How are you testing for good outcomes? Strengthen your approach using appropriate and robust frameworks, giving you a 360 view of the entire customer journey and highlighting anything that needs adjustment.

As the mortgage industry gears up for full implementation of Consumer Duty by July 31st, we’re supporting institutions with practical guidance and measurable steps to ensure all your ducks are in a row.

Outcome Testing

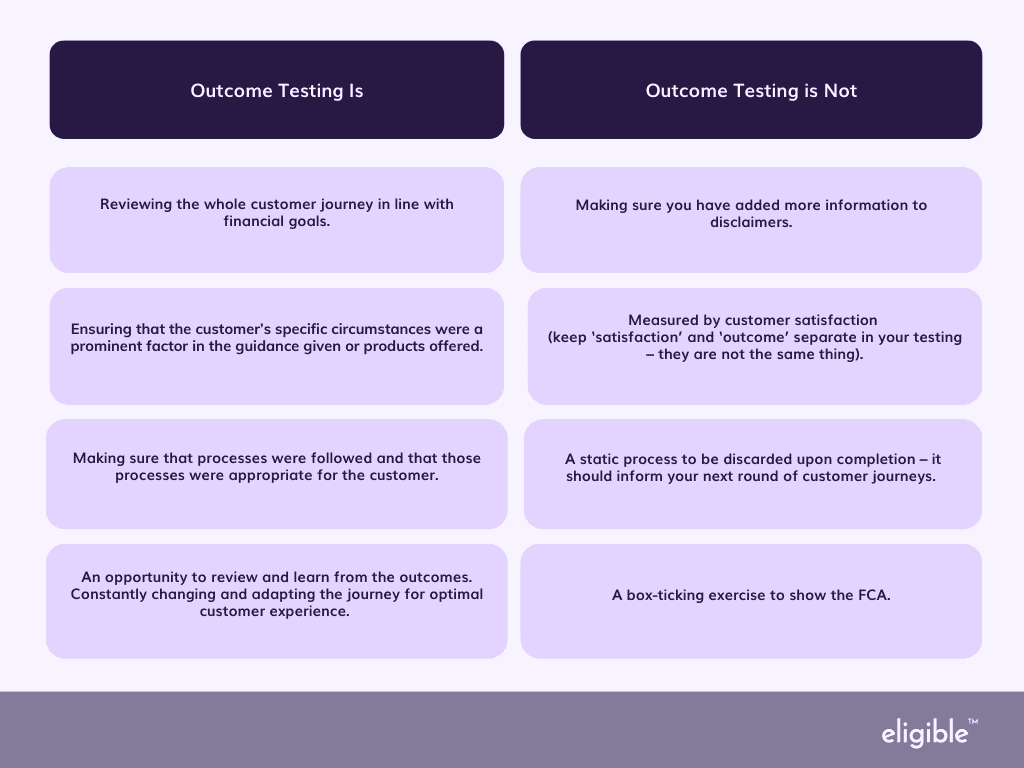

When you look at a specific customer’s journey from beginning to end, can you conclude that their outcome was fair? From first communication to contract signing to follow-up care, was the customer given every opportunity to achieve a beneficial outcome?

This is the crux of outcome testing.

It is not simply ensuring your firm has followed procedure or policy – it is looking at each step of the customer journey and concluding that the overall outcome was fair to the customer. As the firm providing the product and advice, you were in the driver’s seat of those transactions – the position of power.

Did you use that power for good?

Robust Outcome Testing Frameworks

You should be able to apply your chosen framework across all areas of your business. In order to facilitate good outcomes, clear definitions need to be set, and procedures need to be clear. Your goal with a testing framework is to ensure that the reports you produce are actionable. They are not the end of the process – they are your jumping-off point for continual improvement across the entire customer journey.

Here’s your action plan for a robust outcome-testing framework:

Definitions

The FCA has left this up to you, which means you can decide to be ambitious in your pursuit of customer excellence! What does a good outcome look like?

First, you must understand your customer’s goals and map the possible outcomes. Assign each possible outcome a rating and set your standard. Given their personal circumstances and the options available, which of those options would be fair? Which of those achievable options comes the closest to helping them reach their goal? Determining ideal scenarios for your customers gives you a clear picture of which steps they need to take next to stay on track.

Your definitions should be robust and translate across each product or service.

Customer Journey Map

Your outcome definitions are set, and now you have to figure out how to get there. Your customer journey details every waypoint and every communication – in short, every opportunity you have to ensure your customers stay on the right path and have the information and support they need.

Where do you need to intervene? How are you delivering the information? Is there a particular process that would benefit from extra interaction with customer support, or the right time to send more literature about their product? How-to emails, snippets of advice, options to speak to an advisor – not only do these combined become a well-thought-out and tailored customer journey, but they also go right to the heart of Consumer Duty.

Support, understanding, value, and fairness.

Clear Processes

The processes you implement should be appropriate and relevant to each touchpoint. If, for example, a customer starts to veer off their path and you’re worried about their outcome – how will you approach it? How will you intervene?

Rather than trying to deal with deviations or problems on an ad-hoc, fire-fighting basis, your teams should be empowered by the processes you’ve put in place. They already know what to do because they’ve had the training and understand the goal. All people, systems and policies are working towards the same thing – good customer outcomes.

Data Collection and Touchpoint Tests

Focusing on your goals, which data will you collect as your customers move through their journey? Depending on your service and product, this will differ, but there are some common threads to consider.

How are you selecting your sample for testing?

Does the sample size accurately reflect your business and its complexity?

Does it accurately reflect the diversity and demographics of your customer base?

Ideally, you want to know who engaged with each piece of content at each specific touchpoint. You want to know what happened after they engaged with it – who continued down the optimal path you defined in step 1? How many got lost and needed a nudge in the right direction? Select the data that will provide rich insight into your customer journey. You designed it, but this is your opportunity to see if and how it works. The robustness of your data collection here should give you a clear indication of performance and informs where changes need to be made to improve customer outcomes.

You also need to ensure you are conducting root cause analysis here. If something isn’t working, make sure you understand why before you change anything. Otherwise, you could unnecessarily spend time and resources while the problem goes unchanged.

Data Insights into Actions

Insights from data collection often get lost before we can turn them into something tangible. How and who is going to analyse the data you have collected? Will you have someone independently verify the results?

Set a regular cadence for these reports, and determine how they will be presented. Visualisation tools give an immediate and clear picture of what has been a success and what needs more work. By establishing regular reporting processes, you can continually improve your customer service and communication.

Always keep the goal clear and the customer at the centre of every decision. Investigate if you notice customers dropping off the customer journey at a particular touchpoint. Find out why. Seek feedback. Take steps to ensure all insights and actions are accurately and clearly reported – this will ensure that submitting reports to the FCA is simple and stressless!

A Consumer Duty State of Mind

The statement you make when you employ robust outcome testing is one of a firm committed to good customer outcomes and excellent customer experience. Every interaction has the potential to cause financial harm, so we must make sure every communication is intentional, driven by a desire to see customers benefit from our services and expertise.