According to recent research, a staggering 88% of Brits do not feel confident about their financial literacy, with a third saying it negatively impacts their mental health. We already know that financial education facilitates positive outcomes, but where should that financial education come from? Many would argue for courses built into the educational syllabus in schools, but the results here are mixed. Some research argues convincingly for education to be delivered at the time of need when people are in the midst of making a financial decision – that is, when they are most engaged and eager to understand.

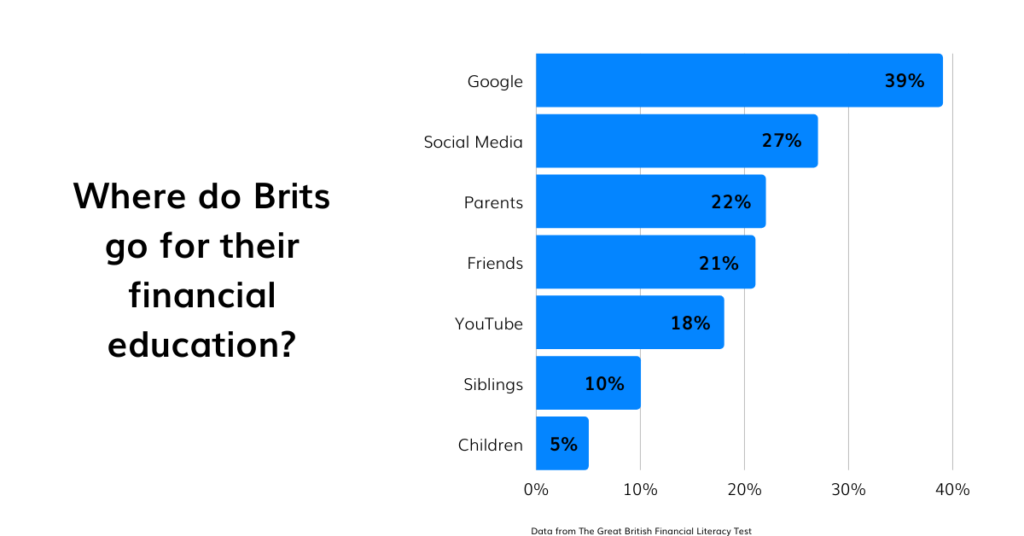

With a low uptake of regulated financial advice, people are turning to other channels to educate themselves.

If nothing else, this highlights a breakdown in how financial institutions communicate with customers. Whether an issue of trust, fear of consequences, or simply that information is still delivered in a dated, unhelpful way – we can’t ignore that the only place people aren’t turning to are the experts.

So, is it our job to educate? Yes. And here’s why:

Visibility and Resources

With some demographics at an increased risk of financial harm and varying levels of literacy across the UK, education needs to be tailored and targeted. This won’t be achieved with a one-size-fits-all educational program in schools.

With access to big data and the means to analyse it properly, the financial services industry is in the ideal position to lead the charge on financial education. We know when customers are about to make a big financial decision and what information they need to make a good decision – we only need to take it one step further to ascertain whether they have access to it.

Not only do financial institutions have the resources to give customers access, but they also have the capability to make financial education front of mind with motivational ad campaigns aimed at solving the UK’s financial illiteracy crisis.

Corporate Social Responsibility

"The financial market is the cause and effect of our business, and hence it is in the best interest of every financial institution to nurture and educate society."

Organisation for Economic Cooperation & Development.

Financial institutions are always looking for new ways to contribute to the communities they operate in. Leading the way on financial education and increasing nationwide financial literacy levels demonstrates a real commitment to being a force for good – something our industry has struggled with in the past. Better financial education, particularly where it is tailored to circumstance and learning style, will positively impact financial inclusion and potentially help those families most in need escape cycles of poverty and debt.

Reducing Significant Losses

People who do not have access to financial education and support are more likely to make poor financial choices, taking out credit they cannot afford, making bad investments, or becoming the victims of scams. This results in significant losses for UK banks.

By making education a priority across all customer journeys, we are able to safeguard the financial futures of people in a way we currently don’t. It is a win-win option, for both customer and provider – reducing losses and helping people to achieve their financial goals.

Rebuilding Communication and Trust

If Consumer Duty has taught us anything, it’s that the UK is ready for a more person-focused financial services industry – one that truly cares about outcomes and proactively facilitates them. Finding ways to help people find autonomy over their finances as they struggle with the cost of living is an excellent building block upon which to foster trust with consumers.

If we provide customers with the tools and knowledge to make good financial choices, we improve confidence levels and build lifelong relationships. In a country as economically advanced as the UK, it makes little sense that such huge swathes of the population are turning to social media platforms instead of regulated experts for advice.

But there’s some work to be done first. In the digital age, customers are more demanding about how they receive their information. It is unlikely they will regin any enthusiasm for archaic paper-based communications, which means financial institutions need to catch up – and quickly. Platforms designed around user-experience that offer a tangible improvement on the advice they currently get online is the only way the UK’s financial services industry can reclaim authority in financial education – they area they should already be excelling in.