People in the UK are becoming evermore vulnerable to financial instability and crises. Every branch of the financial sector has suffered instability, and consumers are becoming increasingly unpredictable as they try to make their lives work in an uncertain economic system. With Consumer Duty, the FCA aims to bring a little humanity back to the processes that directly impact customers. It’s the financial services equivalent of the good samaritan – when you see someone struggling, you instinctively go to help.

But how do you spot someone who needs help among vast swathes of customer data?

Glad you asked…

Predictive Factors of Vulnerability

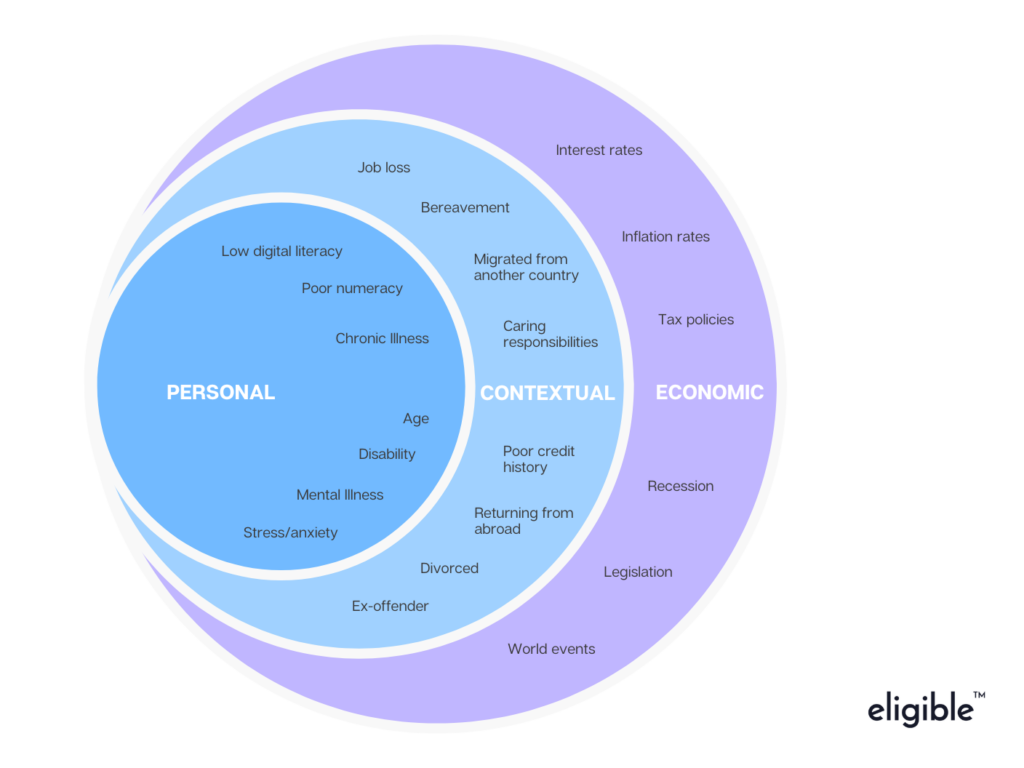

There are three different elements to consider when assessing financial vulnerability: personal, contextual, and economic.

A person can be pushed over the threshold by just one of them, but often, people are contending with two or three at any one time. This layering of circumstances puts them at a much higher risk of an adverse outcome. Add bad advice or an inappropriate financial product to their situation, and there’s potential for real harm.

This isn’t an exhaustive list by any means. The problem is multifaceted and complex. While people on lower incomes are more likely to suffer financial instability, this does not mean those on higher incomes are immune. So, how do we learn to spot those about to fall off the edge in order to intervene?

Getting the Basics Right

Identifying vulnerable customers to begin with relies heavily on self-disclosure during the application process. Where these circumstances make up the fabric of everyday life and are unlikely to change (chronic illness, disability, etc.), people are more likely to disclose them.

