Following on from our 2022 predictions for mortgage brokers, here is our mortgage industry outlook for 2023, crammed full of insights and expectations.

Of course, you don’t need us to tell you how challenging this year will be for the mortgage industry.

We’ve included some of the many opportunities for brokers, alongside plenty of insights.

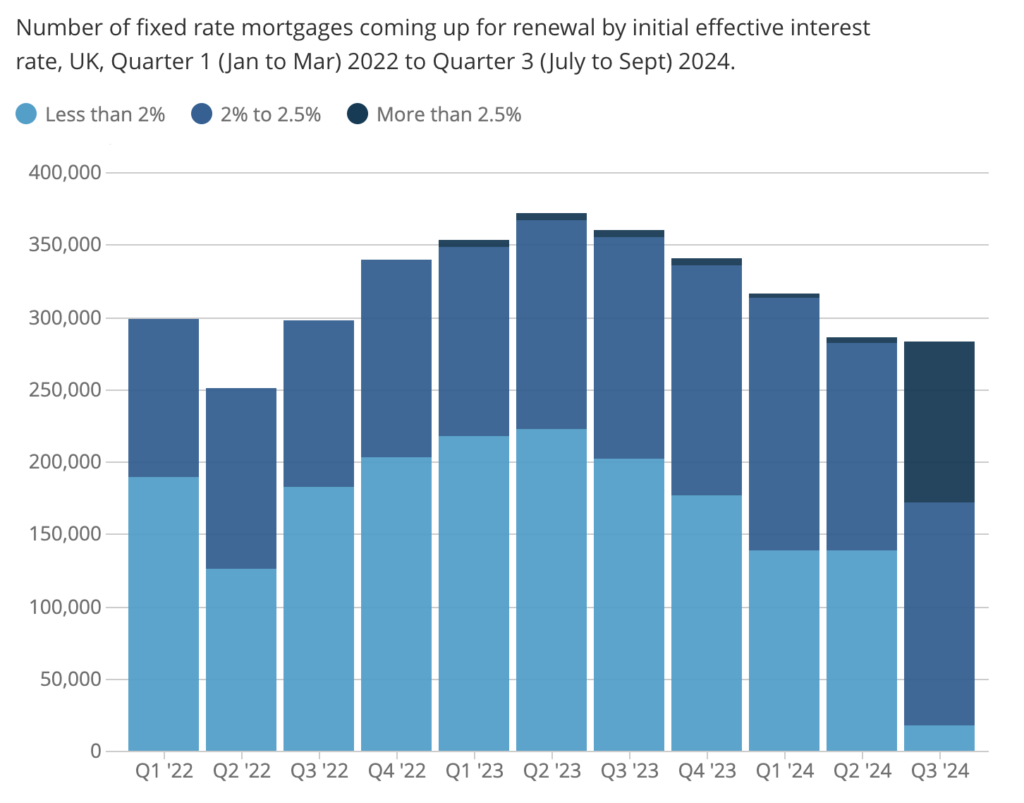

As for how many… let’s start the bidding at 1.8 million. That’s how many fixed-rate products are set to expire this year.

The fall in lending to new buyers means it’s crucial for mortgage brokers to keep in touch with existing clients. Contact them before their current product expires to discuss options.

Lenders & Lower Rates

HSBC UK recently announced reductions of up to 0.15% across 100+ rates. These are open to new and existing residential mortgage customers.

Tracker mortgage rates and buy-to-let products are also being reduced by up to 0.10%. There are also plenty of cashback options available too.

Halifax, Nationwide, and Virgin Money have also cut interest rates.

This will be an important driver of business during the year. We now appear to be in a mortgage rate war which is contributing to an increase in demand not seen since October 2022.

There’s also the stamp duty factor.

From 31 March 2023, threshold changes will be reversed. Back to £125,000 (from £250,000), and £300,000 (from £425,000) for first-time buyers.

Wages Rising... Inflation Still Ahead

At the same time, your clients are already dealing with the ongoing cost of living. Inflation touched 10.5% in December, slightly lower than October’s 41-year-high of 11.1%.

Private sector wages growth is rising at the fastest rate for 20 years, but is still below inflation.

Talking of which, the Monetary Policy Committee has pledged to respond “forcefully” and “take the actions necessary” to get inflation back down to its 2% target.

This makes the outlook particularly difficult to predict this year. There’s uncertainty over how quickly inflation will be brought back under control. It’s a tough call for how much interest rates will have to rise.

On the plus side, unemployment is likely to remain low (despite the UK expected to be in recession for most of 2023). This should prevent a large number of forced sales.

Even so, with house prices falling, expect to see an increase in down valuations from lenders.

