Share this post:

“Access to financial services gives families up and down the UK the ability to plan their lives, make important decisions about their futures, buy homes, save for retirement, and insure the things most valuable to them. Education, proportionate regulation and financial capability all make a difference. The current economic climate means that financial inclusion and capability are more important than ever….”

Andrew Griffith MP, Financial Inclusion Report 2021-22

An estimated 13 million people in the UK face financial exclusion (The Inclusion Foundation, 2020). The cost-of-living crisis creates more challenges, with rising food and energy prices impacting people’s financial resilience. This pushes households across the country closer to vulnerability. Financial exclusion creates a poverty premium, making it harder for people to get back on their feet.

The challenge comes as new Consumer Duty rules are set to come into force at the end of July. The rules require financial services providers to put their customers’ needs first and act to deliver good customer outcomes.

Boosting financial inclusion is an issue for the entire financial services industry, particularly those providing bank accounts, insurance, savings, loans, and mortgages.

Financial Inclusion

In a UK context, it allows people to plan for the future and protect themselves from emergencies. Buying a home, saving for retirement and taking out insurance all require access to the financial system.

When people are financially excluded, they are unable to benefit from the financial products and services others have access to. This means they aren’t able to earn interest on savings or save for retirement through a pension.

They will also have to pay a significantly higher interest rate if they need to borrow money. They will be unable to take out a mortgage or insurance or access the best deals for gas and electricity. It is also more difficult to receive government benefits. In extreme cases, financially excluded people may not even be able to buy food easily (if, for example, a local grocery shop only accepts card payments). Meanwhile, keeping cash at home makes them more vulnerable to theft.

The Barriers to Financial Inclusion

The World Bank refers to financial inclusion as people and businesses having access to financial products and services that meet their needs. Furthermore, these products and services must be relevant and affordable. They cover banking transactions, payments, savings, borrowing and insurance. They must be delivered responsibly and sustainably.

The cornerstone of financial inclusion is ensuring people have access to basic banking, enabling them to send and receive payments or store money. People should also be able to easily access other financial products, providing equal opportunity across all demographics.

Financial inclusion is a global issue because it reduces poverty worldwide. In fact, it has been identified as an enabler for seven of the 17 United Nation’s Sustainable Development Goals.

Financial exclusion is a complex problem. Several factors impact financial inclusion, including poverty, digital exclusion, mental health issues and addiction. Other barriers include poor health and unexpected negative life events. There is also a correlation between financial exclusion and social deprivation scores. People from black, Asian and ethnic minority communities face higher levels of financial exclusion (Adami, 2022).

A lack of money management education is also a barrier to financial inclusion. One in five adults say they lack the confidence or knowledge or confidence to manage their money (FCA, 2022). This lack of knowledge hinders people from knowing how to access relevant financial products. It also makes them more likely to get into debt.

Meanwhile, the financial services industry has not always been quick to help financially excluded people. There is a lack of innovative initiatives in the sector to tackle the problem. Where action has been taken, the government and regulator often drive it.

