Last year, we predicted a challenging year ahead for the mortgage industry. We weren’t wrong. Between volatile mortgage rates and multifaceted new regulatory requirements, financial institutions have had to work hard to keep morale up this year. It has also been a difficult year for consumers, with homeowners reportedly searching for mortgage-related information every 23 seconds. Today, we’re reflecting on 2023: what we thought might happen, what did happen, and how we navigated a turbulent 365 days.

Mortgages and the Payment Shock

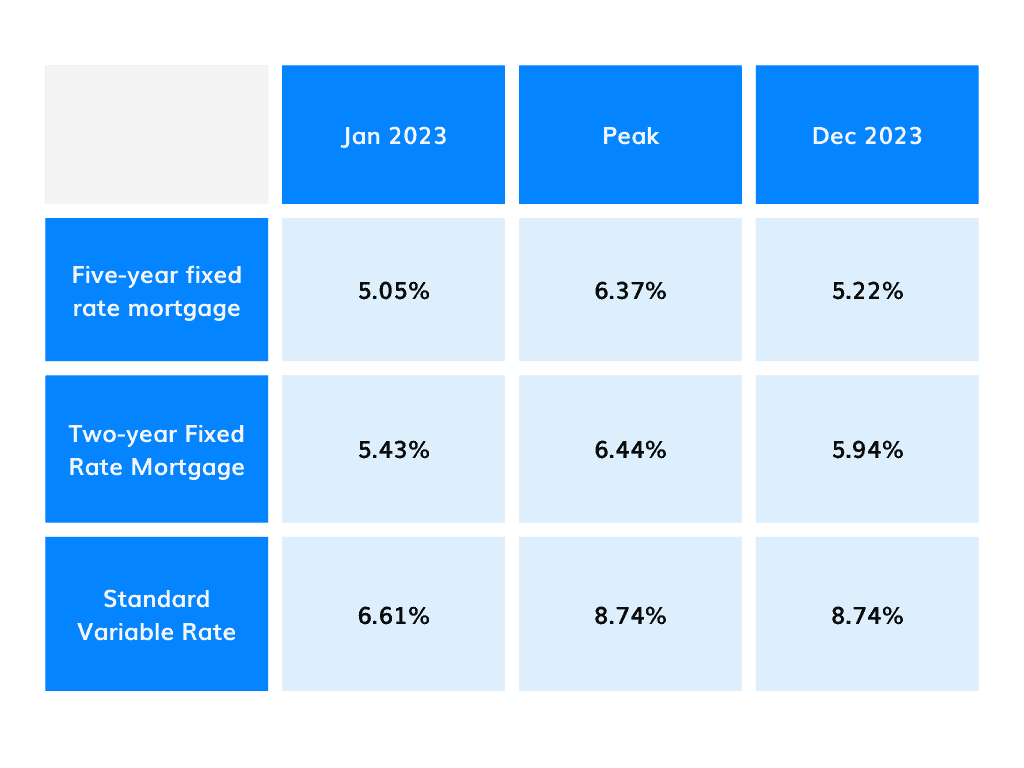

At the beginning of the year, we touched on the fact that 1.8 million fixed-rate products were set to expire in 2023. What we couldn’t have seen was the payment shock those homeowners were set to experience. While we reported that economists were anticipating a rise in interest rates to a high of 4.5%, no one anticipated the actual rise – peaking at 6.44%. For homeowners who secured a deal on a rate below 2% in 2021, their expiry this year would have seen their monthly outgoings increase by hundreds of pounds.

Moving into 2024, the Bank of England suggests that nearly 500,000 households will spend more than 70% of their post-tax income on their mortgage alone. Against the backdrop of a cost-of-living crisis, organisations tasked with helping people are understandably concerned. The Citizen’s Advice Bureau has warned that the UK is “facing a debt time-bomb“, having recently seen a huge upswing in people seeking advice while working with a negative budget.

Here’s a breakdown of the mortgage rates we saw for fixed-rate products in 2023:

In April, 700,000 Britons missed their mortgage and rental payments, prompting the UK government to take action by introducing the Mortgage Charter. Aimed at supporting worried homeowners. 85% of the UK’s lenders signed it, pledging that those in arrears would not have their homes repossessed and those due to remortgage would be guided through the process without being subject to affordability checks. A number of solutions were put forward for those who were struggling; people could switch their mortgage rate up to 6 months before expiry, and they could also choose only to pay interest across a 6-month period.

We are yet to see reports of how many people took advantage of the Charter, but there was a significant jump in internet searches for information on interest-only mortgages following its introduction. The online behaviour of homeowners seemed to suggest that people were indeed researching what was on offer and leaning on the support.

