What will influence consumer decision-making in 2024? Being a mortgage customer this year will be anything but straightforward. Wallets are already stretched, and interest rates remain high. So, with all products being equal (and expensive), we’re taking a look at the things likely to play a part in a customer’s decision-making process over the next 12 months.

Using our own data and the trends we saw across the industry last year, here are our predictions:

Cost vs Expectation

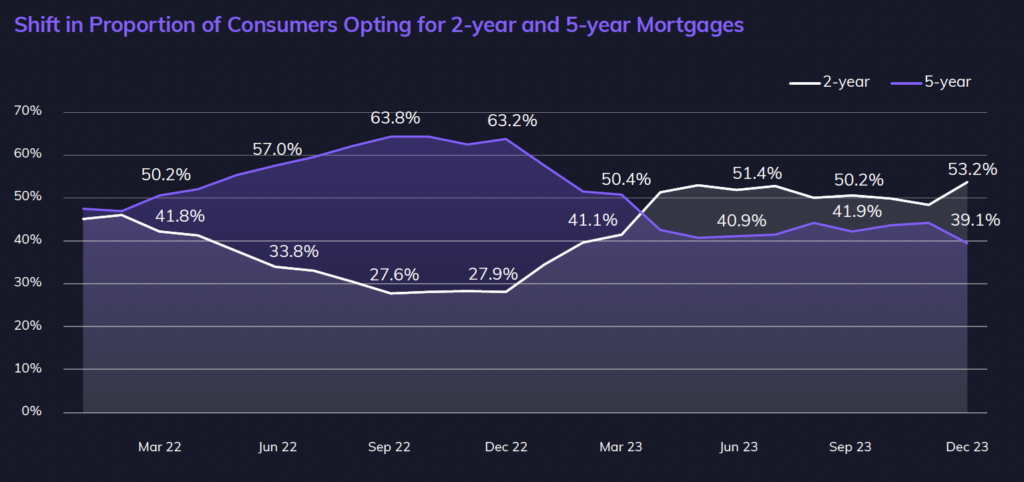

It’s easy to assume consumers make mortgage decisions based on immediate cost alone, but our data shows this isn’t the case. With five-year products currently cheaper than two-year, we’re seeing an increase in people opting to spend more now, hoping to save money long-term.

In 2024, decisions are being made according to expectation and predictability. People continue to struggle with the cost of living, which leaves them with a difficult set of options to navigate. No one wants to get stuck at a higher interest rate than everyone around them, and so we see an influx of people cautiously opting for a shorter term allowing them to secure a better deal early if at all possible. For those choosing the five-year deal, it could be about a cheaper monthly cost, but it could also be about stability – opting for a predictable and affordable payment long-term.

Innovative and Flexible Products

At the beginning of 2024, the choice of mortgage products in the UK is the highest it has been in 15 years with 5,899 available across the market. It’s clear that lenders are keen to help homeowners by offering real choice in a difficult situation.

Some are going even further, bringing a little added security and flexibility to their offerings. For example, Virgin announced their Fix and Switch mortgage last month, hailed as “one for the records” by brokers. It’s a five-year fixed mortgage, but the early repayment charge (ERC) is only applicable for the first two years. For consumers, this means protection against higher interest rates, but the option to switch to a new deal after two years if rates drop. This is the kind of best-of-both-worlds product that will win over consumers in 2024. Here, Virgin have offered both security and assurance – an invaluable combination for today’s market.

