Every year, UK banks spend millions of pounds on customer support, and it seems every year there’s another survey suggesting customers are dissatisfied with their experience. Disjointed and reactionary initiatives ensue, where banks engage in firefighting the ‘right now’ problems instead of focussing on the root causes. With all of the support and literature available from providers, why are customers still unsure of their own products? They continue to incur charges for late payments despite huge investments by UK banks in early digital warning systems, and they still turn to Google or social media for advice instead of seeking expert guidance. We have to wonder if it’s not the calibre of support available but the absence of sound financial education that keeps this cycle going.

Can an investment in financial education reduce the costs of customer support and improve overall customer satisfaction scores?

The Cost of Good Customer Support

First Direct comes out at the top of this year’s Which? consumer satisfaction survey. In fact, First Direct are consistently in the top 5 for customer support every year, scoring 5 stars for service, complaints handling, mobile and online banking. In order to understand how they achieve it, you need to understand the methodology behind it.

Rather than adding more customer service agents year on year, First Direct invest heavily in new initiatives that serve customers on a personal level. Sometimes co-creating products and services with the customers themselves, First Direct highlight the importance of integrating behaviour and factors that influence decision-making into all new ideas. This goes beyond normal banking – balancing money and data management to provide real value to customers. It’s all about creating meaningful conversations with customers – something we align with strongly here at Eligible.

The cost of good customer support is two-fold: there’s obviously financial investment, but there’s also an absolute commitment to helping customers live without unnecessary stress.

“Every day first direct’s people try to deliver for customers. We understand people value interactions which are simple, safe, and enable them to get on with their lives. Easy to say but much harder to do consistently day in day out, year after year... Our focus is on providing a frictionless, digital banking experience, offering only those services which are genuinely useful and add value. But we also know how much worth there is in having highly trained, empathetic people available 24/7, empowered to treat customers as individuals not just another number.”

Chris Pitt, CEO, First Direct

The Cost of Bad Customer Support

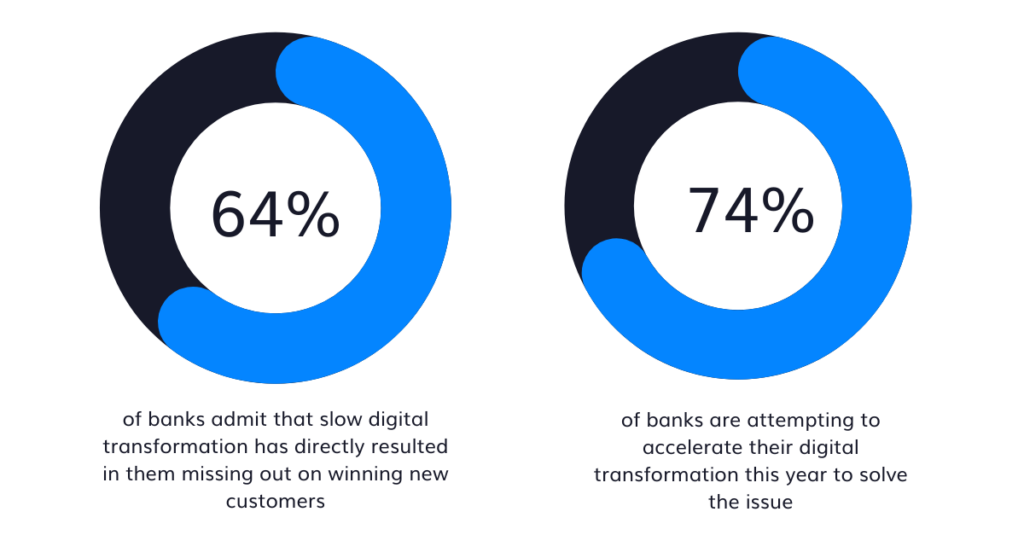

According to 10x’s landmark study in 2023, global banks are losing 20% of their customers every year to poor customer experience. Surveying hundreds of senior decision-makers across the international banking industry, 64% cited their organisation’s slow response to digital transformation as central to the loss of customers. The report suggests that instead of focusing on customer interaction, more emphasis needs to be put on helping customers solve their problems:

“Over my career I have learnt banking is about customers, but the reality is most of the banking industry has overlooked what matters, taking a product-focused approach rather than focusing on the customer. Banks need to think about solving problems in a way that makes customers’ lives easier... Banks often mistake transformation for innovation. Innovation is a linear series of marginal improvements, whereas true transformation is a non-linear step-change in improvements, beginning with a material improvement in customer experience."

Anthony Jenkins, CEO, Barclays

Banks that remain resistant to creative problem-solving technologies will continue to lost large portions of their customer base this year to those who have embraced them. It’s no wonder then, that 74% of those surveyed have stated that accelarated digital transformation is high on the agenda for 2024.