Consumer Duty and the Race for Implementation

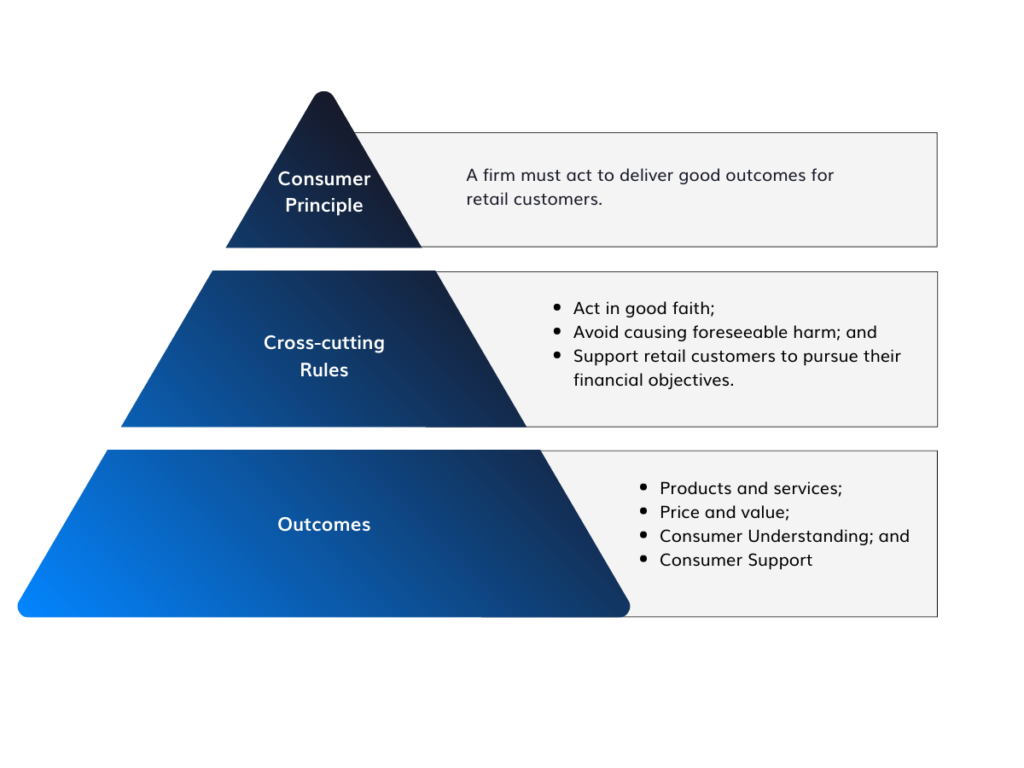

July 2023 saw the FCA’s Consumer Duty come into force, where the culmination of a year’s work for all in financial services was finally implemented. Aiming to set a new standard in customer-focused products and services, financial institutions have been left to find their own way to demonstrate compliance – with varying degrees of success.

Consumer Duty is a marathon, not a sprint. The initial planning phase may be over, but firms will need to test and adjust, introducing new technology and make room for a new way of thinking. And that’s the hopeful note Consumer Duty leaves us on in 2023 – that while the work is laborious and complicated, it is paving the way for a new, healthier relationship between institution and consumer.

Now the deadline has passed, the industry is feeling more optimistic about Consumer Duty and how it will change the scope of financial services. With industry leaders describing it as a catalyst for innovation and an opportunity to focus on good service, it seems we are all breathing a sigh of relief as we come to the year-end, enthusiastic to put those core consumer-focused principles at the heart of all work in 2024.

“Firstly, under the new regulations of Consumer Duty, there is a heightened obligation for banks to be more proactive in supporting their customers. Secondly, there’s a growing political focus on this issue, which has led to the government and banks signing a mortgage charter. This charter essentially commits lenders to utilise all available tools to support their customers – which has been even more important given the current economic climate. Banks bear a significant responsibility in helping Brits improve their financial literacy, and they are inherently motivated to refine their language in digital channels in order to do so. The crucial shift in the concept of financial literacy lies in recognising that it’s not merely about comprehension at the point of sale for financial products such as mortgages, credit cards, auto loans, and personal loans, as these are not everyday acquisitions.”

Rameez Zafar for The Finteh Times, 2023

Eligible in 2023

2023 was a big year for Eligible – not just for our incredible team but also for our partners. Together, we’ve built on the success of our award-winning platform, turning feedback into brand-new features – all of them designed to eliminate financial stress and anxiety for mortgage customers.

We have delivered on some challenging technical features, improving efficiency, value, and the overall customer experience of our service. We have championed financial autonomy by introducing new seamless product selection for eligible users, allowing them to select and compare multiple products, understand the key terms, and deliver their decisions straight back to their lender.

We implemented important new service notifications, widening the scope of our communications to include the full life cycle of a mortgage. We did this knowing that consistent messaging and improved engagement strengthens relationships between consumers and institutions and builds loyalty.

To take the sting out of Consumer Duty, we’ve launched a robust and sophisticated reporting module to capture the data our clients need to demonstrate compliance on two of the four outcomes: Consumer Support and Consumer Understanding.

We close out on a remarkable year ready to tackle 2024 head-on with fresh ideas and a plan to eliminate stress and anxiety for mortgage customers across the UK. From everyone here at Eligible, we wish you a very Merry Christmas and a Happy New Year. We’ll see you in 2024!