Choosing the right financial product is more complex now than ever. Those struggling to stay afloat during the ever-present cost-of-living crisis are increasingly turning to credit to keep themselves afloat. This often pushes them further into difficulty and increases the likelihood of having to borrow more in the future. For every decision, there are hundreds of variables, hundreds of options, and a market saturated with providers all claiming to offer the best deal. Financial literacy, or illiteracy, inevitably puts some groups at a constant disadvantage due to a lack of financial education.

The research all points to the same conclusion: that improving financial literacy has a profound impact on outcomes, from personal financial stability to broader economic resilience. And yet, financial literacy is low – even in advanced economies. In fact, it’s estimated that only one-third of people worldwide are familiar with the basic concepts needed to make everyday financial decisions. As the industry enters a more person-focused era, emphasising the need for accountability from our financial institutions, it’s time to follow the evidence and create a culture of curiosity regarding financial decision-making.

The Consumer State-of-Mind

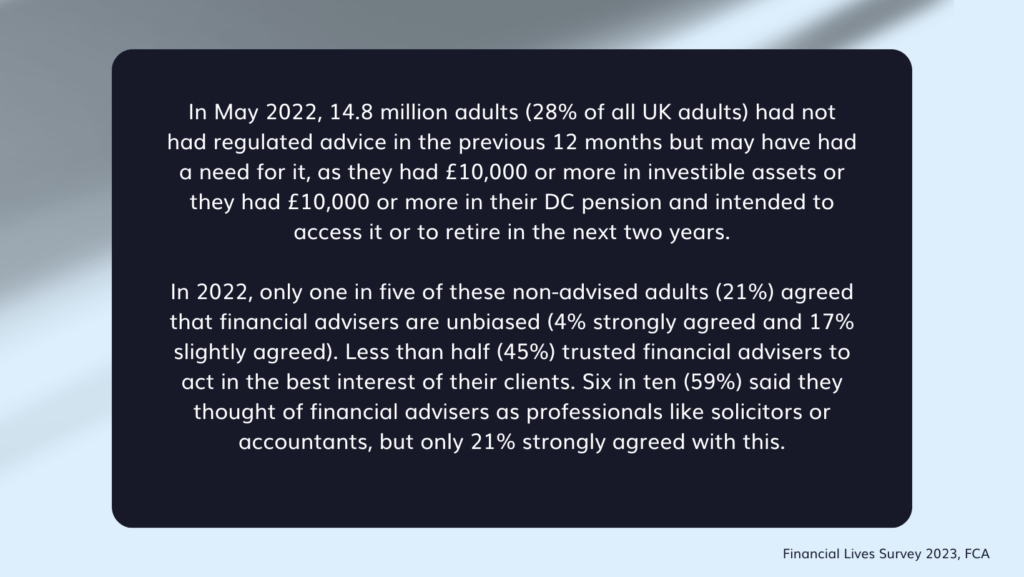

The most recent Financial Lives Survey gives us some worrying feedback. Alongside the general malaise with regard to financial service providers and a likely pension crisis a few years ahead, the general uptake of financial advice from regulated channels is low. And yet, there has been an increase in people (nearly 30%) seeking financial support from unregulated public resources. This includes the Citizen’s Advice Bureau, Which? And MoneySavingExpert.com.

This should alert us to an urgent need to re-establish trust with consumers.

It will likely take more than a loyalty scheme to get consumers back to a place of confidence in financial services, but there are some key places to start. Firms should be making a considerable effort to be the source of their customers’ financial education. Consistent engagement with high-value content has the capacity to influence outcomes and dramatically increase satisfaction scores – particularly where this is tailored to their own products, learning styles, and circumstances.

The Impact of Education on Personal Finances

“Financial literacy is not only the knowledge and understanding of financial concepts and risks, but also the skills, motivation, and confidence to apply such knowledge and understanding in order to make effective decisions across a range of financial contexts, to improve the financial well-being of individuals and society, and to enable participation in economic life.”

The Organisation for Economic Co-operation and Development, US.

Financial Literacy as a Lifelong Skill

Financial education has a huge part to play in overall financial literacy. The results for teaching financial education as part of a school or syllabus are mixed – particularly with those on lower incomes. For these groups, specific problem points, like debt management, are difficult to influence with mandatory financial education. It is far more effective where education offerings are made and intensified during ‘teachable moments’ in real-world situations. A one-size-fits-all method is ineffective. Education should be tailored and targeted exactly when someone needs it in order for them to make more informed financial decisions, leading to better outcomes.

Breaking the Cycle of Debt

Many people make bad financial decisions based on need and desperation, eager to solve the problem right in front of them rather than look at the longer-term implications. With proper financial education, people can make better decisions to help them through hardships. People with more financial knowledge take conscious steps to spend less than they earn and plan ahead to make themselves financially resilient by saving.

Improved Savings and Investment Behaviour

Knowledge breeds curiosity, and when people have seen positive outcomes for themselves through learning, they are inclined to learn more. Research by the Global Financial Literacy Excellence Center (GFLEC) indicates that individuals who receive financial education are more likely to save for retirement, invest wisely, and achieve their long-term financial goals.

Enhanced Financial Decision-Making

Financial education equips people with the tools they need to make informed choices. More than just being informed, they are confident in their decisions and more likely to have better financial outcomes in both the long and short term.

We have a unique opportunity as an industry to provide people with the knowledge they need precisely when they need it. Instead of providing hypothetical advice for decisions they may never make, we can give practical guidance for the decisions they are making right now. Helping your customers to educate themselves puts Consumer Duty at the heart of your service, and shows your customers you’re committed to helping them achieve their financial goals.