House Prices

The only certainty is uncertainty

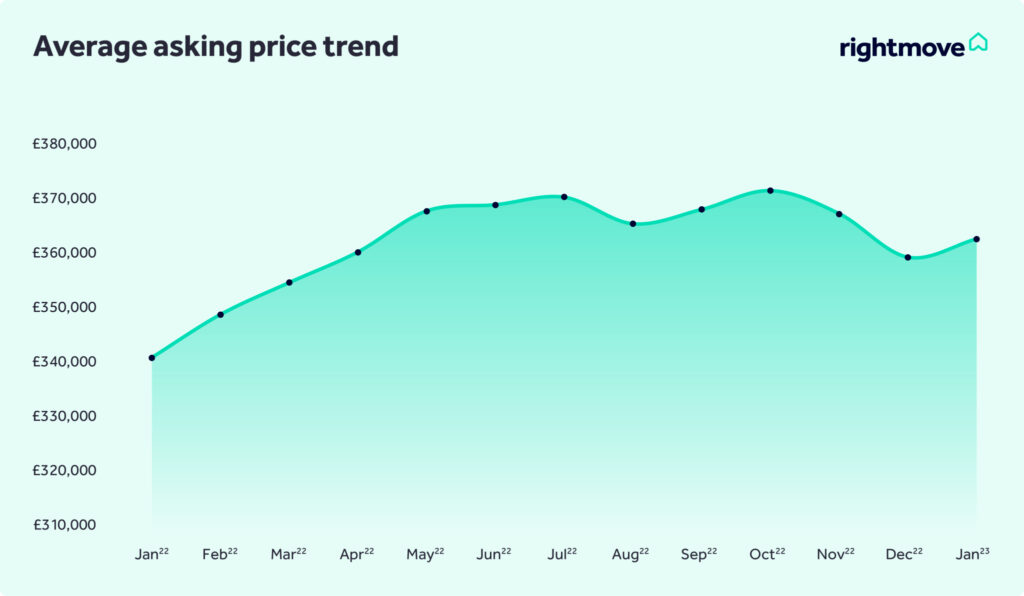

The average cost of a property has already fallen by 2.3% from its peak, according to Halifax.

The correction was triggered by the financial turbulence caused by the mini-Budget. This sent mortgage rates soaring, compounding growing cost-of-living pressures and stretched affordability following strong house price gains.

Going forward, the combination of high mortgage rates, still high inflation and a recession are expected to continue to put downward pressure on prices.

Predictions vary for how far house prices will fall in 2023. Estimates range from a relatively soft landing of 5%, to drops of as much as 20%. All parts of the country are expected to be impacted.

That said, there are signs the current tightening cycle may be starting to loosen.

Past the Peak

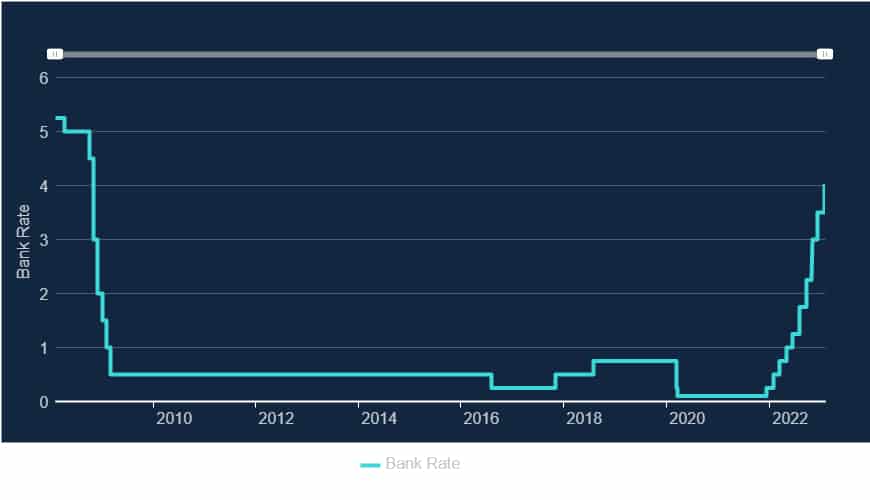

The Monetary Policy Committee (MPC) voted 7–2 to raise the bank rate by 0.5% in February, to 4%. This followed an increase by the same percentage points in December, although it’s lower than the 0.75% increase seen in November.

The MPC also indicated that it thought inflation had now peaked and “was expected to ease further in the near term”.

The current economic consensus is that the Bank Rate will be increased to 4.25% – only 0.75% higher than it currently stands – in the first half of 2023, before falling rapidly in 2024.

Affordability Rules

Tighter, yet with freedom to move

Lenders have already tightened their affordability criteria – a process expected to continue during 2023.

The fall in mortgage availability is expected to be particularly stark for loan-to-value (LTV) ratios of more than 75%.

Although there is some positive news too. Following a meeting with the government and regulators, lenders have agreed to allow customers who are up to date with their mortgage payments to switch to a new product – without having to do another affordability test.

