Share this post:

Recent years have seen a huge shift in how financial institutions appeal to customers. Whether due to rapidly expanding digital competition, tighter regulation, or an increase in consumer feedback surveys, the intention is clear: providers are ready to talk about money.

But are customers as willing?

The value of providing customer-first service has become evident. In the digital age, financial institutions are closely watched and loudly confronted if stepping out of line. As a result, the tone has shifted. When it comes to communication, balancing authority with understanding and compassion has become the focal point of customer communication.

However, as eager as the industry is to change the narrative around financial services, there may be larger barriers to overcome before the message lands. The cultural and psychological factors at play when it comes to people feeling able to talk about their finances are many and complex. Understanding them is key to building a loyal and trusting customer base and changing the UK’s public perception of financial services.

Talking about Money: The Statistics

- 50% of adults in the UK believe that talking about personal finances is taboo

- 44% of people avoid discussions about money

- 25% of people have lied to friends and family about their finances

- 32% find it stressful to talk about money

- 43% say they feel embarrassed to talk about their finances

- 56% of young people are worried about getting on the property ladder

But 61% of people say they feel better when they have had the opportunity to discuss their finances with someone.

Psychological and Cultural Barriers

The factors blocking people from speaking openly about their finances are complex and often deeply wound within the fabric of our societal norms. The most prominent are:

Shame and embarrassment

Culturally, we have a history of tying morality up with well-managed personal finances, leaving many with a sense of failure when facing financial difficulties. This makes it difficult to ask for help, with people feeling ashamed or embarrassed by their situations. Society’s negative attitude towards debt and financial hardship often reinforces that shame – despite the problem being ever-more common in the current economic landscape. Even with the cost-of-living crisis prompting a more sympathetic tone from the media, people still worry that having debt will make them appear reckless or irresponsible. Fear of judgement keeps them from seeking help when needed, instead preferring to avoid the conversation altogether.

Fear of rejection

People often worry that financial providers will view them as a risky investment and refuse to help. They’re also concerned that a rejected application will appear on their credit score and that this will impact future applications. Around 48% of people experiencing financial problems are unlikely to even contact a provider, having convinced themselves there is no point in applying.

Lack of financial literacy:

This can be a huge psychological barrier for people who need to reach out for help. Without understanding the options and resources available to them, people find it difficult to find the support they need.

Public Trust:

Money determines the kind of lives people lead and the opportunities afforded to them. When negative press hits our financial institutions, people can’t help seeing the consequences in their own lives. Eroded public confidence in the financial industry can be attributed to previous financial crises, a lack of transparency, or what is perceived as unethical behaviour. On top of this, people’s views are often coloured by their own experiences – whether that’s poor customer service or being overwhelmed by financial jargon.

What’s the impact on individual lives?

According to the Money & Pensions Service, 24 million adults in the UK don’t feel confident about managing their money. As an unavoidable daily pressure, this can have a detrimental effect on both mental and physical health.

Anxiety around money issues can lead to panic attacks, loss of sleep, and high blood pressure. Long periods of stress also have several negative effects on the body, including heart disease and an impaired immune system. It can also leave people feeling isolated, as living in a constant state of worry can negatively impact social relationships.

Helping customers talk about money

Financial institutions can and should work to create a more supportive and inclusive environment for people experiencing financial difficulty. It’s time to de-stigmatise the conversation by ensuring that information is non-intimidating and invites curiosity.

With more online options, more and more people are choosing to get all their financial guidance digitally. This is an excellent opportunity for providers to ensure their customers receive expert advice in a format they can easily understand. This is even more important for those who admit they’re too scared of rejection or judgement to apply for the financial product they need.

Timed correctly, digital communication can educate your customers, leaving them excited about their financial options, instead of fearful.

Why is this important to Eligible?

Eligible is the platform for financial institutions serious about putting their customers first. Built by banking experts, fully automated, and driven by data, we transform the entire user journey.

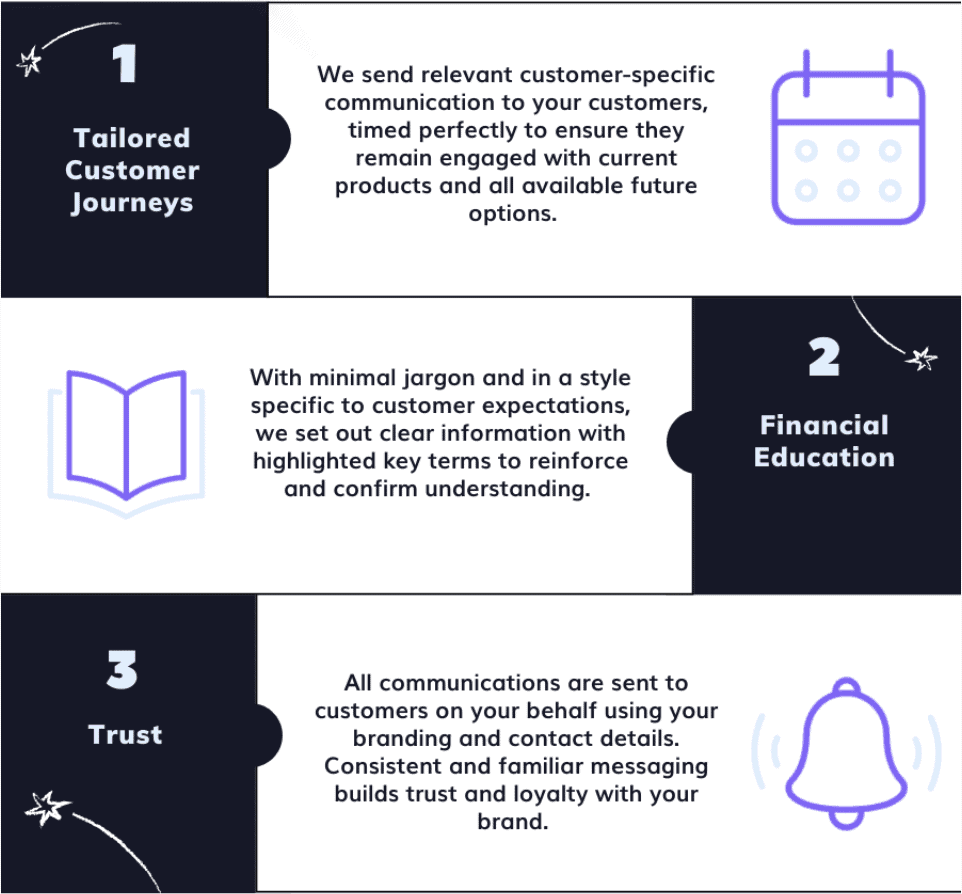

Here’s how Eligible is helping to change the public perception of financial institutions: