We already know that financial literacy is low in the UK, with a huge 9 out of 10 people claiming the education system has left them completely unprepared to manage their own finances. But where are the biggest knowledge gaps among the masses?

Mortgages

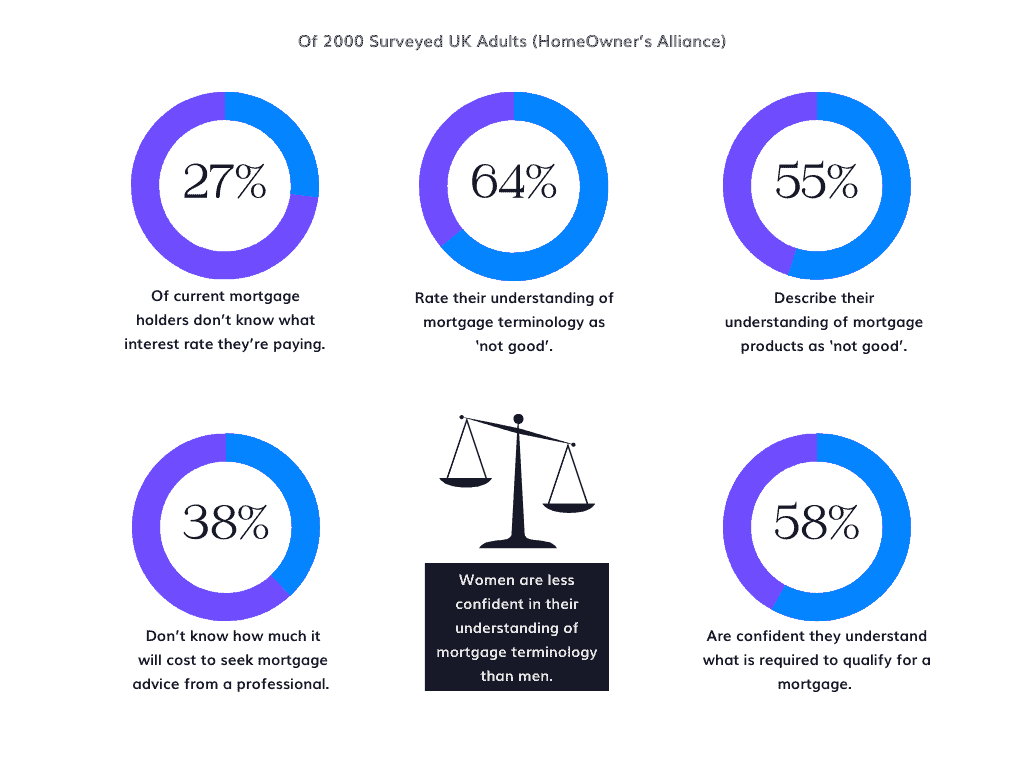

Research from HomeOwner’s Alliance should give all mortgage professionals cause for concern. When surveying 2000 British adults (570 of whom currently have mortgages), they found that people were often confused about terminology, interest rates, and what they would expect from a mortgage adviser. Here’s a closer look at the results:

Mortgage terms appear to be a general pain point, with people often overestimating their own understanding. For example, 75% of people claimed they understood the term ‘Standard Variable Rate’, but only 44% of these people got this right when tested. The disparity between financial confidence and financial knowledge is something all professionals should be addressing under Consumer Duty as this can have a direct impact on outcomes.