For mortgage brokers, this could be a good opportunity for your clients with soon-expiring deals. They may now find it easier to remortgage to a more competitive deal (with your help, naturally). Instead of facing their lender’s revert rate.

Good News

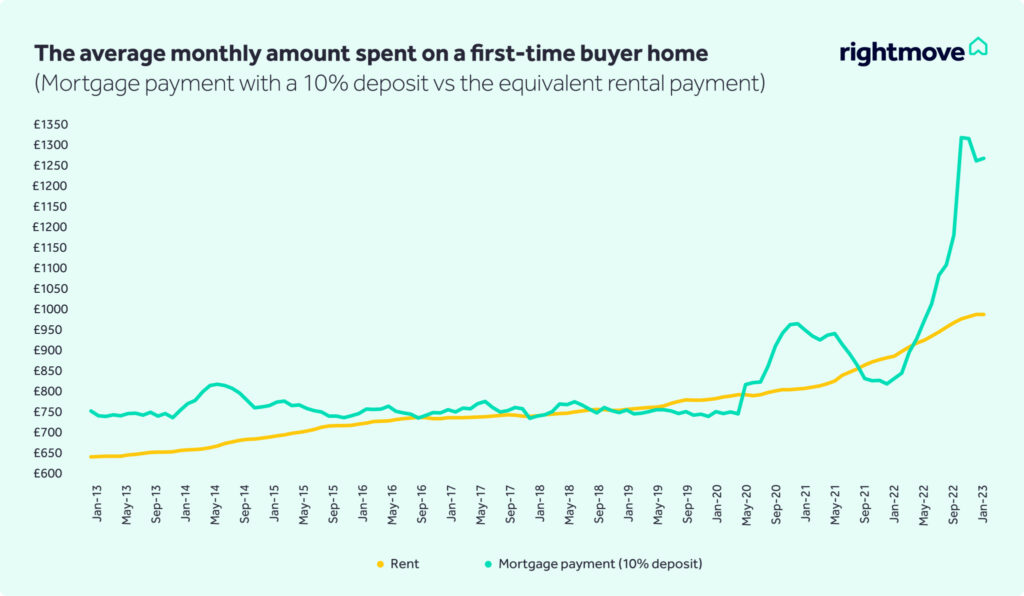

For first-time buyers & low equity home-movers

Now for some certainty. The government has announced it will extend the Mortgage Guarantee Scheme for an extra year until 31 December 2023.

“Extending this scheme means thousands more have the chance to benefit, and it supports the market as we navigate through these difficult times.”

John Glen, Chief Secretary to the Treasury

The move will support the market for 95% LTV mortgages. These can be for existing or new-build properties. Purchases must be with repayment mortgages, not interest-only.

Fall in buy-to-let deals

Things look different in the buy-to-let market. The number of BTL landlords is expected to fall significantly.

Investors continue to exit the sector, with house purchase lending down 27% year-on-year and re-mortgaging volumes dropping by 22%.

Delivering Great Service

Under new FCA duty of care rules, higher and clearer standards are set for mortgage brokers and firms “to act to deliver good outcomes for customers.”

In practice this means avoiding unfair charges, making it easier for them to switch products, and ensuring key details are easy to understand and not buried in the small print.

The new Consumer Principle, which covers both mortgage lenders and brokers, will apply to:

- New mortgages arranged after 31 July 2023

- Mortgages sold before 31 July 2023 if they are still on offer to new borrowers or available for renewal for existing ones after it

Mortgage Broker Industry Outlook

How to succeed in 2023

Combine the steep increase in interest rates, mortgage market volatility, and cost-of-living squeeze. This means opportunities for mortgage brokers as homeowners are more likely to seek guidance this year.

Your expertise will be needed to help clients make sense of their mortgages. Become the broker they can trust by being proactive and offering clear guidance:

- Identify clients close to expiry and prioritise contacting them to discuss options

- For existing clients, check if they may be eligible for deals that could save them money

- For new clients, make sure you stay in contact at every stage of the product lifecycle – not just at renewal time

Because you made it this far...

You might be reading this and thinking, “Yes, that all sounds good – but I only have 24 hours in a day.”

Brace yourself, here comes the pitch. We do all that for you. Through automated emails, notifications, and an app. All branded from you and your firm. Developed, designed & delivered on your behalf.

Giving your clients the right information at the right time. Encouraging them to contact you when it’s time to switch or explore new products. Helping you nurture and strengthen your client relationships.

Leads automatically managed

Call requests come in and are automatically added to broker to-do lists. You can sort and view client deals expiring soonest. A quick way to identify potential leads.

Plus, the data you need is available from one dashboard. Share, collaborate, and keep teams aligned and informed

Join 2,000+ Brokers

Ready to discover how you can grow revenue, retain business, and build lifetime client relationships? Book a tour today to experience eligible.