The suggestion of using AI in financial services still evokes a little anxiety among professionals – even in the digital age. In the same way we are reluctant to embrace driverless cars, removing the human element feels alien and makes us uneasy about where the technological pitfalls will appear. These concerns aren’t baseless, but as Eligible co-founder Zahra Hassan states, “It’s all about the application.”

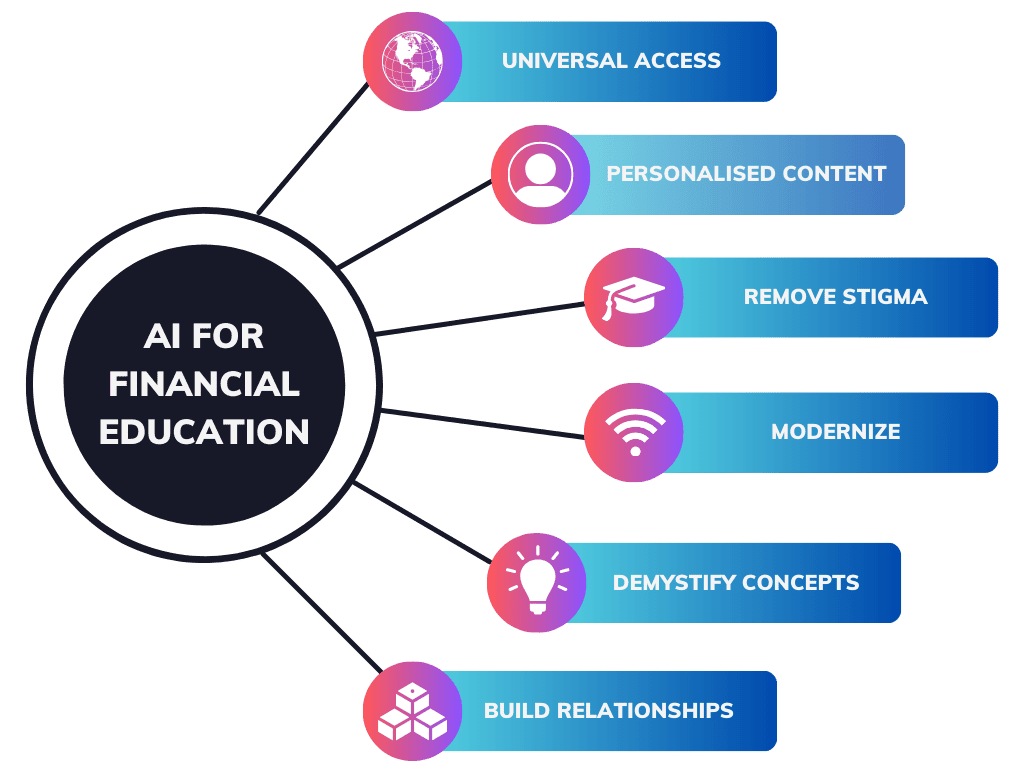

When it comes to financial education, however, it’s hard to find the downsides. AI has the ability to process vast amounts of data, including thousands of micro-interactions, bringing a whole new level of granularity to learning. It also brings flexibility to customer communications, adapting format or language to ensure customers understand what they are being told. With the current state of the UK’s financial literacy levels, we owe customers an opportunity to learn in their own time, in their own way, on their own devices.

Ironically, artificial intelligence puts the human element back into financial services.

Universal Access

Imagine if your geographical location were no longer a predictor of your financial literacy. This is what online platforms can do for underserved communities. With the freedom of on-demand, responsive educational systems, they suddenly gain access to information they were previously excluded from, with immediate support if it’s needed.

The assertion that people will seek financial advice from their providers if they need it is a false one. In fact, the evidence shows that the people taking one-to-one financial advice are already financially literate. Increasing the volume and availability of advisers, therefore, will not solve the problem. This calls for new ways of reaching people who need financial education, but aren’t persuing it.

AI-driven platforms can overcome geography, language barriers, anxiety issues, and learning styles, to name just a few. It is a unique opportunity to make sure everyone has access to the information they need to live their lives.