Credit Scores

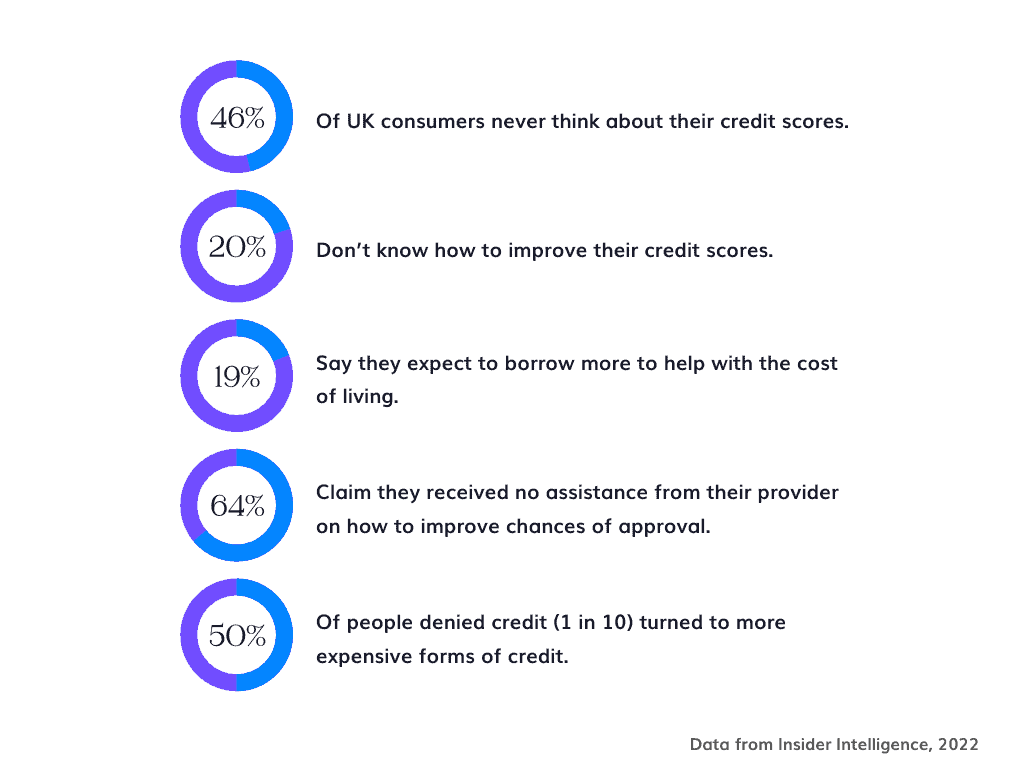

The cost of living crisis continues to push more people towards credit – even when a huge percentage of the UK population don’t know or understand how their credit score works. In fact, according to Insider Intelligence, nearly half never think about their credit score despite the huge impact it can have on their lives. This lack of awareness puts people at risk and threatens their chances of achieving favourable outcomes financially.

The UK’s general understanding of credit scoring is the worst across the countries surveyed (France, Germany, Italy, Czech Republic, Slovakia, and the UK). In particular, it highlights a lack of communication between financial institutions and consumers, and instead of being helped, people are being forced into more debt to survive.

Interest and Inflation Rates

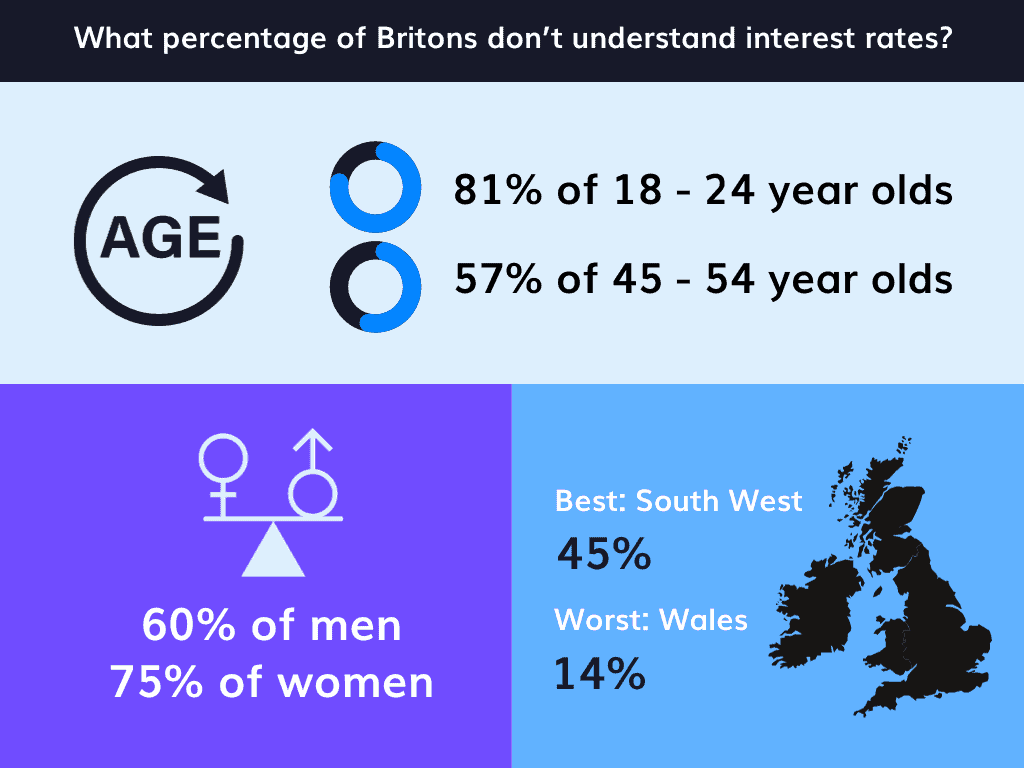

The last research conducted on Britons’ understanding of interest rates was by MoneySuperMarket, indicating that over half of Britons don’t understand what the term ‘interest rate’ means and couldn’t correctly identify the Bank of England’s base rate.

Adding to this, a study conducted earlier this year by Aviva sought to explore people’s understanding of basic financial principles, including inflation, compound interest, and risk vs reward.

The results revealed another knowledge gap: British people lack fundamental understanding about how inflation impacts their buying power and savings.

Only 44% of people understand the impact of inflation on savings. And only 37% understand compount interest.

Without an understanding of basic financial principles, people cannot make fully informed decisions about their financial futures. In a more consumer-focused era, financial institutions must ensure these concepts are understood – and not just by way of having been issued in small print.