Mortgage rate predictions for 2023 from the expert team at eligible. Falling mortgage rates, buyer demand, and the cost-of-living crisis are all having an impact. These are our key points for the rest of the year:

- Mortgage rates have fallen to a six-month low, despite rising interest rates

- The 60% LTV space remains the key area in which lenders are competing

- Mortgage rates appear to be at a crossroads and could start rising soon

- 1.4 million homeowners have fixed rate deals that are due to expire this year

- The cost-of-living crisis is due to hit mortgage availability and lead to rising arrears

What’s happening to mortgage rates now?

Mortgage rates are currently moving in the opposite direction to official interest rates.

While the Bank of England’s Bank Rate has increased by 1.75% since the beginning of September, average mortgage rates have fallen to hit a six-month low.

The typical two-year fixed rate deal currently stands at 5.32% – 0.11% less than in early October. Five-year fixed rate mortgages have dropped by 0.23% to stand at 5.00%.

This situation has been caused by the chaos unleashed by former Chancellor Kwasi Kwarteng’s mini-Budget.

The mini-Budget led to a sharp spike in gilts, which led to a jump in Swap rates. This pushed average mortgage rates above 6%, while lenders also withdrew hundreds of products for repricing.

The good news, is that choice is now back where it was in August 2022 with a total of nearly 4,400 different deals available. Lenders have also relaunched their high loan-to-value (LTV) deals.

There are currently around 160 95% LTV products on offer and nearly 550 90% LTV ones.

Despite this, the 60% LTV space still remains the key area in which lenders are competing. Availability of 60% LTV has hit its highest level since Moneyfacts records began, while this sector of the market has also seen the biggest rate cuts.

Five-year fixed rate deals continue to offer better value than their two-year counterparts. With the 0.32% premium charged on a two-year deal compared with a five-year one now at its highest level for 15 years.

What’s the UK housing market outlook?

House prices began falling in August last year. Declines gathered pace as mortgage rates increased following the mini-Budget. The combination of high mortgage rates and the cost-of-living crisis will continue to impact the housing market this year.

Buyer demand is between 20% and 50% the level it was last year. Meanwhile, sellers are having to accept offers of £14,000 less than their asking price on average. Economists are predicting further price falls of between 5% and 10% in 2023.

Key Mortgage Prediction for 2023: With the outlook for the housing market uncertain, expect to see more down valuations from lenders.

What are the current mortgage rate predictions?

The mortgage market appears to be at a crossroads. The falls in rates that followed the reversal of the mini-Budget now seems to have run its course.

Looking ahead, there are conflicting factors that will influence the direction of mortgage rates.

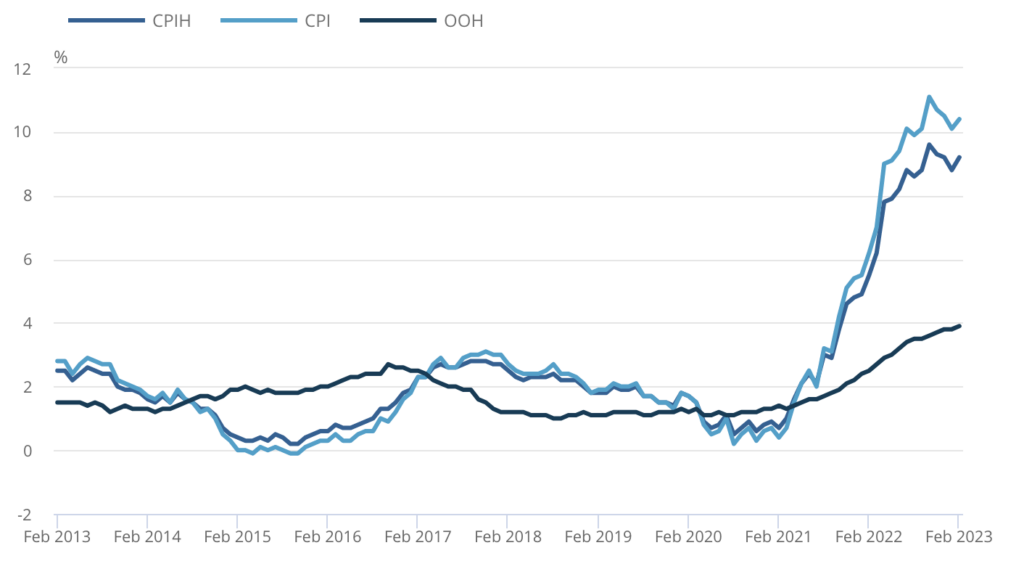

On the one hand, the surprise spike in inflation suggests the Bank of England may increase rates further. Inflation, as measured by the Consumer Prices Index, rose to 10.4% in February from 10.1% in January.

