Share this post with:

The FCA describes the new consumer duty as a ‘paradigm shift’ in expectations for firms providing financial services across the UK. The new rules are complex, but at its heart, the new consumer duty aims to enhance protection and improve the experience for millions of customers accessing financial services. The rules create a framework to protect consumers from harm and sets higher standards for advice, products, and support.

The timing is apt because the cost of living continues to rise, and more people struggle to make ends meet. From housing costs to food prices, it is becoming ever more difficult to manage expenses on a fixed income. Customers need expert advice and support from their providers.

Therefore, the new consumer duty is a welcome development for UK customers, but how can lenders manage strict criteria and help consumers reach their financial goals?

What is the new Consumer Duty?

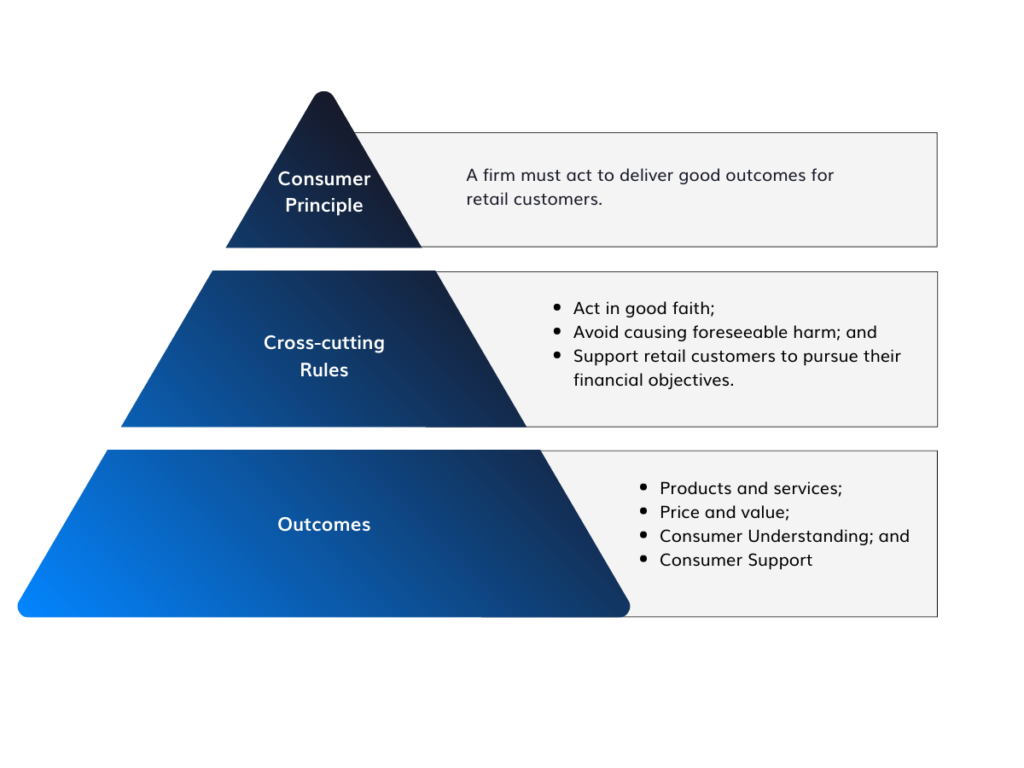

The Duty is a collection of newly defined measures, setting out a new standard of care and aiming to ensure businesses prioritise their customer’s needs over their own. These measures include a new principle (Principle 12), new cross-cutting rules outlining the recommended approach, and four key outcomes from which success can be measured:

Under the new rules, firms must proactively identify and address potential consumer harms, including those arising from new technologies. They should also be transparent about their services, providing clear and accurate information about their product features, benefits, and limitations. Finally, businesses must be accountable for their actions and be able to demonstrate that they have taken reasonable steps to comply with the new Consumer Duty. Furthermore, plans should be optimised for swift action if a product or service may have caused harm to a customer.

New Consumer Duty and the financially vulnerable

An increasing number of households across the UK are approaching financial vulnerability because of the rising cost of living.

The Office of National Statistics (ONS) reports that ‘the price of consumer goods and services rose at the fastest rate in four decades’ in the year leading up to October 2022. This has led to more people borrowing or using credit cards to bridge the financial gap. The research suggests households with high energy bills (those with large families, for example) and low incomes struggle the most.

