lives, they also give firms a clear competitive advantage.

Ensuring Product Transparency and Fairness

Consumers face an overwhelming array of choices when it comes to products and services. By leveraging AI algorithms to monitor and analyse product descriptions, information, pricing, and terms of service, firms can have visibility on the whole picture and can proactively move to fix something that might inadvertently put customers at risk.

This is not an exhaustive list, but you get the idea. In order to embrace Consumer Duty properly and embed it into your culture, you need technology. It is the key to compliance.

It’s also important to note that the firms already embracing technology across the customer journey have immediately seen improvements in customer loyalty and retention, visibility, as well as enhancements their tracking and monitoring tools. And that’s just the beginning of it. While those handing on to manual processes scrabble to make sense of the data, those with the right technology have already analysed it, formed action plans and implemented them.

“Treating your consumers with a fair and reasonable duty of care is impossible to do with any level of confidence without technology.”

- Darren Rushworth, President of NICE International talking to Forbes 2023