Personalisation

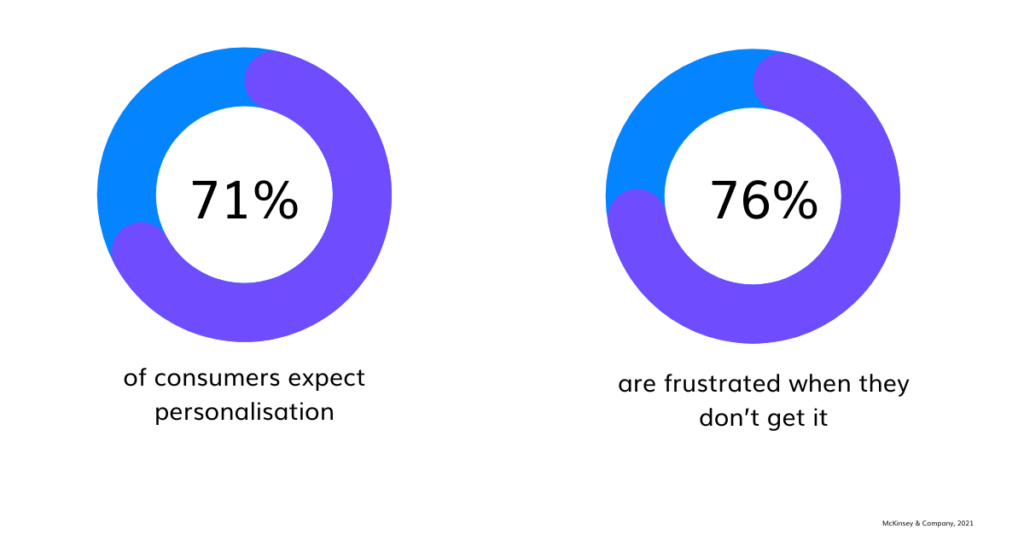

Consumers now expect the companies they engage with to know them on a personal level. However, recent research from Eligible suggests that nearly a quarter of customers have never received personalised communication from their banks – and this often leads them to ignore communication altogether. Technology has allowed business to tailor content to each individual consumer, essentially providing a more personal service than, well – people. Decisions will be made on trust this year, and personalisation garners trust. Instead of stagnant, scheduled content, consumers expect immediate, dynamic, and relevant conversation. To provide this service at scale and keep up with competitors, lenders should be looking to invest in experience-boosting technologies.

Education and Engagement

Against a difficult financial landscape, consumers are beginning to educate themselves on products and services. They’re looking to Google, Facebook, and sometimes even TikTok for financial advice – while only a small proportion contact their banks. This, again, likely highlights the lack of trust between banks and consumers, but it also speaks to the modern digital world and the value of convenience. Consumers need guidance, but they don’t want to wait on hold for hours, and they’re also worried that disclosing certain financial information will land them in trouble. So, instead, they look to social media platforms and apps to help them decide their next move.

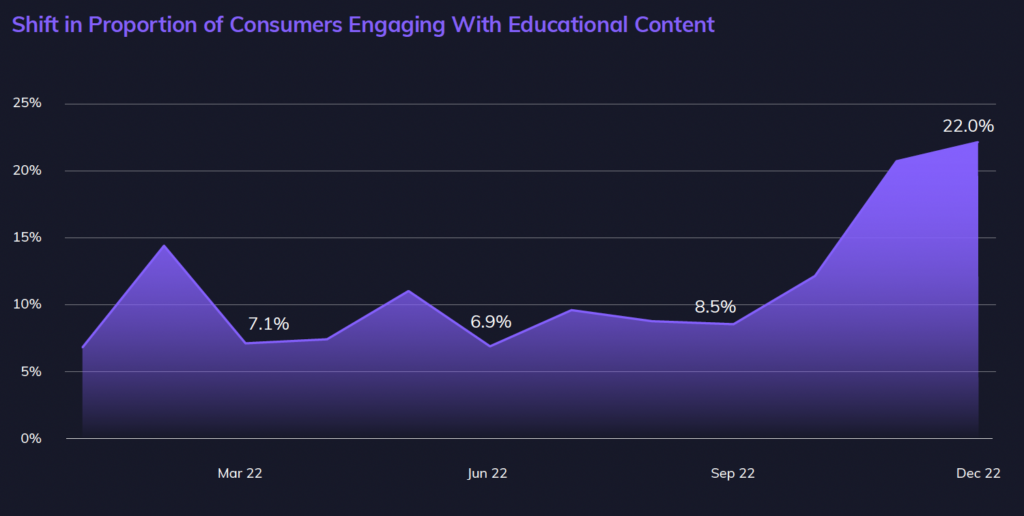

Customers are more engaged than ever before and want to know more about their options. These are Eligible’s engagement stats from last year, demonstrating a 116% increase in content engagement on the platform.

Platforms like Eligible give lenders the opportunity to provide bespoke financial advice to consumers, building trust, loyalty, and a better-educated customer base.

Changing Political Landscape

Of course, the last major factor affecting consumer decision-making in 2024 will be the promised general election in the latter half of the year.

General elections cause, on average, a 2% surge in house-buying – a potential sign of consumers hoping for change and acting on their optimism. We also have to consider the impact a change in government will have on consumer decision-making. Many promises have been made by both the Conservatives and Labour with regard to first-time buyers, affordable housing, buy-to-let, etc… and many will want to hold tight before they make any large financial decisions. For an in-depth look at how a change of government might affect the mortgage market, click here.

Eligible is the UK’s first consumer-focused mortgage servicing platform. Our solution leverages AI to educate and empower consumers to achieve good outcomes. We work with financial institutions of all sizes to meet the obligations of Consumer Duty and the Mortgage Charter, providing dynamic and personalised journeys for every customer.

To learn more about how Eligible can help you meet your consumer’s expectations in 2024, get in touch using the form below.