Education to Improve Experience and Reduce Costs

Banks are increasingly adopting more holistic approaches to customer journeys, including providing non-traditional financial services to supplement their products. We’re seeing a push to understand customers on a granular level this year: how are customers interacting? How do they feel about the content they’re seeing? It’s all about guidance and ensuring every step of the customer journey is designed to benefit the individual according to knowledge and circumstances.

Using each customer journey as an opportunity to improve financial literacy is a win-win solution for the bank and the customer. Customers feel better informed and, therefore, less stressed about their finances, while banks save both time and money by implementing the right customer education initiatives.

- Resolve common queries instantly

- Reduce call volumes

- Reduce footfall to in-branch advisers

- Free up support for more complex cases

- Collect user insights to mitigate risks

- Improve customer engagement rates

- Understand financial literacy levels

- Create dynamic and personalised education

- Reduce number of complaints

- Improve customer retention rates

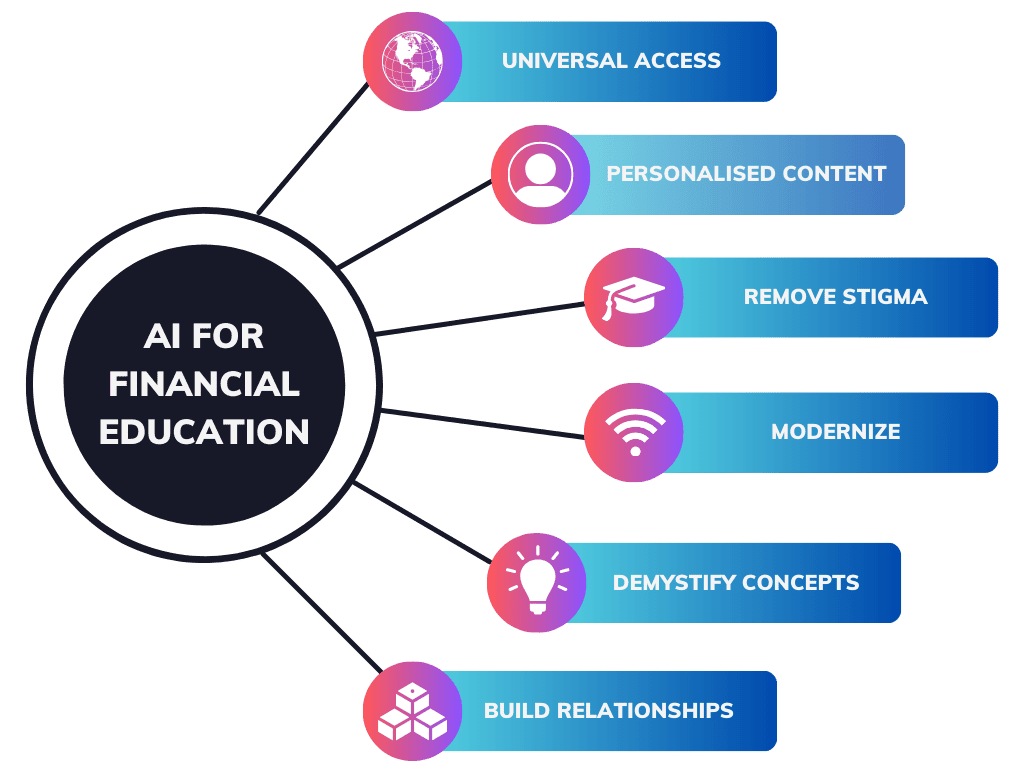

Implementing a sound and proactive educational programme for customers is complex and multi-faceted for large financial institutions. It requires either the hiring of thousands more account managers, or (and perhaps more sensibly) the introduction of transformational technology. At Eligible, we use AI to communicate, educate, and empower customers with their financial decisions. For user experience, it is unrivalled – achieving a 116% increase in customer engagement last year for our clients. It is a proven cost-saver for institutions of all sizes, and alongside operational benefits, it creates a fairer, more equitable system for educating customers such as:

You can read more about how the Eligible system achieves these markers here.

Eligible enables financial autonomy by zeroing in on the content customers need at any given point in time, delivering it in a way they can understand. Trusted with the mortgage journeys of over 1 million mortgage customers, Eligible provides tailored, expert advice for decisions being made in real-time.

Responsive educational content is the transformation all financial institutions need in 2024 to keep up with personalisation trends and customer experience goals.

Eligible is the UK’s first consumer-focused mortgage servicing platform. Our solution allows financial institutions to leverage AI, educating and empowering consumers to achieve good outcomes. We work with financial institutions of all sizes to meet the obligations of Consumer Duty and the Mortgage Charter, providing dynamic and personalised journeys for every customer.

To learn more about how Eligible can help you meet your consumer’s expectations in 2024, get in touch using the form below.