THE SOLUTION

How it works

Eligible’s white-label solution and fully configurable system delivers unrivalled customer journeys.

Meet the first AI-driven servicing solution for the mortgage market

Exceptional customer journeys

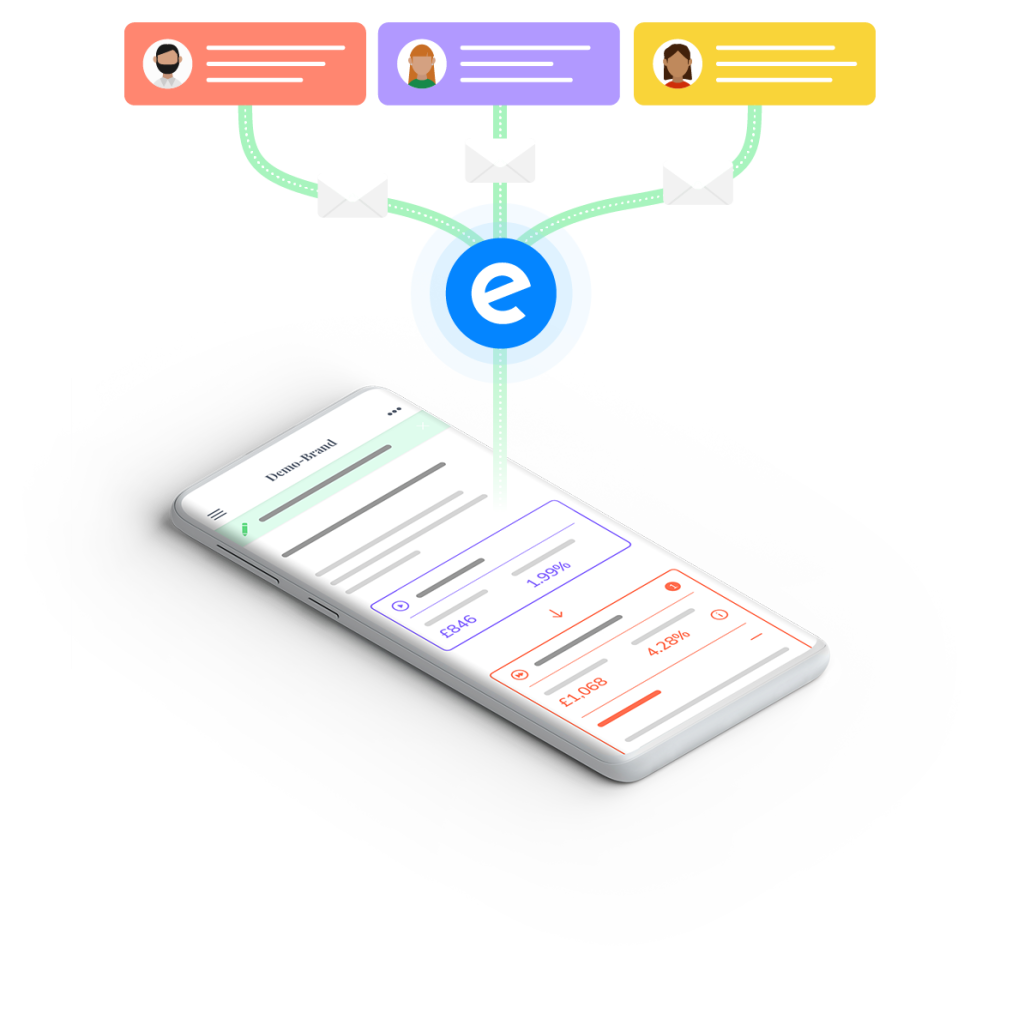

Eligible’s fully responsive consumer platform engages and nurtures customers, increasing retention and delivering a

world-class user experience.

Bringing together award-winning technology with real-time behavioural data, we transform mortgage servicing into tailored customer journeys.

Industry approved

Partnering with Eligible has transformed mortgage servicing, combining financial services expertise and data-science to deliver an unrivalled solution.

“We have in-house capabilities across servicing, marketing, data science and IT – however building a solution would take time and resource away from an already full IT roadmap. Eligible’s solution was deemed the most ‘oven-ready’ solution versus other large mortgage system providers and enterprise style toolsets.”

“Following launch, we were pleasantly surprised to see we had a definitive uplift in our retention after just 3 months. We set internal performance target – which Eligible met.”

“Eligible was required to regularly engage with our second line. These interactions were productive, and it was quickly evident that Eligible had already run through similar tenders – and were able to satisfy and often pre-empt second line queries. “

THE SOLUTION

Eligible’s white-label solution and fully configurable system delivers unrivalled customer journeys.

Implement without disrupting your existing processes. Eligible is a zero integration solution with no requirement for internal IT resources post-procurement.