CPIH, OOH component and CPI annual inflation rates for the last 10 years, UK, February 2013 to February 2023

In its March meeting, the Monetary Policy Committee increased rates by a further 0.25% to 4.25%. It also warned that it would consider a further hike if high inflation persisted. As a result, some economists see interest rates rising to 4.5% this year.

On the other hand, the recent failure of Silicon Valley Bank in the US and the forced takeover of Credit Suisse by UBS could trigger loser monetary policy.

Swap rates, which had begun rising in February, fell on fears of contagion in the banking sector. They have since resumed their upward trend, suggesting mortgage rates could follow.

Key Mortgage Prediction for 2023: Customers who need to remortgage should take advantage of the recent rate falls. And with the typical revert rate hitting a 15-year high of 7.12%, delaying lining up their next mortgage is likely to prove expensive.

Demand to come from remortgaging

Mortgage demand from people purchasing a home has slumped since mortgage rates spiked in the wake of the mini-Budget.

Bank of England figures show that the number of mortgages approved for house purchase has fallen for five consecutive months to stand at just 39,600 in January. This was the lowest level since 2009, excluding the pandemic.

With house prices currently falling and expected to continue to do so for the rest of the year, mortgage demand for house purchases looks set to remain muted.

In fact, trade body UK Finance has predicted mortgage lending for house purchases will drop by 23% in 2023.

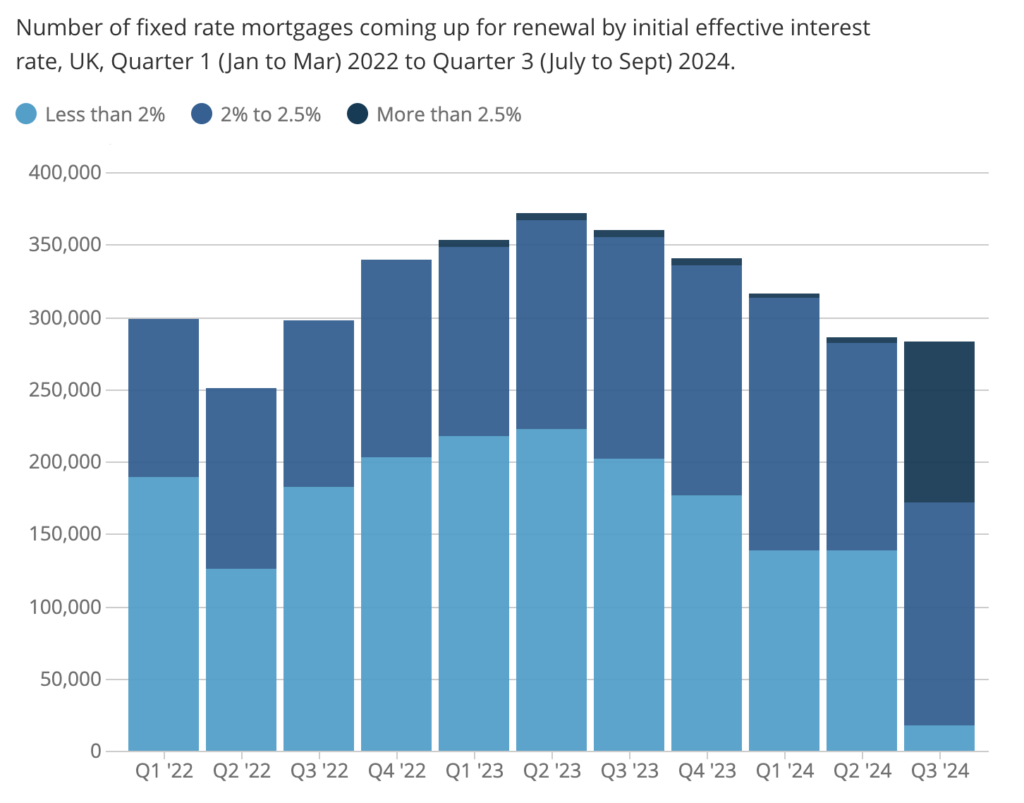

By contrast, it is expecting an 8% increase in the value of the remortgage business. A total of 1.4 million homeowners have fixed-rate deals that are due to expire this year.

