Share this post:

Reducing pricing as a strategy to increase customer retention may seem appealing, but it comes with its own set of challenges and drawbacks. Eligible Founder Rameez Zafar explains, using worked examples, why reducing product pricing to increase retention is a false economy.

Reduction for Retention: A double-edged sword

In an environment with volatile inflation and interest rates, mortgage lenders must focus on retention due to a slowdown in house purchases. However, reducing retention product pricing does not always yield the desired results and can negatively impact a lender’s profit (P&L).

To put it simply: reducing product pricing often (if not always), actually reduces P&L.

A lender would be better off doing nothing.

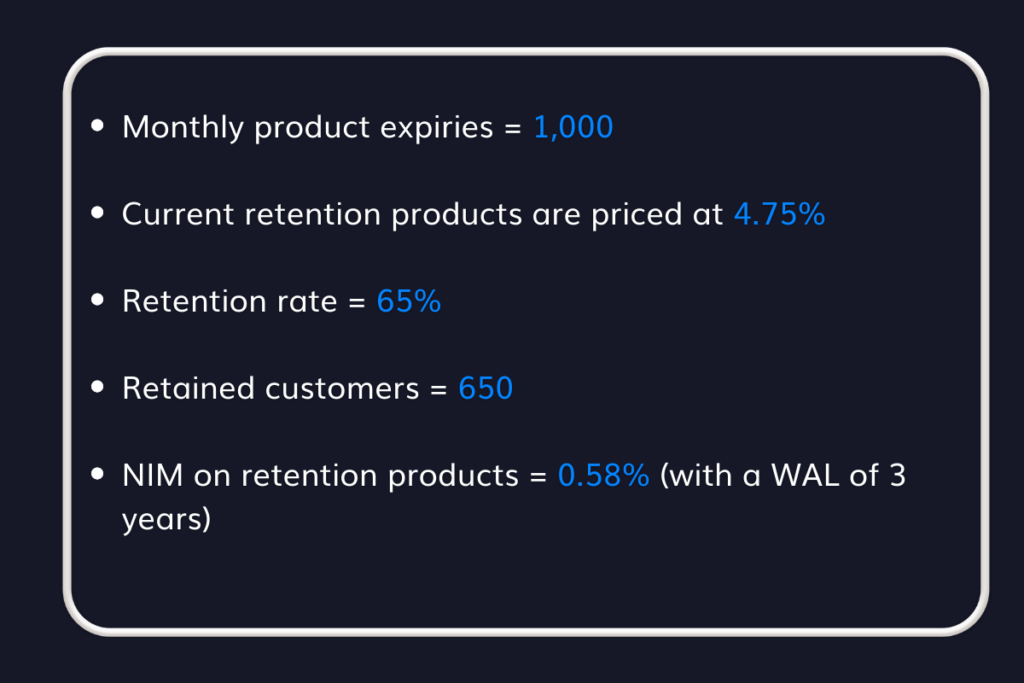

It’s a bold claim, but let’s work through an example. To illustrate the point, we’ll calculate this for a hypothetical lender working within the following simplified parameters:

Using these figures, we can estimate the cumulative P&L from retention is £1,320,313.

Now let’s say the lender wants to increase their retention rate by 5% and decides it will reduce its retention rate product pricing by 25bps.

Now the figures would be:

The new estimated cumulative P&L from retention is £ 1,065,750. (£250,000 lower!) Despite the aim of attracting more customers, the outcome is a decrease in the cumulative P&L.

*In fact, in this example, even if you only reduced rates by 10 bps (to 4.90%), and this caused your retention rate to increase to 65%, you would still just break even.

The before-and-after illustration below gives you a clearer idea of how this works:

What's going on here?

When you lower your product rates, you lower your net interest margin (NIM) on every customer (including the 600 you had already retained).

So while you achieved your goal of getting 50 more customers to switch with you, this is offset by all 650 of these customers earning you less.

New purchase products and retention products are NOT the same.

So why is this the common approach to try and increase retention? My best guess is that it’s applying the wrong ‘mental model’ to retention – in this case, new product pricing.

While new purchase mortgage pricing and retention mortgage pricing seem the same, there is one important difference.

To put it contentiously, new mortgage pricing is a form of lead generation and retention mortgage pricing simply isn’t.

Let me clarify – when lenders are pricing new purchase mortgage products, one of their goals is to move up to the top of a broker’s sourcing results or a consumer’s search results (for given LTVs and other eligibility/affordability criteria).

This makes sense because a new borrower is not aware of what lenders are out there, beyond perhaps the bank/society that provides their current account.

Consumers (direct or via their advisers) rely on product sourcing results to narrow their focus to select lenders and products. This isn’t dissimilar to why SEO and getting to the top of Google is so important.

Why are retention products different?

New customers are price-sensitive and this is a primary factor in their decision-making process. However, existing customers already know their lenders. Their focus is on product transfer options and the switching process. These customers need to know:

- That their current term is coming to an end.

- Their product transfer options.

- The process of switching to a new product.

- When retention products are available.

In the current landscape, particularly with the introduction of the new Consumer Duty, lenders need to prioritise value for customers over mere price reduction. The focus must be on creating loyal customer relationships, providing valuable services, and ensuring an outstanding customer experience.