Personalised Content

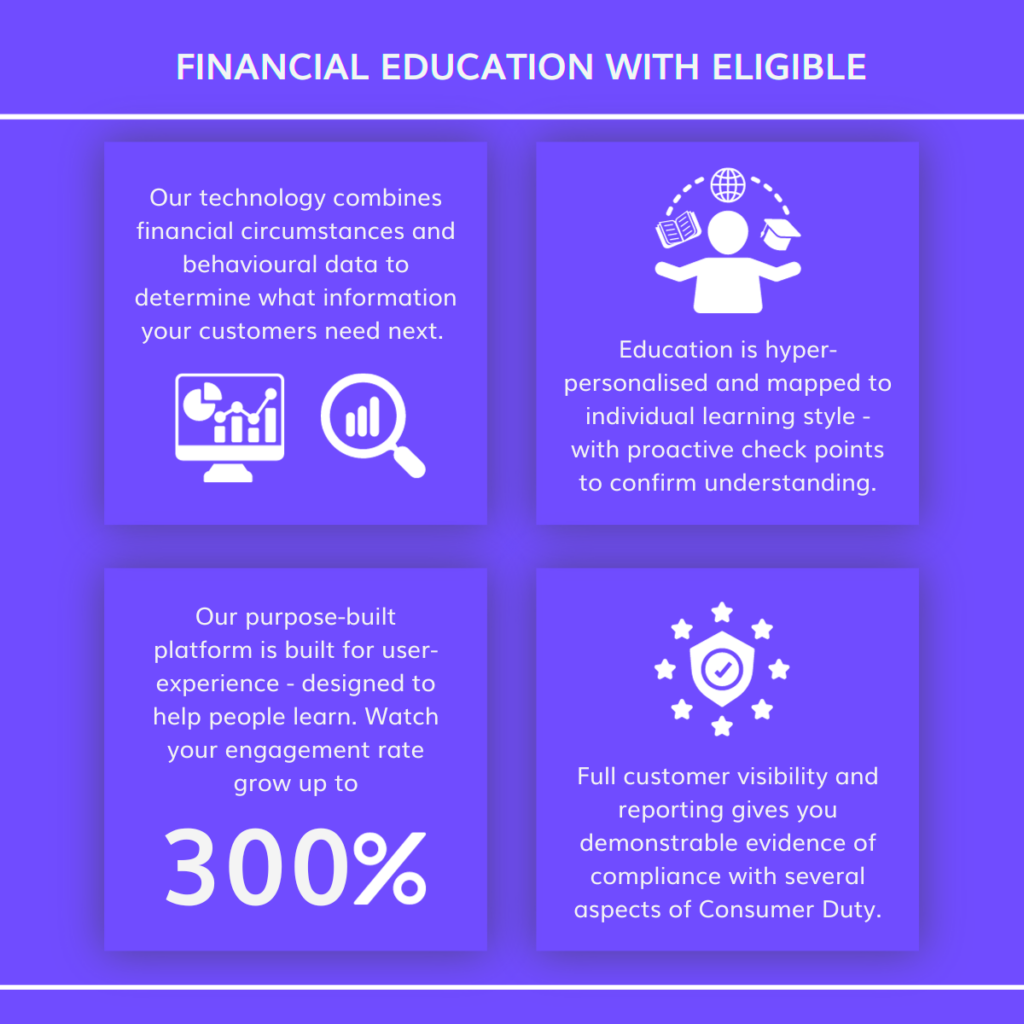

AI revolutionises learning for customers on a personal level. Upon analysing customer engagement and behaviour within the context of their own financial circumstance, it can make an immediate decision on how best to serve them. This content is tailored and has the capability to guide them to the best options available to them.

For people with specific financial needs, generalised advice isn’t helpful. This means that outdated, generic communications are irrelevant to the customer they are designed to help.

Advisers dealing with customers face-to-face receive limited feedback on their delivery of information, whereas AI can receive actionable feedback and respond immediately, presenting information in a different way, an altered format. It also has the time to keep doing this until a customer confirms they understand and need no further assistance.

Remove Stigma

Somewhere along the line, good financial management and literacy have become intrinsically linked with morality. There is an unspoken assumption within UK society (and likely in many other advanced economic countries) that if you are in a bad financial position, it is down to your own behaviour or lack of control. We make people solely accountable for their circumstances, which feeds into the fear people feel about financial institutions and seeking advice.

Narratives like this perpetuate low self-worth, promoting feelings of failure and shame. People in this position may be less likely to ask for help when needed. To exacerbate the issue, our financial literature is often so full of jargon that people become overwhelmed and confused, leaving them no more clued-in but potentially more stressed-out than they were to begin with.

In reality, it is our traditional approach to financial education that is inadequate – not the people in need of it. AI-driven platforms designed to guide people through the financial decision-making process take the fear out of learning -customers can learn without feeling any scrutiny or anxiety.

Modernize

Over the past three generations, we have seen a growing trend of people turning to social media platforms for advice and guidance on their finances. While most financial institutions have some presence on social media, it’s surprising that more aren’t taking advantage of the general concept: dedicated online platforms delivering approved and regulated advice.

How people consume their information constantly evolves, and those still trying to educate customers using paper-based communications are being left behind. Purpose-built portals, where customers can digest information at their own pace, are the only way forward for a generation that lives primarily online.

Demystify Concepts

AI can adapt the information it gives if someone struggles to understand a complicated concept. By creating a full customer profile, demographics, circumstances, stress levels, and pain points, algorithms can deliver information in a variety of ways that facilitate learning. The idea is to reduce overwhelm by educating in a non-pressurised, optimised environment.

Each time a user successfully understands a concept, the system gets to know them a little better and understands how to present the information next time. Customer engagement can increase by up to 300% with AI educational platforms, building and shaping behaviours that will help them achieve their financial goals.

Build Relationships

We’re back to the human element, and the instinct is to dismiss AI as a faceless, impersonal way of interacting with customers. But consider this – throughout the three to five years of a mortgage term, your firm might contact them once or twice just before their current deal expires. Now consider giving customers access to a platform that engages them daily with up-to-date, personalised content, delivered according to their preferred learning style and aware of their financial circumstances. A platform that engages for you, with your branding and your contact details. It’s a full-suite servicing solution, using one-of-a-kind technology to build loyalty, trust, and satisfaction among your customer base.

So the only question left is what are you waiting for?