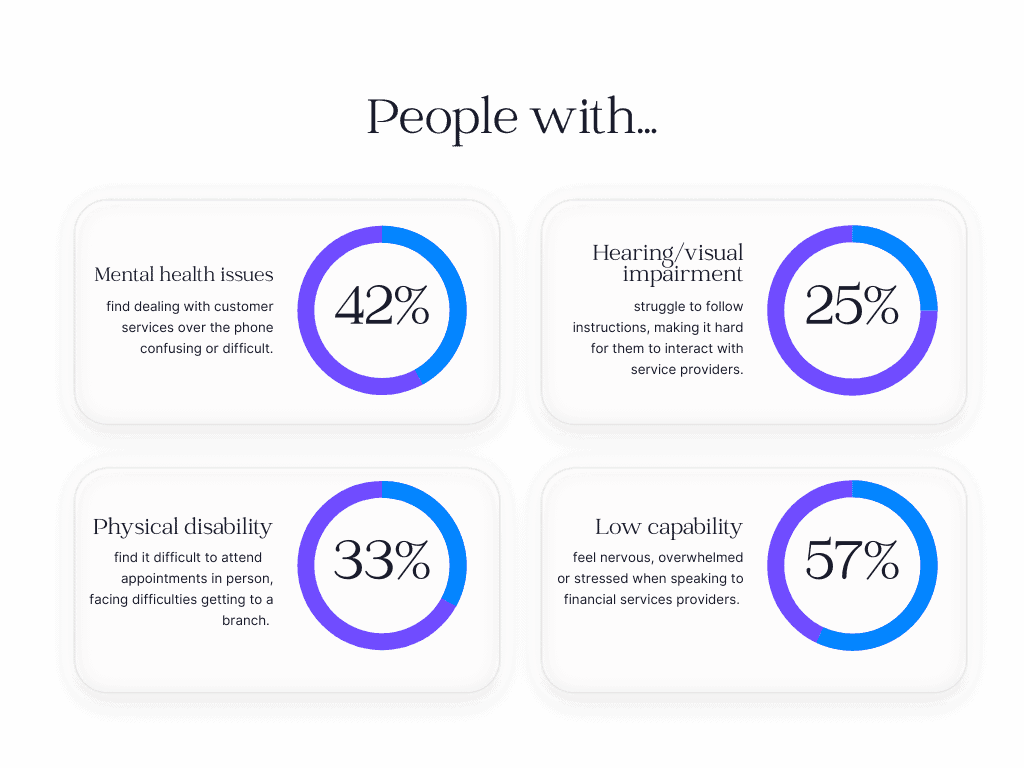

However, contextual circumstances, which are often unpredictable and changeable, are less likely to be disclosed. We already know that people largely don’t like talking to their providers about money problems for fear that it might make the situation worse. We also know that accessibility within financial services customer services remains an issue:

The first step to solving the issue is ensuring it’s as easy as possible for people first to contact, and secondly, converse freely with customer services. Start identifying any barriers that might exist between your customers and your support resources. Take the opportunity to remove them before reworking your support portal to become a flexible, welcoming place.

Next, look at providing speciality training for staff. You want all of your customers to feel heard and understood, so whoever’s picking up the call should know how to have difficult conversations with compassion. This will help everyone, but particularly those with mental health difficulties or low financial capability. Separate resources should be available for people with disabilities or hearing/visual impairment. This way, you’re adding value to your customer experience and putting Consumer Duty’s cross-cutting rules at the heart of your process.

Spot Emerging Vulnerability

Beyond the initial application process and self-disclosure, there are four approaches to spotting emerging customer vulnerability. Utilising all three will help you catch as many as possible before they fall over the threshold.

1. Framework

Many markers indicate financial vulnerability: payment defaults, expenditure vs. income, high-risk borrowing, and lack of financial resilience, to name a few. Developing your own framework for assessing customer circumstances is a sensible place to start. Set a threshold for concern so that when a customer crosses it, you are alerted to intervene.