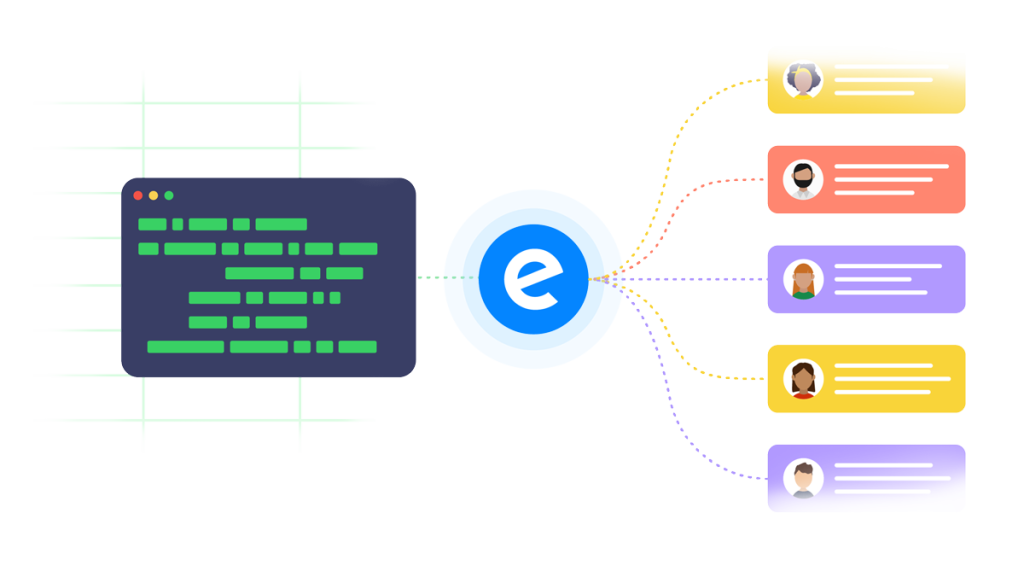

AI technology analyses each customer’s financial and behavioural data to predict what information they need next.

Financial institutions partnering with Eligible see an immediate increase in retention rates and ROI.

A deeper understanding of customer needs and behaviours allows for hyper-personalised communication. Eligible is designed to optimise engagement and facilitate good outcomes.

Consumers get a personalised platform with curated content feeds, delivering the right message at the right time. All communication holds your branding and is designed to help consumers feel supported.

Full customer visibility: With eyes on the whole customer journey, Eligible offers sophisticated reporting and lead prioritisation. Customers are directed back to your portals at the right time.

“We want firm’s communications to support and enable consumers to

make informed decisions about financial products and services. We want

consumers to be given the information they need, at the right time, and

presented in a way they can understand.”

– FCA, Consumer Duty

Customers feel supported by their financial institutions throughout their journeys.

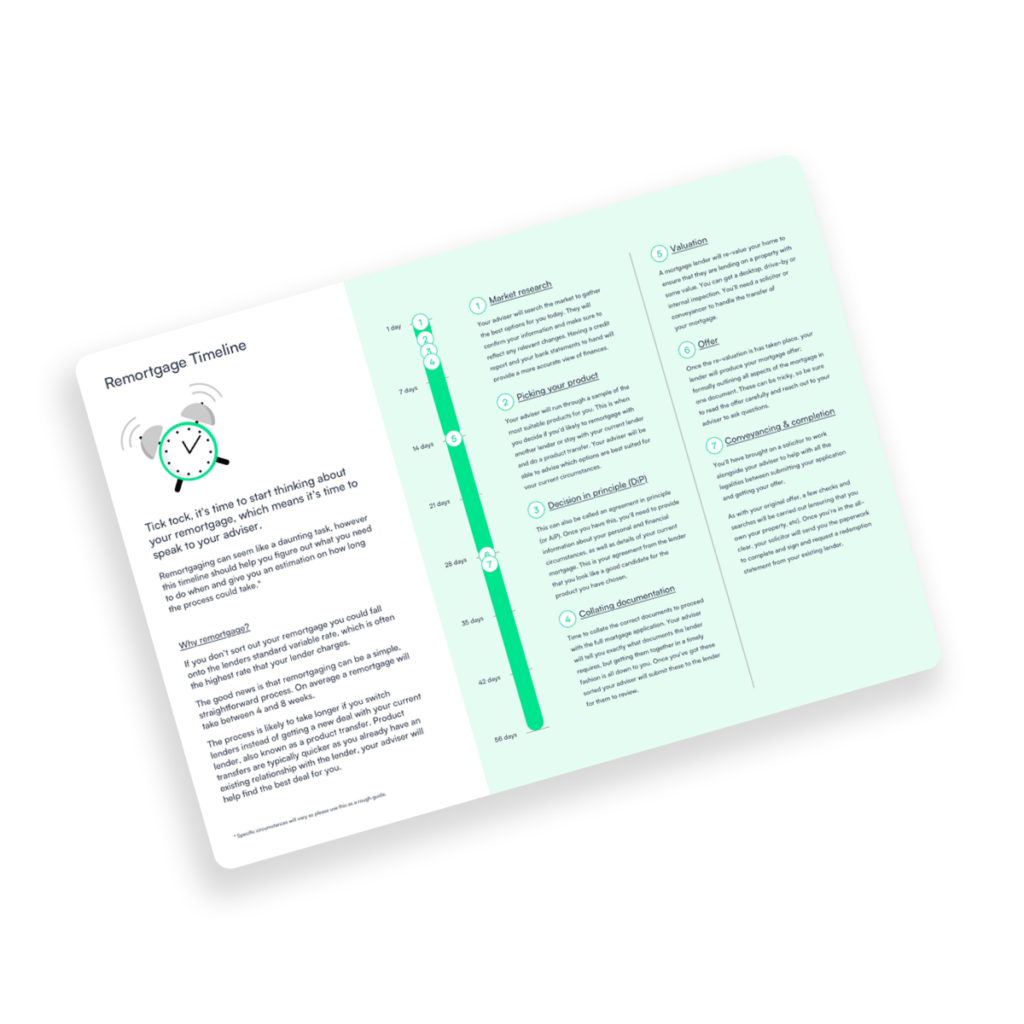

Customers are sent relevant and jargon-free information, mapped to communication preference, with built-in checkpoints to confirm understanding.

Financial institutions are able to use sophisticated reporting tools to demonstrate compliance and commitment to good outcomes.

weeks to implement

communications sent

ROI

Access our proprietary data insights and get free content for your clients.

Key insights for your business: What to expect from the mortgage market in 2022.

Help clients understand the process and exactly when to talk to you for advice.

Take a look around

Join the community

Book a live demo