Around 57% of these people are coming off two-year fixed-rate products. But those coming off fixed-rate mortgages are likely to face significant payment shock.

The last time people on two-year fixed rate deals remortgaged, average rates were around 2% – that is 3.32% lower than today. This translates into a £367 a month increase in repayments for someone with a £200,000 mortgage.

There is a glimmer of good news for people remortgaging. Customers who are up to date with their payments can switch to a new deal with the same lender without having to do an affordability test.

Key Mortgage Prediction for 2023: Mortgage demand for house purchases looks set to remain muted, while demand for remortgage products will rise.

What impact has the cost-of-living crisis had?

Consumers are coming under increased stress from the cost-of-living crisis.

Two-thirds of people are spending less on non-essential items and 23% of people are borrowing more.

There was some relief in the recent Budget. The government’s energy price guarantee will remain at £2,500 for a further three months, helping people with higher energy bills. Fuel duty was also frozen for 12 months.

In addition, there are plans to offer more free childcare to families. But this will be introduced in stages from April 2024.

Meanwhile, rising house prices and interest rates have pushed up mortgage payments. Monthly repayments for someone buying a semi-detached home are 61% higher than a year ago. Stretched budgets have led to 30% of people struggling to keep up with their mortgage or rent.

This pressure is beginning to translate into rising mortgage arrears. Going forward, the Financial Conduct Authority has predicted 356,000 homeowners could be at risk of missing a payment by the summer of 2024.

Key Mortgage Prediction for 2023: While there were some positive points announced for consumers in the mini-budget, the rising cost of living will continue to impact the mortgage market – with an increasing number of people struggling to make payments.

Lender Appetite Declines

Unsurprisingly, mortgage lenders are becoming more risk averse.

Mortgage availability has fallen, according to the recent Bank of England Credit Conditions Survey. And lenders expect it to drop further going forward.

Availability has fallen for all borrowers. But those with LTVs of 75% or more have seen the biggest drop. Lenders have also tightened their credit scoring criteria and reduced the proportion of loans they approve. They expect this trend to continue going forward.

Looking ahead, they plan to reduce the maximum loan-to-value ratios they will advance. But maximum loan-to-income ratios will remain broadly unchanged.

Key Mortgage Prediction for 2023: Mortgage availability will continue to fall, with tighter criteria as lenders mitigate risk.

Buy-to-Let market recovers

The buy-to-let mortgage market has taken longer to recover from the mini-Budget. But product choice is now back to where it was in August, with more than 2,400 deals available. The average interest rate charged on fixed-rate buy-to-let mortgages has also fallen. The typical cost of a two-year fixed-rate deal is now 5.81%. Interest on a five-year mortgage has dropped to 5.72%. But investors coming off two-year and five-year fixed-rate mortgages will still face significant payment shock.

The average interest rate charged on a 60% LTV two-year fixed rate deal is now 5.39%, up from 2.14% in March 2021. Average rates on five-year products have increased to 5.22% from 2.74% in 2018. Higher mortgage rates make it more challenging for investors to pass their lender’s affordability test.

Under the Interest Cover Ratio, rental income must be the equivalent of 125% and 145% of monthly mortgage interest payments. Despite rents rising by 4.7% during the past year, the increase may not be enough to offset higher mortgage rates.

The current complex market creates an opportunity, with mortgage advice more important than ever.

Key Mortgage Prediction for 2023: With product choice for buy-to-let mortgages improving, landlords will need to seek sound financial advice to navigate the new financial landscape and ensure their income.

Share this post:

Mortgage firms and lenders should be prioritising consumer confidence, with consistent and tailored communication.

Find out how eligible can manage your customer retention strategy, while you concentrate on everything else.