People disadvantaged financially by their circumstances are more vulnerable to harm. The new Consumer Duty addresses the need for extra protection by putting the onus back on businesses to ensure they act fairly and with good intent towards their customers.

With a rise in both renters and homeowners reporting inability to afford unexpected bills, it is falling to lenders to ensure people have options for mortgages and renewals.

How are lenders able to help?

Many lenders are embracing their role in helping people navigate the rising cost of living, particularly those who cannot make their mortgage repayments. Here are just a few of the ways lenders are stepping in to protect and support consumers:

Tailored mortgages

To help people achieve their ambitions of owning their own homes, mortgage lenders can tailor their products to meet the specific needs of their clients.

Customisable options

Firms can offer alternatives where homeowners can reduce their monthly mortgage payments or extend their loan term. This can be especially helpful for individuals facing long-term financial challenges, such as a reduction in income due to retirement. Some lenders will also allow customers to choose their payment schedule or frequency of their payments. This helps borrowers manage their finances more effectively and ensures their mortgage payment fits their budget.

Flexible payment terms

Offering products that allow for lump-sum payments, increased frequency of payments, or payment holidays. This will enable customers to adjust mortgage payments according to their financial situation.

Forbearance options

The temporary suspension of mortgage payments for homeowners experiencing financial hardship can be a lifesaver. This adds protection and support for people who are suddenly unable to work or without their regular income.

Specialised mortgages

Mortgage lenders also offer specialised mortgages to meet the specific needs of particular groups of people. For instance, lenders now offer mortgages tailored to self-employed individuals, non-UK citizens, or those with less-than-perfect credit scores. These specialised products help people who may have previously been unable to obtain a mortgage achieve homeownership.

Resources and Counselling

Financial education programmes are becoming increasingly popular among the UK’s lenders. These initiatives aim to help people create and stick to a budget, better manage debt, and build up their savings. Counselling services are also increasing, improving credit scores and making debt more manageable for struggling people.

Lenders can positively impact lives and the broader economic climate through new initiatives and ideas. This is alongside advocacy for new policies that increase safe access to credit for those with hopes of owning their own homes.

The new Consumer Duty: Measuring success

Under the new Duty, businesses are held accountable for consumer outcomes. To fulfil the requirements correctly, there are key elements that need to be addressed and implemented across all areas:

-

Definitions: Firms are required to define their criteria for determining whether their products and services are of fair value to consumers. Furthermore, providers should develop these definitions in line with the cross-cutting rules and the four outcomes in the new consumer duty.

-

Data should be collected and monitored. This ensures that firms meet the requirements throughout the product or service’s lifetime. It also facilitates early intervention if a customer may be on the route to financial harm.

-

Workstreams should be simple, providing milestones along the customer journey to ensure each customer receives the appropriate care and attention.

-

People: Firms must implement the necessary training for their staff to ensure the new Consumer Duty is understood and prioritised. Internal communications and incentive schemes could benefit staff adjusting to process changes.

-

Documentation: A firm must be able to evidence that they provided products and services in good faith. They must also keep precise and accurate records throughout the customer journey.

Implementing a consumer-first approach

The cost-of-living crisis has highlighted the need for extra support for those struggling to make ends meet. As prices continue to rise and wages are slow to follow, the accountability lies with financial institutions to operate in the best interests of their customers.

In a positive step forward, the new Consumer Duty prioritises the person on the receiving end of each product or service, helping to pave the way towards financial inclusivity. Lenders are in a unique and powerful position to start ongoing initiatives and create opportunities for the UK’s financially vulnerable.

The new Consumer Duty emphasises the core value that Eligible was built on: a belief that achieving best-in-class status comes from delivering quality products and services that add real value to people’s lives.

Eligible & the Consumer Duty

Our approach to customer relationship management has now become an FCA expectation for which all firms are being held accountable. We’ve been helping clients implement and automate these processes for years.

Here's how we communicate with customers on your behalf:

- Tailored customer journeys based on financial and behavioural data.

- Consistent and jargon-free language.

- Communication style matched to customer expectation.

- A focus on education about existing products and potential options.

- Simplification of complex concepts to enhance understanding.

- Clearly laid-out options with comparisons and outcomes.

Here's how we inform your approach to consumer understanding and support:

- Real-time reports of consumer actions and progress.

- Data-driven communication, event-triggered and delivered at precisely the right time.

- Monitoring and measurement of consumer understanding.

- Comprehensive engagement data and testing.

- Continuous optimisation.