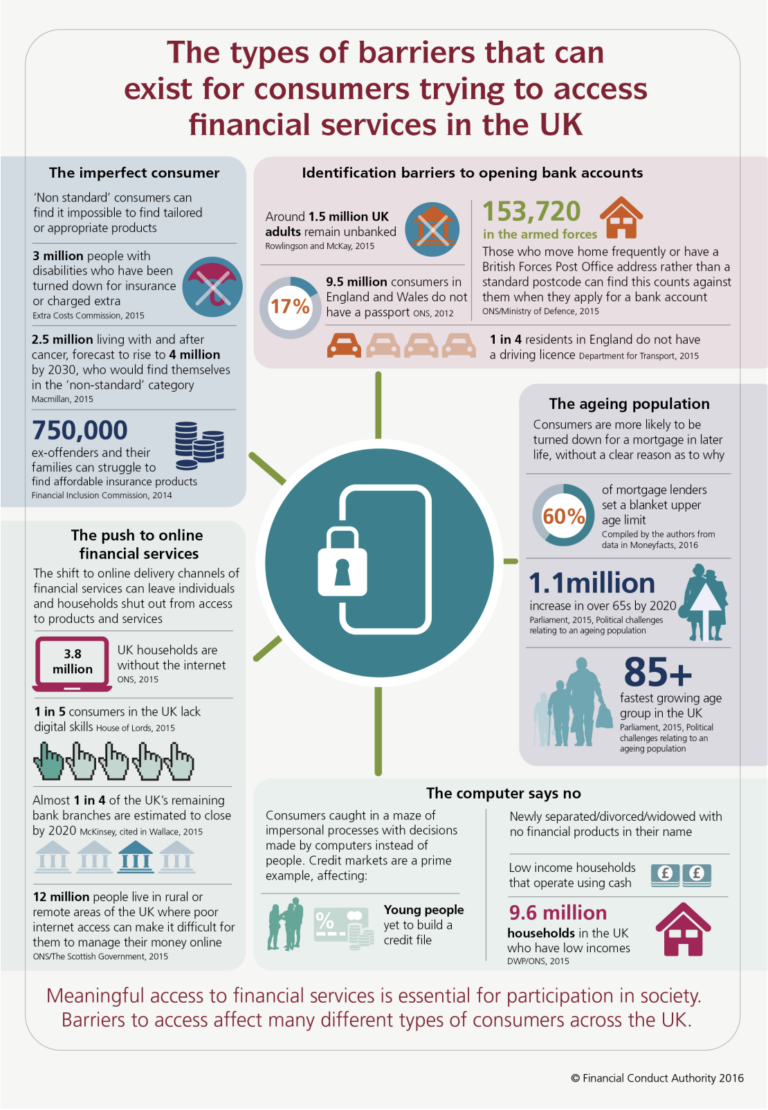

The following infographic was published by the Financial Conduct Authority in 2016, detailing the barriers to financial inclusion in the UK.

What is being done to help people access essential services?

The good news is that some action has been taken to boost financial inclusion. The nine largest financial services providers in the UK are required to offer basic bank accounts. These are free accounts that provide basic transaction services. They are available to people who would not normally qualify for a standard current account. More than 7 million people in the UK have one of these accounts (HM Treasury, 2022).

At the same time, credit unions offer access to savings products and affordable credit for people who cannot access mainstream products. Credit unions are run as non-profit organisations that serve local communities. An estimated 1.4 million people use credit unions. Some of these unions also offer access to basic insurance products, including life insurance.

The government is also working with the insurance industry to ensure people are not excluded from certain insurance products due to personal characteristics. For example, ensuring older people have access to motor and travel insurance, and that people in areas at risk of flooding have access to affordable home insurance.

The impact of the cost of living on financial inclusion

Unsurprisingly, rising living costs are making the problem of financial exclusion worse. The poorest people (who are already financially excluded) have been hit hardest, with reports showing that UK households are in a worse position during this crisis than they were during the pandemic.

More people are also being pushed into financial vulnerability as prices rise. Nearly 40% of people have run out of money by the end of the month, and 24% do not have enough to cover essentials (ONS, 2022). Meanwhile, 17% of adults have no savings to fall back on (Money & Pensions Service, 2022).

The crisis has also led to increased borrowing. An estimated 12 million people are now borrowing money to pay for food or energy bills. Half of these are doing so for the first time. This borrowing is typically done at high-interest rates for those with a bad or no credit history (Money & Pensions Service, 2022).

According to Plend’s most recent Financial Inclusion Report, financial stability among UK consumers is worsening. Most alarmingly, research suggests people may be turning toward unregulated and illegal forms of lending to stay afloat.

The high cost of living is also impacting people’s ability to future-proof. Around a third of people are using their savings to fund essential costs, leaving them vulnerable to financial shocks (KPMG, 2023). There has also been an increase in people putting money into speculative investments, such as cryptocurrency. Many are borrowing to do this.

How can the financial services industry help?

To help increase financial inclusion, providers need to show empathy to their customers and their needs. Global firms such as Deloitte even suggest that products and services should be designed with vulnerable people in mind.

Offering robust support and debt counselling to people with financial difficulties can help those struggling to recover. In addition, these services help to build trust in the financial services sector. Meanwhile, offering flexible products and tailored lending could enable more people to access affordable credit.

Lenders should explore alternative ways to assess people’s creditworthiness for those who do not have credit histories.

Providers should also work with third parties to help reach financially excluded people. For example, local councils and social housing providers can direct tenants to basic bank accounts or credit unions.

Offering increased money management education and free budgeting tools can help increase financial inclusion by increasing people’s financial capability. It should include helping people understand how to access financial products, including opening a bank account, improving their credit rating and avoiding getting into debt.

Technology also has a role to play in boosting financial inclusion. Initiatives such as Open Banking have enabled firms to develop more innovative products and services that widen financial inclusion. The initiative also makes it easier for people to budget, compare utility providers and access credit. Meanwhile, fintech can help increase financial inclusion by offering more choices and new ways of accessing financial services.

Fintech companies like Eligible also highlight the need for comprehensive analysis of consumer data and timely communication to protect people from harm. Marrying financial and behavioural data creates a full financial customer picture. It allows providers to step in before a crisis occurs, with tailored information designed to foster much-needed trust between institution and consumer.