2. Profiling

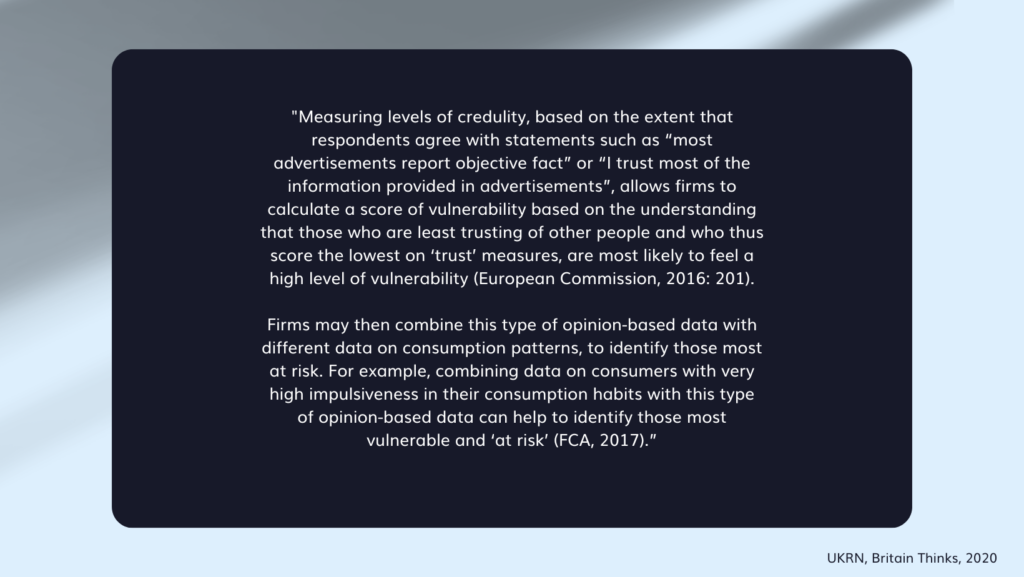

Profiling involves surveys and other qualitative data collection to get a sense of how your customers think and feel. Combining this with research on consumer behaviour trends, you gain insight into vulnerability traits and can work to safeguard them in a more bespoke approach.

3. Monitoring

Monitoring becomes extremely useful for companies with the ability to combine large datasets across different partner organisations. Where data is cross-referenced in this way, we are able to build a picture of who the customer is interacting with and for what reason. It essentially streamlines the process of identifying vulnerable customers and allows you to act sooner. For example, The Department of Work and Pensions already records where people might be in a poor financial situation. With access to this data, you would be immediately alerted to customer circumstances without relying on self-disclosure – saving time and potentially lessening the emotional impact on the customer by saving them a difficult conversation (UKRN, 2020).

4. Behaviour

These digital tools provide insight into any particular customer, identifying behaviour patterns that indicate whether or not they understand what they are being told and if they need further help. By analysing what is normal for them, sophisticated analysis tools can detect where something has changed and may need addressing. They are able to highlight not only risk but also opportunity for each customer, enhancing their overall experience with you. Using these in your strategy to avoid foreseeable harm reduces risk for customers, providing a more tailored service. As an added bonus – they also help with regulatory compliance!

Eligible and Consumer Duty

Eligible helps you stay compliant with Consumer Duty by providing an unrivalled customer experience. Financial data and behavioural analytics assess customers in real-time, helping them to:

Pursue financial objectives

Providing real-time updates on their current products. The Eligible system then uses sophisticated algorithms to determine what information they need next.

Understand their options

Communication is responsive, delivered at the right time and mapped to customer preference. Clear and jargon-free information, with built-in check points to confirm understanding.

Feel supported

Careful monitoring of engagement data determines if customers need more help. Tailored customer journeys mean communication is specific, timely, and relevant. Where customers need further guidance, they are directed back to your channels.

Avoid foreseeable harm

With the Eligible system, you can take proactive and reactive steps to help your customers achieve good outcomes. Engagement monitoring and real-time reporting on customer progress helps you step in when you need to.