It’s crunch time, and firms everywhere are feeling the pressure to implement solutions to the FCA’s Consumer Duty by July 31st. Of the 4 outcomes, it’s likely that Consumer Understanding was last on the list, with many companies believing their approach was adequate to begin with.

However, with the FCA making it clear that ‘adequate’ doesn’t cut it anymore, quantifying and proving consumer understanding is complex and multifaceted. Compliance is no longer a box-ticking exercise. Firms should show a holistic approach, demonstrating with data that they’ve achieved it and, most importantly – that it worked.

Consumer Understanding: What the FCA Says

“We want firm’s communications to support and enable consumers to make informed decisions about financial products and services. We want consumers to be given the information they need, at the right time, and presented in a way they can understand.”

What does this mean for current processes?

In short, that a full review of all current communication strategies must be carried out. Poorly informed financial decisions can ruin lives, and every communication a customer receives has the potential to cause harm. This includes the way in which information is delivered and the channel used to deliver it.

Financial services do embrace digital, with some commitment to user-friendly communication (SMS, email, push notifications, etc). Despite this, the industry is still way behind the curve. Furthermore, the Consumer Understanding outcome may even push firms further down the information rabbit hole – plying consumers with lengthy 5-page emails to make sure they have carefully explained everything in writing. When the average time spent reading an email is 5-10 seconds, we can be fairly certain the email is not being read in full. Supplying information is not the same as informing; one is passive, and the other proactive.

The FCA accepts that consumers have agency over their own decisions. This means firms will not be held accountable for poor outcomes where information has been provided, understood and accepted. But they must ensure that information has met the Consumer Understanding requirements.

So, what’s the solution?

Deliver the right message, at the right time, tailored to the consumer, and proactively facilitate good outcomes.

Instead of seeing each customer interaction in isolation, entire customer journeys should be placed under the Consumer Understanding lens and mapped for optimisation. In many cases, this will mean a complete overhaul and redesign of customer journeys. Firms should now consider where information should be displayed, when the customer needs to see it, and how many different touchpoints it should be available on. Alongside these elements, companies are expected to provide evidence to support their assertion that consumers have understood their literature.

- Does each communication add value and strengthen customer comprehension?

- Have we used language that facilitates understanding?

- Will the journey give the customer every opportunity to achieve their financial goals?

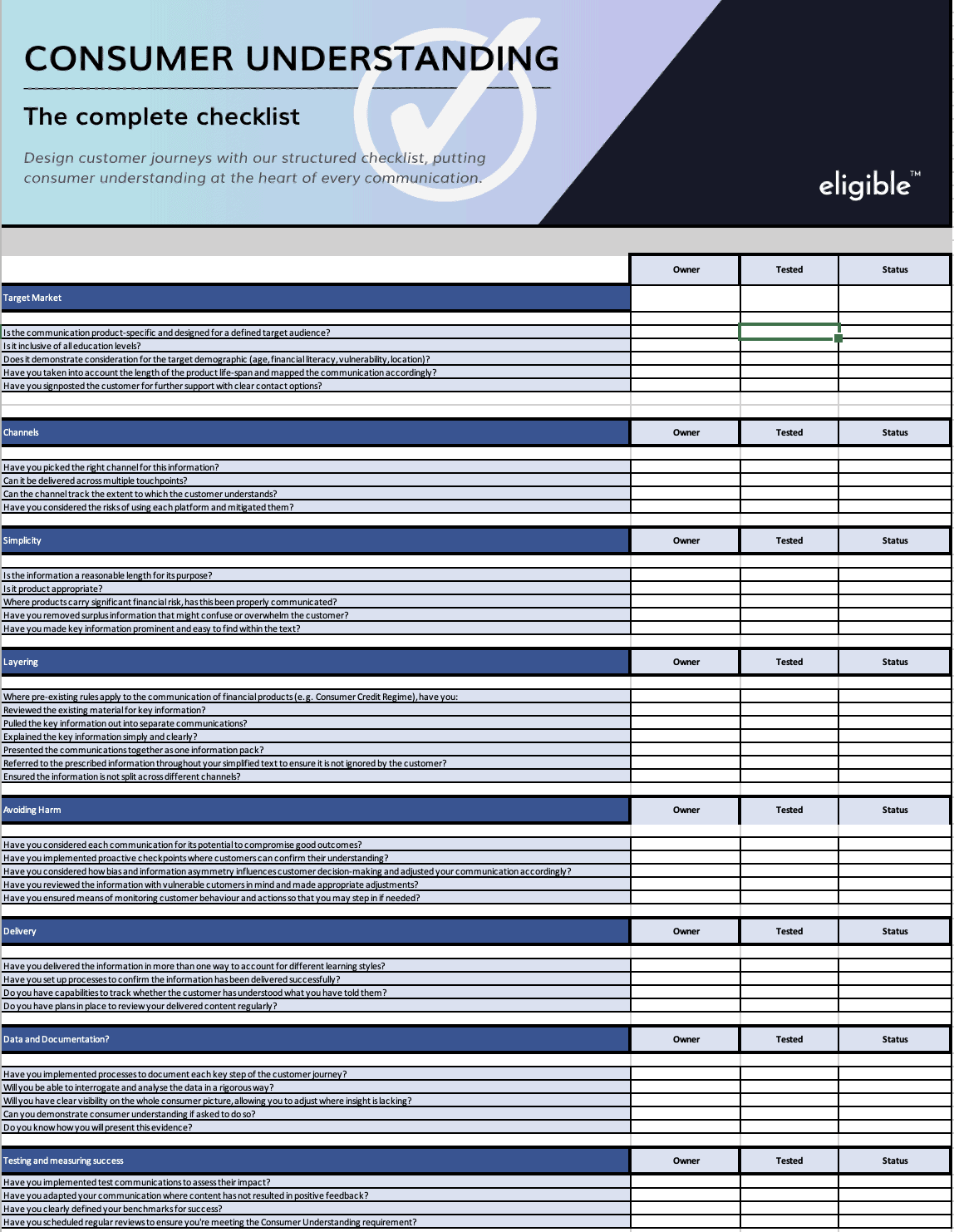

Download our Consumer Understanding checklist to make sure you’re on the right track with the Consumer Understanding outcome.

And if you’d like to know how Eligible delivers every one of these checkpoints its state-of-the-art solution, book a demo with us before July 31st.

Download the checklist